In this article, we break the ice on tax advice. As our client or perhaps prospective client (eh?), you may not have prior experiences with tax or legal services. Or: as an otherwise seasoned ‘advisee’, you may not have experience with us as a firm. Either way: the uncharted is mysterious. So we set out to explain what our objectives are and what it is we do, how we do it, and what you can expect. Let’s dive in!

Before we get started, some context: what is taxation anyway?

This question is as simple as it is philosophical, judging by the plethora of quotes one could find on the matter. Some of those say tax is the necessary cost of civilization, while some say it is legalized theft. But such broad perspectives put aside, we think that put most simply, tax is an involuntary contribution to government revenue.

To better understand taxation and how it is designed though, it is perhaps most useful to define its functions. In that regard, tax literature clasically lists the following:

- Budgetary Function: taxes are a means for governments to raise the funding they need to complete their programs and objectives;

- Distributing Function: taxes are also a means to allocate costs and income among citizens and groups, for instance to redistribute moneys from wealthy individuals to poorer ones or from polluting businesses to green ones;

- Instrumental Function: taxes can influence behaviors by incentivizing or rather disincentivizing them. For instance: high excise duties on tobacco and alcohol can help divert consumers from these ‘fun’ but unhealthy choices, while additional deductions for green investments can encourage taxpayers to allocate cash to sustainable installations;

- Controlling function: finally, taxation can be the instrument underlying certain reporting obligations, giving governments a means to collect data and to monitor, understand and control flows of funds in societies.

How do these functions impact me?

Let’s list that equally:

- Tax costs you cash;

- Tax creates reporting obligations, and;

- Tax can contain or convey benefits and incentives.

Being part of a society that is upheld by programs funded through taxes, you incur tax reporting and paying obligations. These reporting obligations are a means to communicate with the tax authorities how you comply with the tax codes and above all, they serve as a formalization of your tax charge so resulting.

But as should be clear from the listed functions of taxation, the tax code isn’t designed to merely maximize revenues. Rather, it is one end of a system that -equally in an ideal world- should help communities thrive and distort as little as possible. Therefore, the codes can contain multiple provisions and systems incentivizing choices that benefit society as a whole. Think, for instance, of pro-startup provisions, those aimed at encouraging highly skilled workers, or those designed to facilitate innovation or sustainability. This means that a design of the tax code can equally be a financial boost or a competitive advantage. And often times, finding this design is just a matter of knowing where and how to look.

If tax is also meant to be supportive, then why are its workings so opaque sometimes?

Despite the best possible intentions, we often have to explain that taxation remains at its core: a highly artificial set of rules. highly artificial and man-made, actually. So much different from the rules of physics, for instance, taxation is not a natural science but rather a figment of human minds and perhaps even a pseudo-science.

As a result, the systematics may not always be based on perfectly mathematical rules and a consistent set of logic. So they can contain imperfections and even irrationalities, and understanding the codes’ intricacies, histories, nooks and crannies can help navigate around those edges.

Another complicating factor is the legislative process itself. As laws are designed through a democratic process [at least in an ideal world], a multitude of interests needs to be observed. And this often means that a general and simple principle for taxation is agreed on first, after which certain caveats are made to serve specific interests and prevent overkill. Then as time proceeds, some Black Swan Events and unintended consequences arise around these caveats, after which they are adjusted and tightened. Then, the constrictions prove overdone in specific instances and the caveats to the caveats are, well, caveated again. Et voila: the provisions expand and what started as a simple rule now becomes complex.

Pair this with the fact that societies and economies tend to move faster than legislation, as a result of which tax codes tend to be reactionary, and it becomes understandable that these turned-complex codes are often either lagging and therefore difficult to overlay on current-day economic trends, or novel and fitting but therefore yet unknown and difficult to anticipate and navigate.

Seems daunting but worry not. Some folks are so intrigued by these politics-meet-economics dynamics that they’ve made watching, understanding and getting creative with these codes into their profession.

