When you’re building your company or division, the business is the leading factor in making it big. But your planned Tax Structure and ‘Legal Chart’ and your chosen road to set them up, can play a major supporting role.

Setting the Scene: the Founders and the Idea.

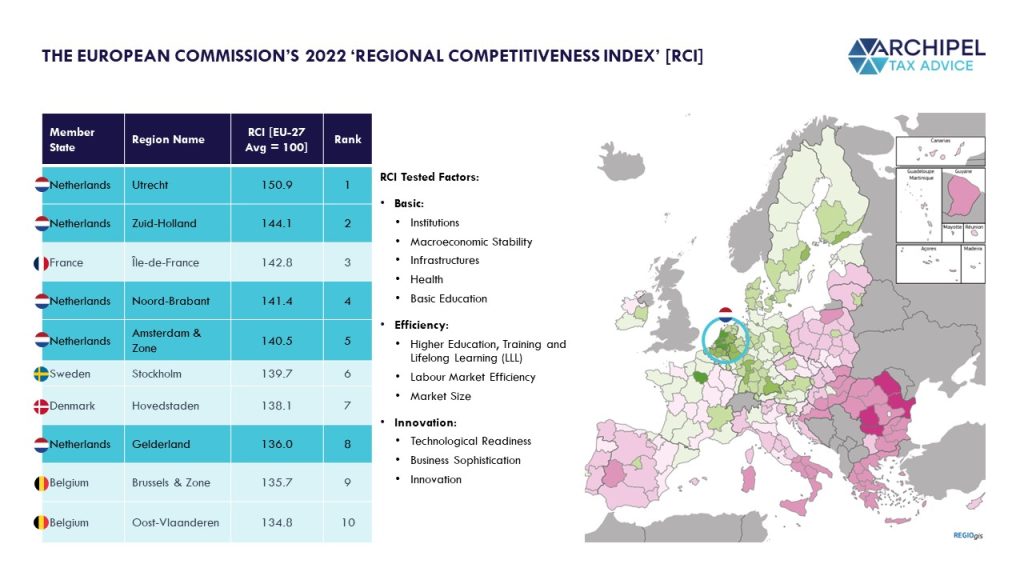

We start from the scenario that two founders have an idea -summarized as the IP- that needs further development than commercialization. And in this scenario, the Netherlands shall be the place to do it. And to briefly pitch why that may be the case, we highlight a 2023 release from the European Commission: the Regional Competitiveness Index, boasting 5 Dutch regions in the top 10 and the Netherlands claiming spots 1 and 2:

With this in mind, we pose a conceivable scenario in which a technical startup proposition sets up for growth in the Netherlands. Note that the Org-Chart-Unfolding Principles we use to build the primary structure to be ready for later add-ons, are broadly similar for corporate spin-offs or business branch-outs. The from-scratch-startup scenario just reads easier.

