The owner-run or otherwise closely held business is a matter of pride, tenacity and loyalty. What often started as a bold idea, turned into the livelihood of many. Close-nitting the business with its owners, its staff, and the families of both.

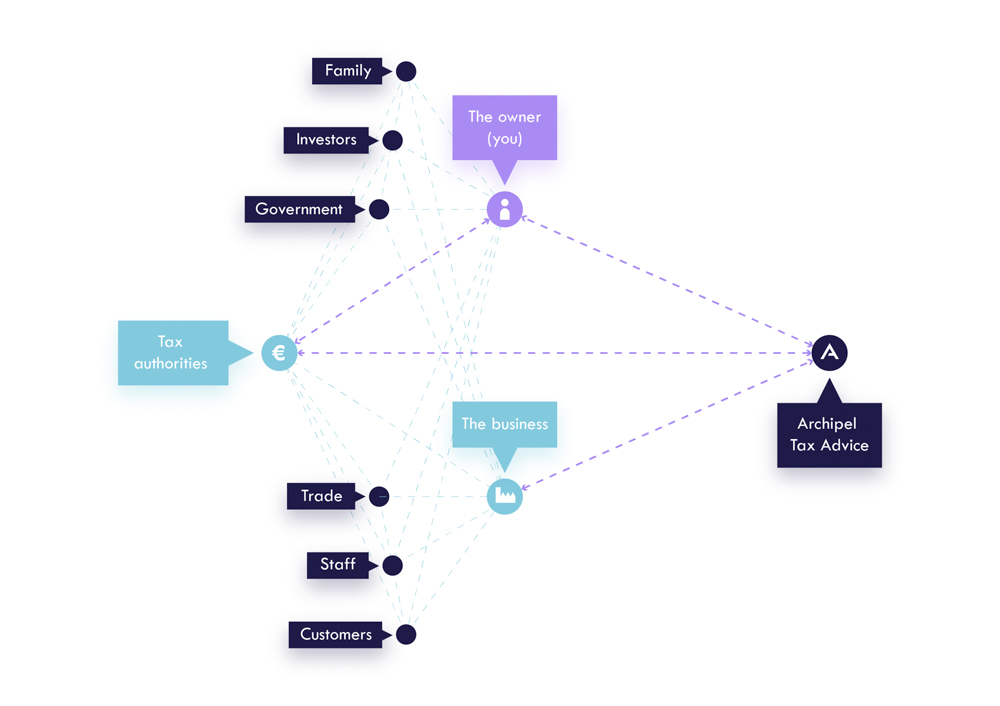

The more the individual interests are aligned within the common goal of seeing the business thrive, the smoother it runs. And taxes are an inextricable part of that equation. They can help the enterprise be an employer of choice, a desirable investment opportunity, and a fruitful path for the risk-takers chairing it.

Our MidCap & Family Owned Business expert group helps you stay mindful of opportunities to optimize your taxes, and of the events that trigger them being payable. In order to preserve working capital and open up new business opportunities. Keeping a transparent relationship with the tax authorities throughout, helps stay on top of your obligations and secures time for your primary line of focus: the enterprise.

The team helps you quarterback the different elements that your finance and tax functions pertain to. Bringing you the calm of knowing your positions are covered on a daily basis, and the comfort that your interests are served in the event of scrutiny. We are happy to support you with tailored services and clear advice, anytime. Let’s get to work!