So if you have a tax situation, if you seek an ally, and if you can find them, maybe you can hire… the Tax-Team!

With that in mind: what does a tax advisor do and how do you become one (and why)?

As the name would suggest, a tax advisor advises you about how to handle your positions and interactions with tax law in order to create a best possible outcome. Our tax advisors are LLMs in Tax Law and/or MSCs in Tax Economics, and subject to the Dutch Association of Tax Advisors‘ professional standards and post-academic programs. To put it briefly, they spend a lot of time on tax! They are therefore invested in the topic, which we often consider obscure more than complex [especially compared to the fields we often find our clients active in!].

Why go for a profession dealing with this small print and nonsensical physics engine? Common drivers behind choosing ‘the Tax Life’ are a sense of vocation in making tax law work [preventing overkill, leveraging incentives], meeting perhaps a more inspiring set of people to sit at the table with that you’d otherwise deserve [you!], a passion for the crossroads between money and politics, and having had a hard time choosing between pursuing Law or Economics – so going for both to some extent.

And a choice for ‘the Archipel Life’ within that tax life is a whole other story on its own, but you can find what drives our folks here: https://www.archipeltaxadvice.nl/experts/

Now back to what a tax advisor does: they advise you on how to best manage your taxes. In light of the functions mentioned earlier, this means:

- Understanding and fulfilling your compliance and reporting obligations;

- Establishing the tax impact of your going activities and plans, and;

- Analyzing what benefits and/or less costly alternatives the tax code holds for you.

Perhaps though, this list is a bit too ‘dry’. Because in essence, your tax advisor is really there to listen to your plans and situations and understand them, and partner with you to establish the most efficient path going forward and to resolve any tax-related uncertainties you may have. To get tax ‘out of the way’ and to make it work for you.

And what does a tax advisor not do?

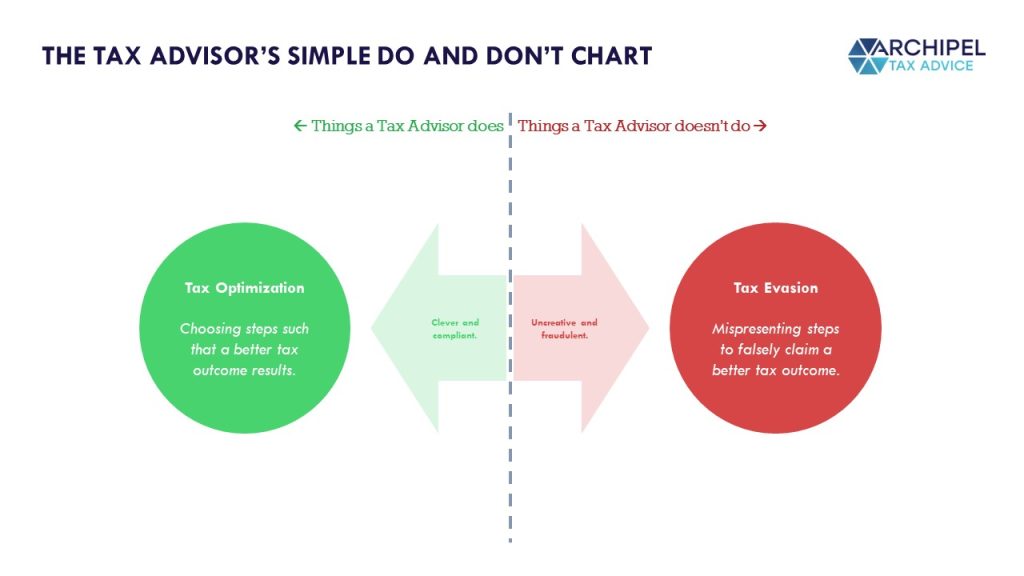

Well despite this mission to ‘get tax out of the way’, it is always important to observe the boundaries and to understand the difference between tax optimization [will do] and tax evasion [will not do].