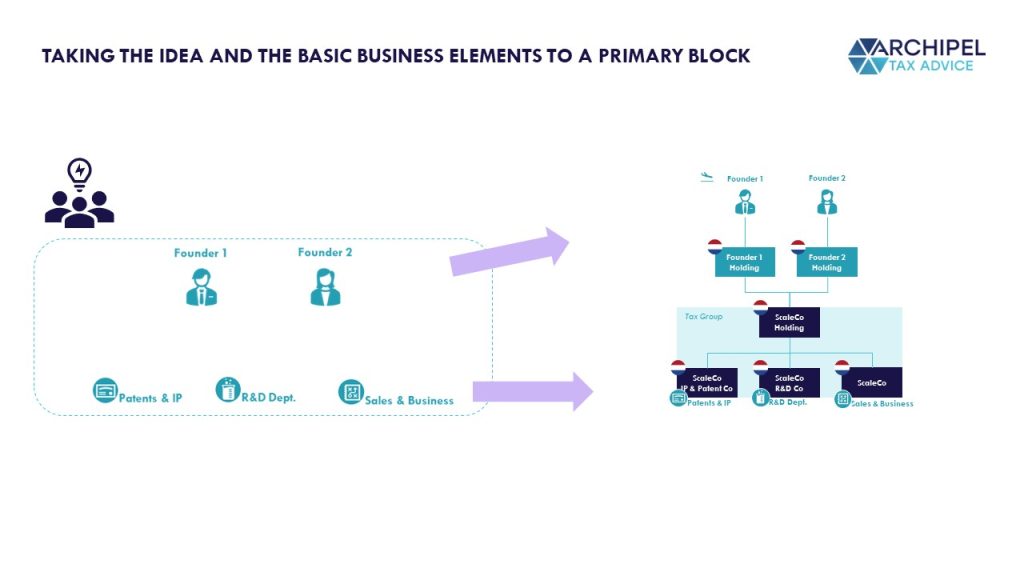

And in this scenario, we first identify the universal starting pieces to our Tax Structure, which we need to put into a future-proof Legal Chart:

- The Founders / Entrepreneurs;

- The IP or Technical Concept;

- The R&D Department, and;

- The Business Department (i.e.: sales, marketing, etc) that will set out to commercialize the technical product.

The Objective: a Structure that Ring-Fences Risks, Protects IP & Owners, and Optimizes Cashflows & Funding Efficiency.

In this blog post, we walk you through our ‘Tested Template’ or best practice for a Dutch Tax Structure that supports your Accelerated Growth plans as an IP-centered business. By being mindful of the Low Hanging Legal Fruits as well as the Tax Benefits that the Netherlands offers, the displayed fundamentals combine strong IP protection with a tax-savvy foundation for expansion.

Step One: the Three-Tier Corporate Structure.

The basic chart would be built with the following data points in mind:

Incorporated Legal Entities are Liable for their own Assets & Debts and so Provide Legal Protection from Liabilities.

A universal principle to the world of legal entities, is that they are ‘legal persons’. This means that they can own things – assets & liabilities. Furthermore, with entities like the Dutch BV [Besloten Vennootschap or Limited Liability Company], the shareholders’ liability is limited to their invested capital. They therefore stand to lose only the money they’ve invested, should the entity at hand incur a liability that exceeds the value of its assets. Legal experts, therefore, generally favor setting up separate entities for different activities -and therefore different risks- to avoid spillover effects or contamination; the invested capital creates a backstop to capital at risk and -within a group- this legal ownership allows specific group assets not to serve as collateral for the operational risks.

Legal Entities are also ‘Tax Persons’; the Participation Exemption comes into Play.

With personal ownership of assets & liabilities also comes a ‘personal’ tax situation; each legal entity has its individual tax position. Dutch Legal Entities pay Dutch Corporate Income Tax, levied at 19% on the first € 200k of annual profits, and 25,8% on the excess. The annual balance is calculated as follows:

[[End of Year Equity -/- Start of Year Equity] – [Capital Deposits} + [Capital Withdrawals] – [Exempt Proceeds] – [Carried-forward Losses]].

Therefore, one may think that when a company owns shares in another entity and receives dividends from it -which are after-tax profits-, these dividends are included in the recipients’ end-of-year equity balance and therefore taxed again, leading to double taxation. But: to prevent precisely this from happening, the participation exemption specifically exempts qualifying dividends [i.e.: generally those received from 5% or greater stakes in subsidiaries that pay at least 10% CIT locally] from the Dutch Taxable Base for Corporate Income Tax. And as you can tell from the formula listed above, receiving a capital investment is not a taxable event either – which is logical, as the resulting capital increase isn’t caused by generating income but rather by receiving more investment from the parent.

This means that double-stacked structures are on the table from a tax perspective, as they do not need to lead to additional taxation layers but do allow for tax-free capital distributions up and down the group chain. And all the while, a multi-entity structure enables the legal ring-fencing of risks as discussed above.

