Industriousness is what drives economies and innovation, and the world’s apex organizations are propelling forces behind it. Therefore, they catch the eyes of governments the world over, who need them in their markets as much as they aspire to hold them to the highest standards.

This fascinating forcefield behind the taxation of multinational and otherwise major corporations, is what shapes the intricate legal system that governs it.

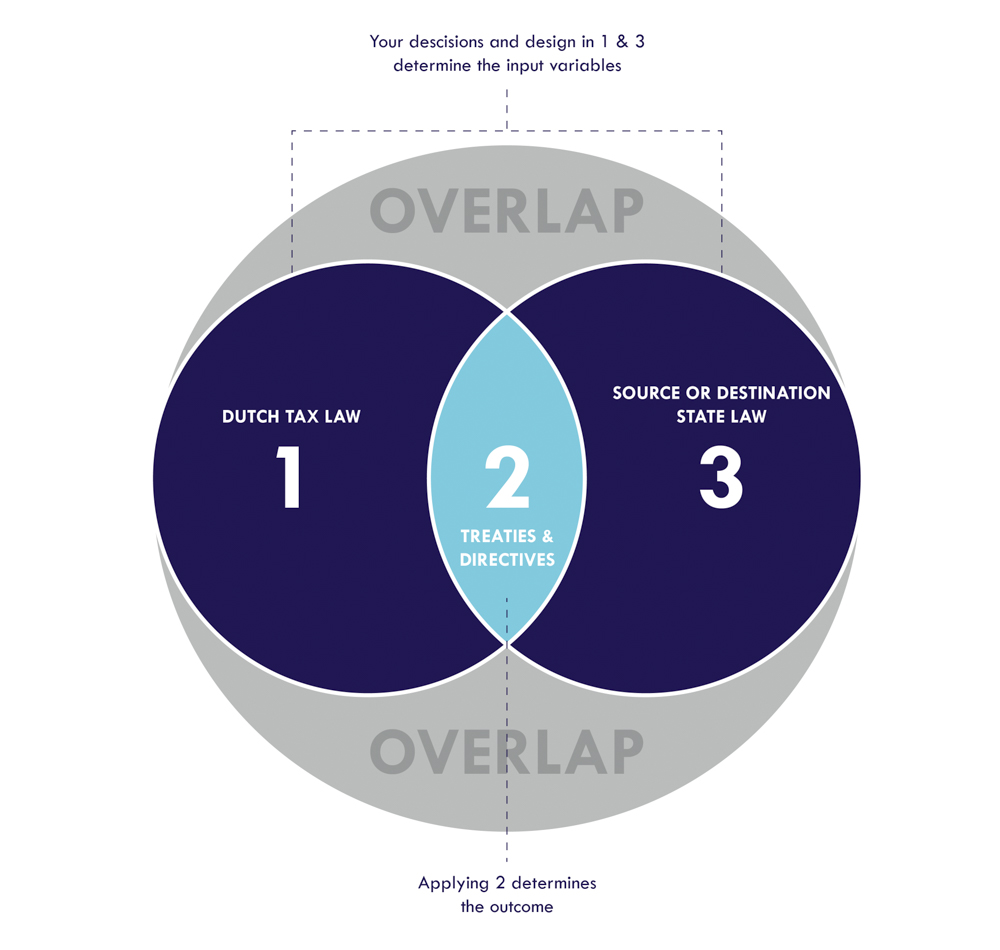

The interaction between different legal systems and the directives and treaties guiding it, make that mindful treading is required, but also that distinct opportunities can be found and supported here.

Our expert group for Corporate Tax Advice is well acquainted with the multi-faceted scope of Dutch and International taxation, both in its outlines and in its details. In symbiosis with our Compliance team, they can help design your bespoke best tax structuring and translate it to an optimal positions report with the Tax Authorities.

This makes us strongly equipped to provide companies ranging up to the ‘Country by Country reporting class’ with the best tax guidance, but in a boutique setting. Our proposition to this group is unvaried: high quality, tailor made services and an efficient use of time. We’re excited to be on your tax side, let’s get to work!