Tax optimization means understanding the law, and securing the incentives or caveats available to you, or adjusting your path to be covered by them. Tax evasion, on the other hand, means claiming benefits unapplicable to you or misrepresenting your path to claim coverage by them. The first category means choosing the incentivized behavior, the latter means falsely claiming having chosen it. It is the difference between being clever and compliant, and being fraudulent and uncreative.

So we stress that as tax advisors, we are not in the business of facilitating fraud or ‘cheating the system’. Much rather, we are in the business of understanding the provisions of the law, how they interact, and what you can do to optimize your situation.

How does the tax advisory process work?

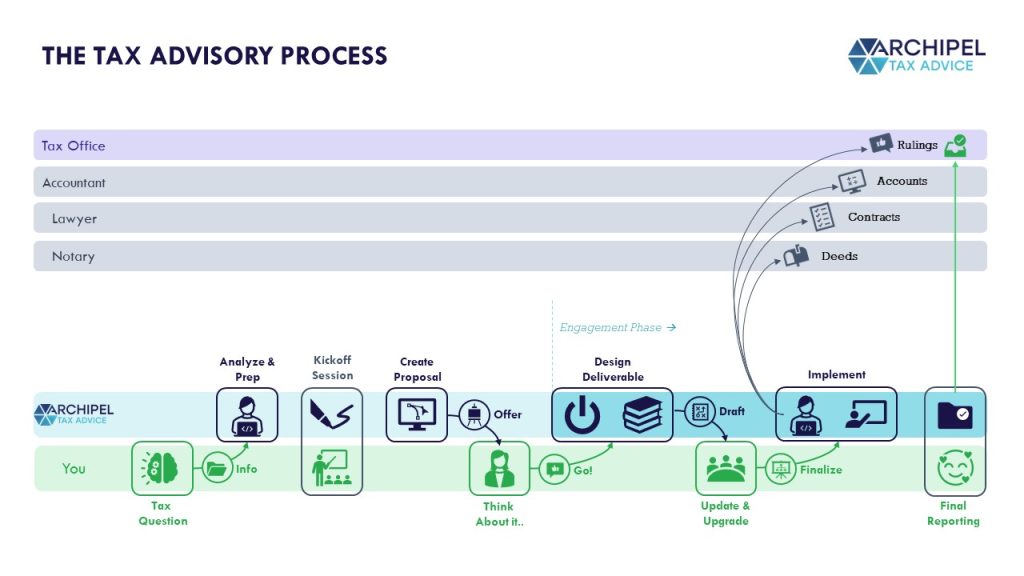

In order to help you fix & fancy your tax, we must know you and your tax situation first. So: step one is you get in touch with us and introduce us to your query. This may be an incidental one, like thinking about making an acquisition or a large gift, but it can equally be a structural one. Like you could be looking for a new day-to-day or on-call tax advisor for your business going forward.

After you’ve laid the first stone, we analyze whether we can indeed help you and, if so, invite you to a kick-off session. In order to prepare for that, we ask you for some further details and materials upfront so we can make good use of your time and ‘win the case’. All of this is still on the house, and our kick-off meeting can be in-person, online or on the phone.

During this session, we make sure that we really get to the core of your queries, and set out to create some initial solutions or tweaks that may work for you.

If you like where we’re headed, we send you a more elaborate project proposal. It lists the deliverable we think we should make, how we plan to go about doing so, and what the costs and terms should be. If you agree, you become our client and we get to work as your tax advisors.

We then get to the desk and footwork and deliver what we agreed, and ultimately help you quarterback the implementation of what we’ve designed and do the final reporting with the tax authorities. Visually:

What does it cost, and how will I know?

This is the factor that can keep many folks away – so we’re eager to shed some light.

Tax consulting is an hours business and project fees are based on the hours spent. So when we scope a project, we do so based on the time we predict we’ll need from the engagement team we’ve compiled for your project, multiplied with the hourly rate of the underlying advisor. That means that some projects may have a more favorable cost/benefit ratio than others, but the basis for calculation is always the same and we consider that as fair as it gets. And when we scope projects, we stick to project scopes.