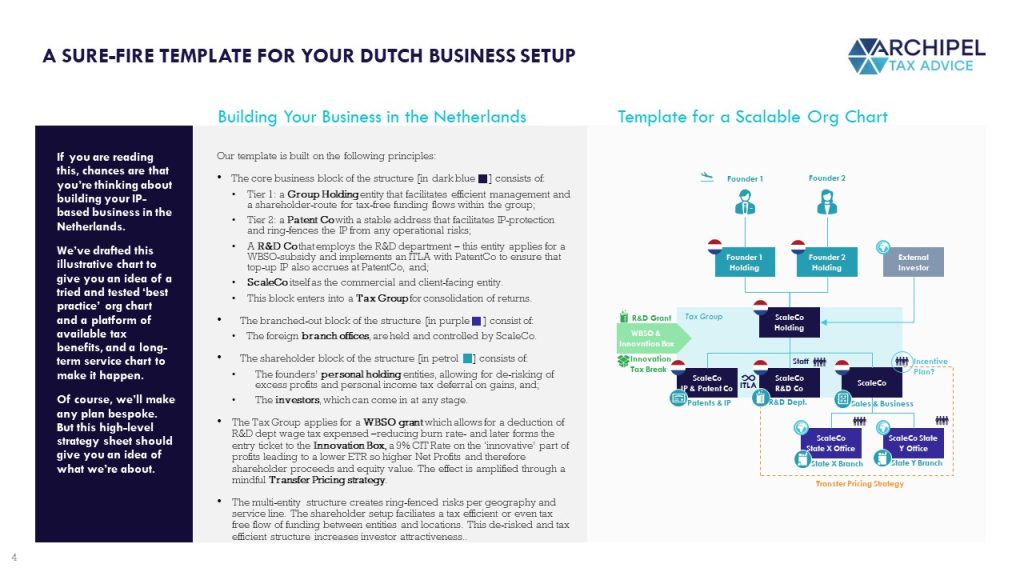

With this in mind, our first building block would look something like this:

Explainer:

In this setup, the top tier consists of the founders’ Personal Holding entities, which allow the founders to receive proceeds from their shareholding in the business under the participation exemption, deferring any personal income taxes until they personally opt to actually pay themselves a personal dividend. This allows for tax-efficient re-investing of operational excess profits or capital gains back into the business structure.

The bottom tier consists of seperate legal entities for each of the ‘Building Blocks’ to the operations:

- IP & Patent Co is the legal entity that is the registered and legal owner of the business Intellectual Property. We recommend ensuring a stable business address for this entity, as some countries’ IP protection is enforceable only when the Patent Registry’s address details are current while charging potentially significant fees to update entries. So: an easy way to avoid forgetting to update or having to bear costs for it, is to set up a purposed entity.

- R&D Co is the entity from which the R&D is performed, employing the R&D folk. This way, any R&D-related Lab & Staff risks can be separated from the ownership of completed research and patents or copyrights. By implementing an Internal Transfer & License Agreement, the IP resulting from the ongoing R&D legally accumulates at the proper entity; the IP& Patent Co.

- Sales Co is the entity that engages in external contracts and employs the other staff. This allows for ring-fencing operational risks from the IP and R&D.

The middle tier is the Group Holding Entity, which allows for a tax-free distribution of funds between divisions, and a single investing entity with a controlling stake in each underlying division. Also, it allows a consolidation point; by creating a tax group, the Dutch operational group is taxed as a single entity despite consisting of separate legal entities. This makes for easier group transfers of assets and consolidation of benefits without losing the legal benefits of the separated balance sheets.

Step Two: Securing Tax Benefits and Accelerating Growth.