Not everything we do is ‘a project’ though; it wouldn’t be efficient to scope every time a minor item arises. And that’s why our engagements are built around two types of work:

- On call advice: when you encounter a day-to-day item, you just give us a ring or send us an email and we turn it around asap. If we can revert you to some of our boiler-plate information, we will. And if we need to spend a couple of hours to resolve your bespoke situation, we will do that too. At some point your ledger contains some line items, and we invoice them to settle.

- Projects: if and when you send us a query that is logically more than ‘just an on-call query’, but something that we think is done properly only after some in-depth analysis and design, we encouter a project. We scope that upronft and agree on timelines, deliverables and pricing and get to work after we’re all on the same page.

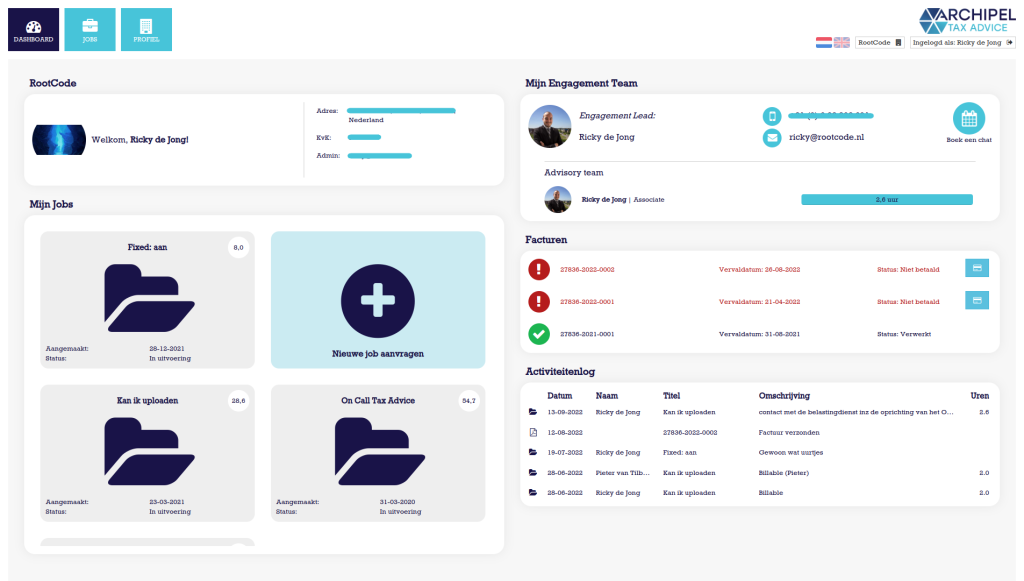

Note that you will have continuous insight into our timesheets through your MyArchipel account so that we avoid the blackbox effect many fear and dislike when hiring legal professionals. Why? Well, we value your business so we want to be transparent and frank – as we know that this transparency ultimately supports your appreciation for our services and, with that, the likeliness that you’ll come back for more rather than take your business elsewhere. But also: we chose this profession because we love getting creative with tax code, not because we enjoy getting creative with passive agressive email language or bickering about invoices after a good job’s been done 🙂

Sure, fees are based on time. But what do you need all that time for anyway; you already know the answer right?