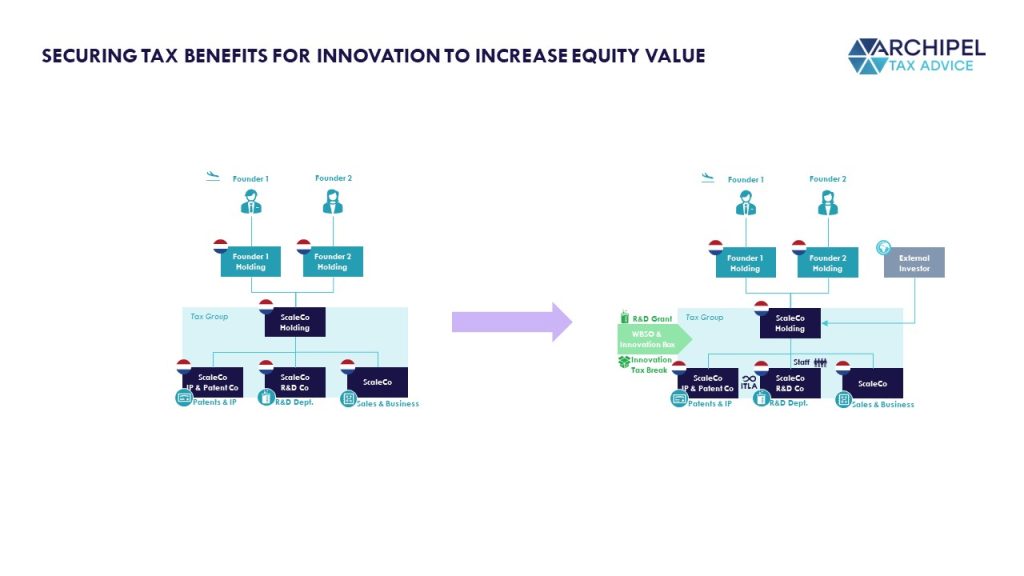

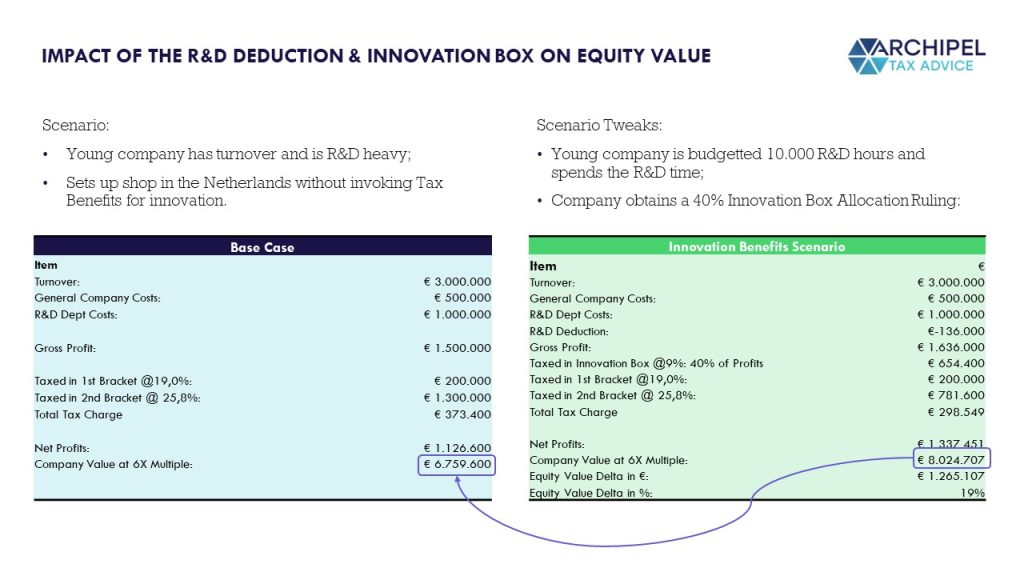

When valuing a company, the Free Cashlows are often a decisive input factor. Tax Benefits can reduce the Tax Bite out of the company’s operational profits, resulting in increased after-tax cashflows and therefore: increased Equity and Shareholder value.

Dutch Tax Benefits for Innovation: R&D Deduction and Innovation Box CIT Break.

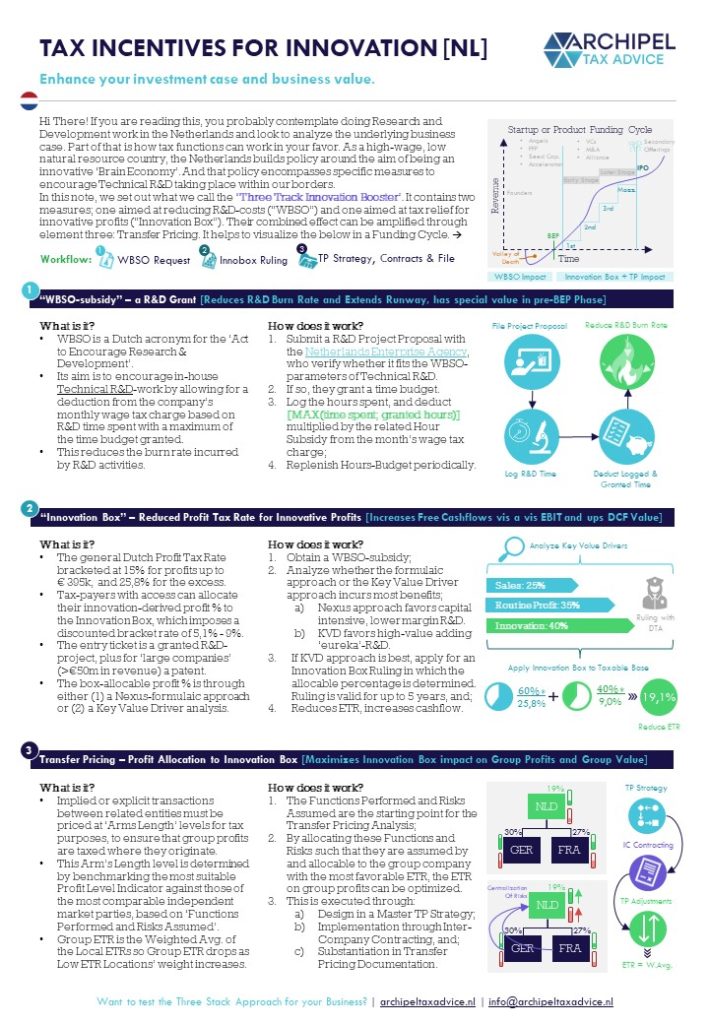

With tax being a means to reach policy goals through economics and the Dutch government aiming to support the country’s position as a ‘Knowledge Economy’, specific tax incentives have been put in place to encourage R&D and Innovation taking place in the Netherlands. The cornerstone is the ‘pincher approach’ resulting from the R&D Deduction and the Innovation Box:

- The R&D Deduction [‘WBSO Subsidy’] is a fixed per-hour deduction on the R&D department’s wage tax bill, with the deduction amount related to the time spent on an ‘approved’ Technical R&D project and the applicable hourly deduction amount [two-tiered rate, depending on company size and maturity]. This deduction is the entry ticket to the Innovation Box:

- The Innovation Box is a reduced-to-9% CIT-Rate regime for ‘Innovative Profits’. Generally speaking, a Key Value Driver Analysis is performed with the Tax Authorities to determine what percentage of the company’s profits are derived from qualifying innovations [based on Dutch R&D covered by the deduction, so naturally resulting from an approved project]. As a result, X% of the company’s profits are taxable ‘in the box’ at 9%, with the residual profit being taxable against the regular bracketed rates [19% – 25,8%].

The result is a lower burn rate for development, and a lower ETR on profits derived from innovations, leading to greater equity returns. For example:

For some further background to these benefits and their effects on company valuations, we put forward two earlier blog posts:

[1]: About Incentives for Innovation in the Netherlands:

[2] About Company Valuations and forecasted Free Cashflows as the input factor for the ‘golden standard’ that is the Discounted Cashflow Method [in Dutch, but Google translate well :)]:

Cap Table Events.