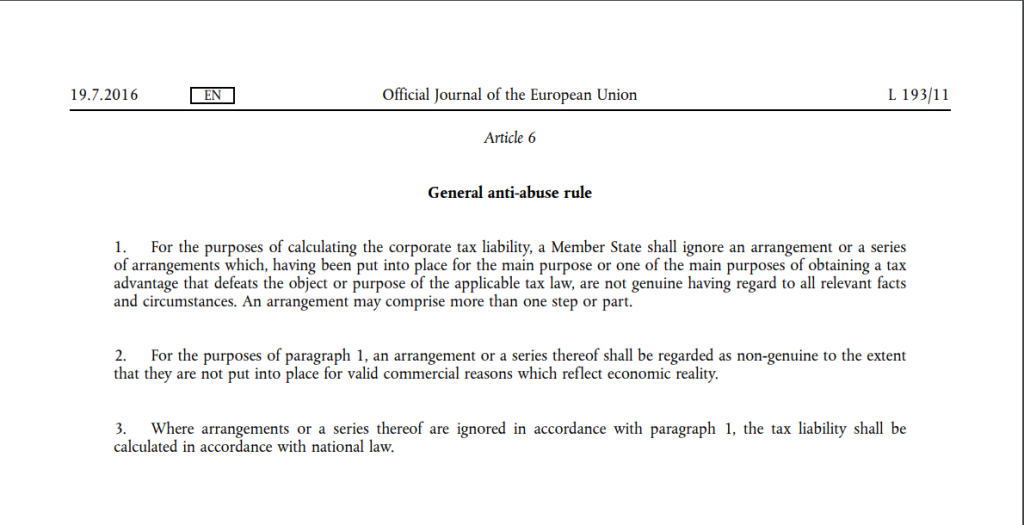

That is a common misconception. Sure, we may know a general direction in which your case would head. And we already convey that in our project scope. But we always run into novel situations and fine print. To grasp the type of provisions and language we work with, have a look at article 6 of the EU Anti Tax Avoidance Directive I, for instance (not necessarily because we venture into the potentially abusive so often, but because it is one of the better brief examples of an open norm):

This specific provision is a ‘catch all’ anti-abuse clause, that Tax Authorities can invoke in cases where you seem to have followed the law by the letter, but they deem the outcome unintended anyway. When analyzing whether it may apply, one may wonder things like: when has an arrangement been put into place ‘for valid reasons which reflect economic reality’? Or: how do we test whether an intended tax benefit was abusively ‘the main purpose or one of the main purposes’ of any arrangement?

Answers to such questions can be found in sources like case law covering the provision, its technical directive or explanatory notes issued upon its drafting. And as you can probably predict, that requires lots of reading, lots of careful testing and alignment with your ‘facts and circumstances’ and options, and good copywriting to write up a convincing narrative.

So sure, we are familiar with the Directive itself, but we would add little value if we advise you ‘off the cuff’ whether its intentionally enigmatic scope covers your design. And in verifying that [and in recommending tweaks to avoid it], we can always limit time available. But that necessarily means that we need to work based on assumptions at points, which is detrimental to certainty but favorable for the bill. And that is why our project fees are based on time needed – and that choice is always yours!

Alright. So what is your hourly rate, and what do you charge for?