In this stage of venture building, some cap table events may equally occur. For instance: an investor may step aboard, and the company may want to involve staff in the cap table through an Incentive Plan. These are moments to reflect on company control going forward and potential tax implications for those involved with the cap table. The Incentives mentioned above significantly impact Equity Value, meaning securing them leads to less dilution and a higher company value.

When properly set up, such cap table events should not lead to taxation. We use this place to insert more information about Incentive Plans:

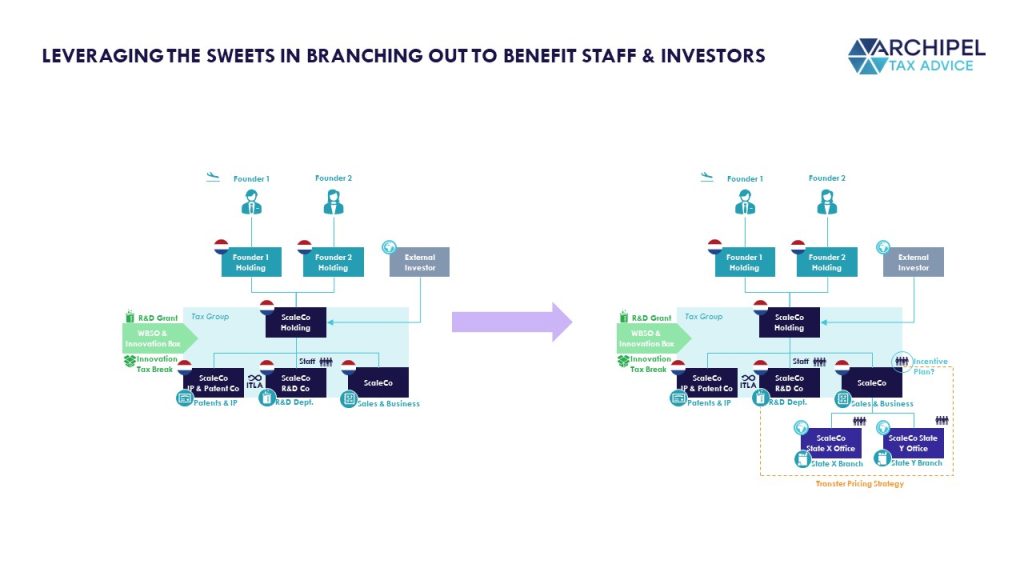

Step Three: Branching Out and Incorporating a Subsidiary Abroad.

As the business becomes domestically mature, opportunities abroad come into play. In line with the basic principles underlying the legal chart, new subsidiaries may be incorporated in the selected countries. As explained above, the investment itself would not constitute a taxable event, and implementing the proper shareholder route secures the applicability of the Dutch Participation Exemption on any after-tax profits distributed up the chain as dividends. But a matter that should be considered as well pertains to the profits that would be allocable to such a foreign branch, taking into account group activities performed elsewhere. We touch upon Transfer Pricing.

Using the Netherlands as a Holding and/or Regional HQ Location.