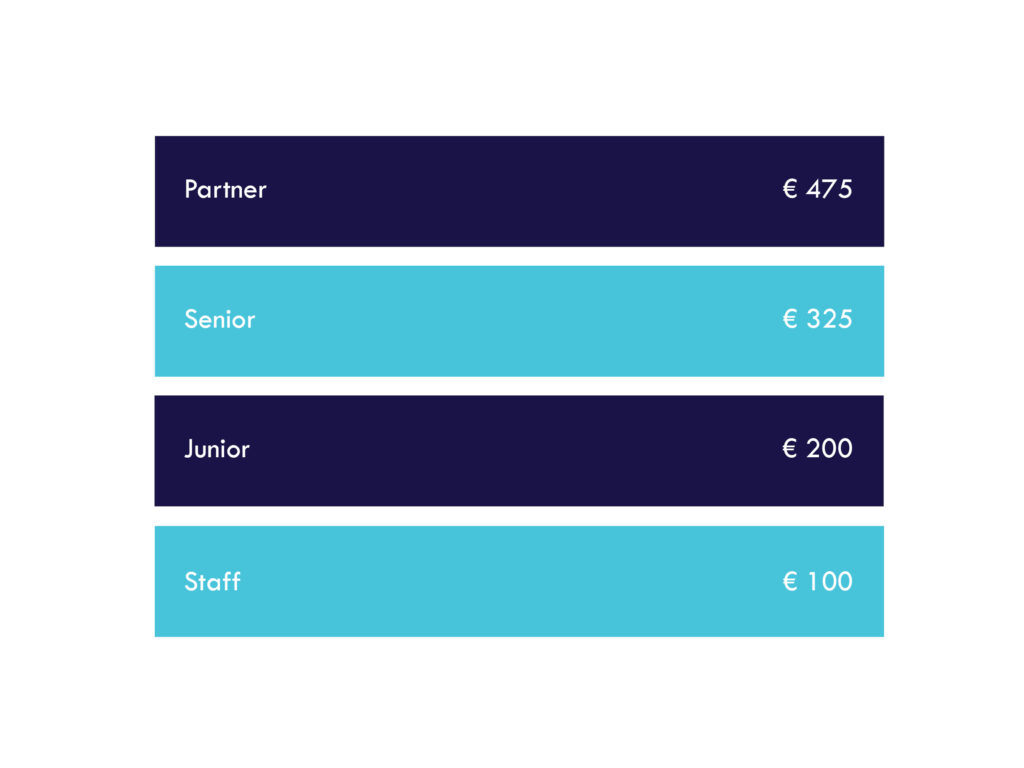

Our rate card is pretty short and simple:

We base these rates on our boutique offering and on market benchmarks. Tax advisors simply have a choice of employers as -like we’ve stated above- too many people wrongfully consider the profession sub-superman. Therefore, we have a clear understanding of the revenue we need to be a competitive office and attract the caliber of tax folks we seek. We find our competitive market edge, though, in some process innovation.

We’ve automated our complete backoffice through our custom CRM-system MyArchipel, which centralizes anything from admin to filing to knowledge banks and boilerplates in one single appified system. Allowing us to run a rate card that is feasible for early stage business and private clients, and therefore plain attractive for larger corporates and Blue Chips. And we always keep some time at hand to pledge or invest in societal passion projects.

Do we offer discounts? No, every client is equally important for us so we charge and therefore organically prioritize them equally too. But can we talk about scopes and budgets upfront? Yes we can – we find it important that you can budget your expenses.

And: do we charge for boilerplate information or do we sell shelf material with a ransomware-ish release-fee model? No we do not. As a testament to this, we open-source as much information as we can. Rather, the time we invoice is not spent on making a bespoke projects that tie large quantities of micro-managed rules and provisions together in such a way that tax really works for you. Which leads us to the last point:

What makes tax advice a value add?

The equation is simple: if the advice costs you less than the tax saved, the service is rational. And if the outsourcing a breadth of tax functions to us costs less than employing the required team yourself, then the value is clearly there too. It goes without saying of course, that we stand for our quality in this.

But sometimes, the savings can be difficult to quantify as they may consist of avoiding a risk the exposure of which diminishes as the advice is more succesful, or of implementing a tweak that has benefits other than tax savings. That is why we also emphasize that tax is hardly ever a singular leading principle and instead a part of a larger household of functions that supports professionalism, clear financial game plans and regulatory comfort.

Similarly, we emphasize that even in the rare direst of fiscal situations, tax services are always a ‘nice to have’ over a ‘need to have’; tax advice is simply never a necessary box to tick and the tax code prohibits nothing. Instead, tax services can help you make the most sensible choice out of many, or make the choice you were going to make anyway all the more sensible.

And for some examples of what that can entail, we invite you to browse our insights catalogue anytime to see what findings, cocktails and adventures we’ve been up to lately: https://www.archipeltaxadvice.nl/insights/

So how do I start?

That’s simplest of all: just send us an e-mail and explain whatever thing ‘tax’ is on your mind, or book a timeslot with us and discover how we can work together to make your taxes an asset. As you now know, a discovery talk is always on the house, and we are those odd folks who love to talk about it!