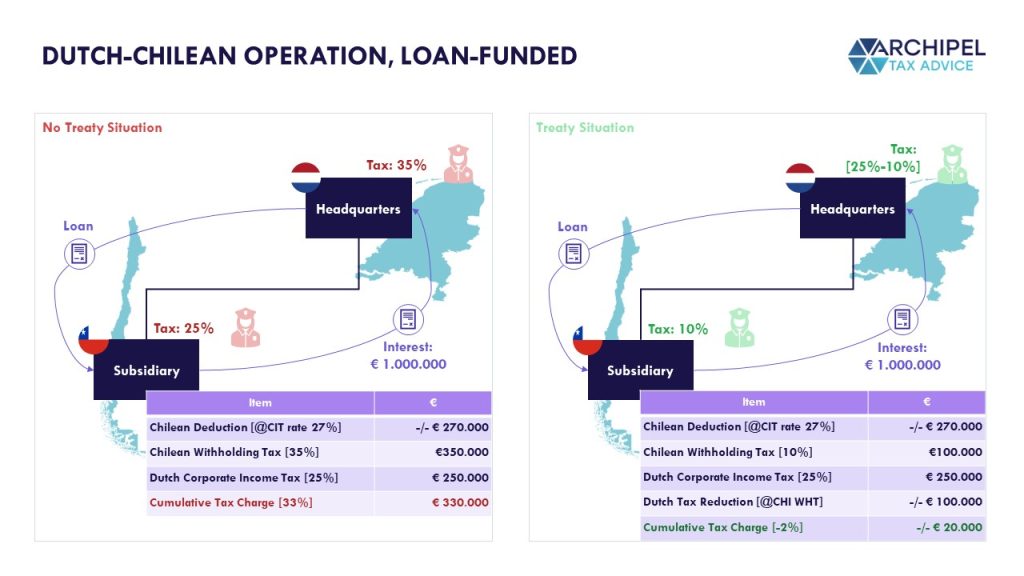

When branching out internationally, the taxation on the international flow of funds depends on the domestic laws of the Recipient and Source state involved, as well as any Treaty that may be applicable. Put briefly: if any involved state’s domestic legislation would impose a withholding tax on outbound payments or an Income Tax on a received payment, this would lead to tax leakage and reduced Returns or Resources Available. An Example of Treaty workings:

Items that make the Netherlands a ‘classic’ location to establish a Local HQ:

- The Netherlands has one of the largest Treaty Networks in the world [Link to the Tax Authorities’ Treaty Database to look up if your jurisdiction is in it];

- The Netherlands is part of the European Union, meaning intra-EU payments are subject to certain Tax Directives warrantying tax-free redistribution within the EU group, and allowing for a free circulation of goods and people;

- The Netherlands has a 100% Participation Exemption;

- The Dutch Tax Authorities offer Advance Certainty when the outcome of tax laws may be unclear upfront [Tax Rulings], and;

- The Dutch Corporate Income Tax Rate is average for the Western EU, meaning any HQ Profit Allocations are subject to a desirable tax level.

We link to an earlier blog-post explaining more about branching out internationally:

Transfer Pricing and Establishing the Proper Contracts between Group Entities.

Speaking of HQ profit allocation; this is the time to highlight Transfer Pricing.

Where related entities interact, shareholder motives can distort the pricing set. For instance: it may be very enticing to have a low-taxed group company charge a soaring service fee to a high-taxed one, to ‘shift’ profits from the high-taxed to the low-taxed country and then collect them under the centralized holding entity. However, the Arm’s Length principle dictates that related parties’ pricing is to be established, for tax purposes, under the premise that they act as separate and independent entities from one another. And the proper pricing method and level are arrived at by analyzing the functions performed and risks assumed.

This means that by creating a fitting organizational chart considering these functions and risks, the group’s profit allocation over entities and jurisdictions can also be taken into account. This can help leverage tax benefits and improve cashflows, as the after-tax profits can aggregate tax-free under the centralized Holding entity, making the group’s global Effective Tax Rate the weighted average of the locally applicable rates. We use a boilerplate to illustrate:

Other Things to Keep in Mind.

Moving People between Offices or even between Countries.

The business, of course, is nothing without its people. When businesses operate internationally, the involved persons may be locals or expats. Note that the Netherlands has regimes in place to attract Highly Skilled expats, business owners included. The go-to facility here is the 30%-Ruling; a regime that exempts the expat’s wages from Income Tax for 30% and exempts foreign assets from the Dutch taxable base, for a period of 5 years. We refer to an earlier blog post:

[1] About Assigning Staff to the Netherlands:

[2] About moving to the Netherlands efficiently as a Business Owner:

Taxes and your Supply Chain.

The Netherlands is part of the European Single Market and Customs Union, meaning that goods can circulate freely within the EU from here on out. Note that Import and Excise Duties and Value Added Tax are internationally lesser known, but important to be mindful of.

Take a look, for instance, at a one-pager we made following Brexit, explaining some benefits that can be found here – such as VAT Deferral upon import:

Tax Compliance.

Tax Design is the creative stuff, but at the end of the day; Tax Authorities need information. The tax compliance work is equally important as any tax design or benefit must ultimately be communicated through fixed forms and paperwork. Efficiency is therefore equally a matter of being in control of the books.

Tying it all Together.

Using the elements and steps set out above, we can generally summarize a ‘go-to’ cheat sheet for a successful Dutch roll-out, be it one as a domestic business or an international one, with the following legal chart:

When we consider legal charts like the one displayed above as the ‘house’ in which the business is run, we can make an analogy for the roles that your team of service providers play in creating it: your Tax & Legal Team are the Architects, the Notary Lawyer is the builder, and your Business & Accounting team supports the operations and performs the maintenance.

Anytime you need more rooms or an add-on or want to do something different with the building: check back in and create a good blueprint. Then build and run it!

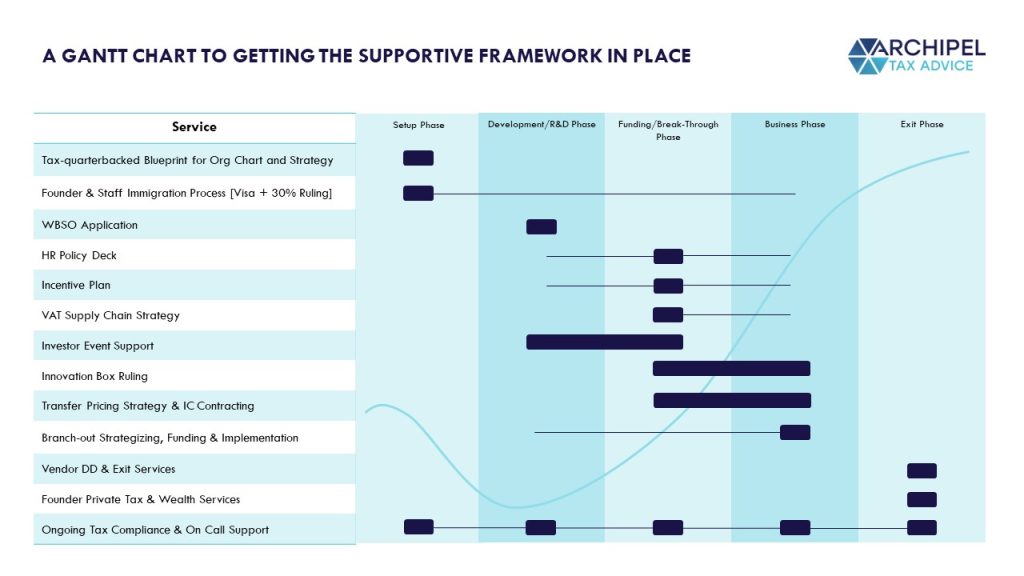

A Gantt Chart to Getting it Done:

The table above is the result of many smaller steps. As it may be difficult to imagine what type of services one can generally expect to invoke along the way and the costs they come at, we pose this indicative Gantt Chart:

Needless to say, a proper setup is always a matter of bespoke advice and ‘getting you right’. But at least this may be a good starting point to consider your legal chart and how to get it in place. And if you think we are the right Tax Team to have in our corner for it, we are happy to pitch something good.

Note that this boilerplate-materials-blog is like an off-the-shelf suit; we still need to tailor-make it to have any value. Tax is artificial enough for the small details like your structure blocks or sequence of steps to have major impact. That’s why 80% of our time goes to fine-tuning that last 20%. But rest assured that we have plenty of experience, and materials for the Evergreens of Accelerated Growth-planning. So we can advise you efficiently on how to proceed. And if you want to break the ice on what a Tax Advice process looks like, check out this final blog:

Want to Discuss? Book a Slot – it’s on the House!

This stuff is our chosen field, so feel free to check in with us and see if you like how we see it!