If you are reading this, it’s likely that you want to expand your business or conquer the European market by establishing presence in the Netherlands, a very good and exiting choice! The amount of choices and regulations for a company when contemplating a move to the Netherlands is cumbersome to say the least. For a zoomed-out view of expanding your business to the Netherlands, we would definitely recommend going through our step by step plan for companies.

This article however, focuses on the challenges that any employer might face in terms of payroll tax and social security compliance as well as the income tax obligations of their employees.

So foreign HR and Finance professionals; keep reading if you are contemplating ‘boots on the ground in the Netherlands’.

Pillar 1: Wage tax in the Netherlands for foreign companies

Income tax from Dutch taxable individuals is levied for a large part through a wage tax withholding from the gross-salary. This basically means that the employer calculates the income tax burden on the salary of the employees and withholds that as ‘wage tax’. The wage tax withholding obligation is a separate withholding besides the social security withholding. However, they are both processed in the same Dutch payroll.

The social security withholding obligation is discussed in the second chapter.

When are you a withholding agent in the Netherlands for wage tax purposes?

Foreign companies can be obligatorily, or voluntarily regarded as Dutch wage tax withholding agents if they employ staff in the Netherlands or assign employees to the Netherlands. In order to be regarded as withholding agents, foreign employers must qualify for one of the following:

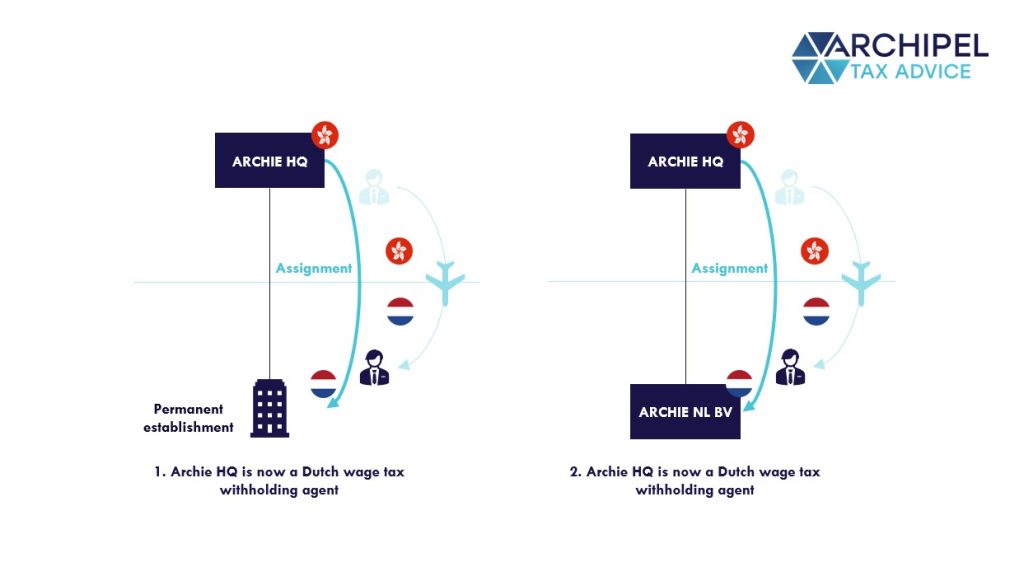

1. A (deemed) permanent establishment for wage tax purposes

If a foreign employer has a Dutch permanent establishment (‘PE’) while assigning staff to the Netherlands, the foreign company will be regarded as a Dutch wage tax withholding agent. This means that the foreign employer will be under an obligation to set up a payroll in the Netherlands and process the Dutch taxable wage of the assigned employee. A permanent establishment in this perspective is defined in line with corporate tax standards. In short, this is the case if the foreign company has a fixed base of operations in the Netherlands such as an office or a fixed representative.

Besides the presence of an actual PE, it is also possible to have a deemed PE for wage tax purposes in the Netherlands. The Dutch supreme court has ruled that a deemed PE exists if a foreign group-entity assigns staff to Dutch group entity. So if a foreign group entity assigns staff to the Dutch group entity, this automatically creates a wage tax withholding obligation for the foreign entity.

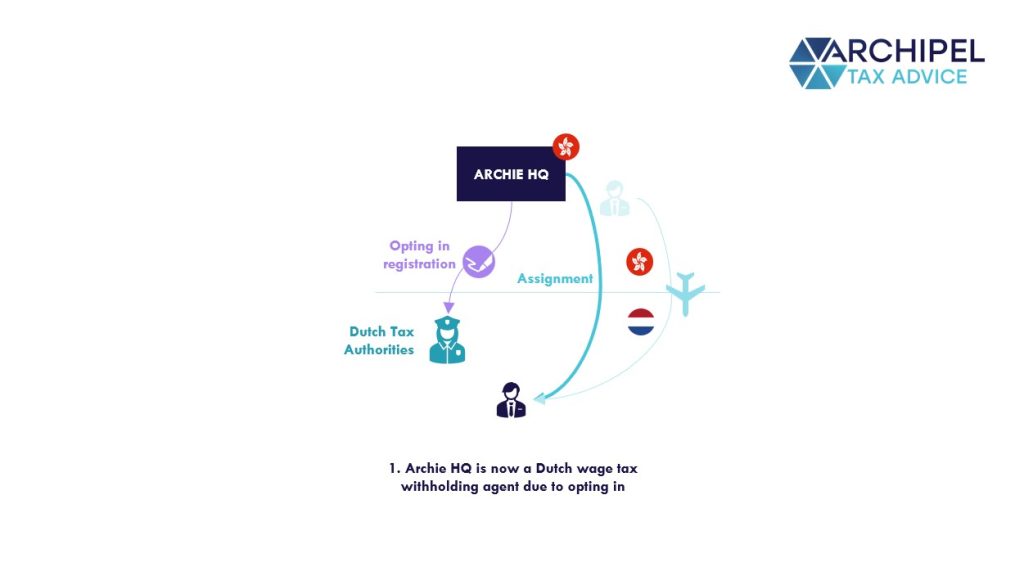

2. Voluntarily opted in for Dutch wage tax withholding

If a foreign employer employs an individual that is liable to pay income tax in the Netherlands on income derived from working in the Netherlands, the foreign employer can opt for wage tax withholding obligation in the Netherlands. In practice, this is done to contribute wage taxes on behalf of the employee when working for shorter periods in the Netherlands. This way, he/she can avoid an obligation of having to file an income tax return in the Netherlands.

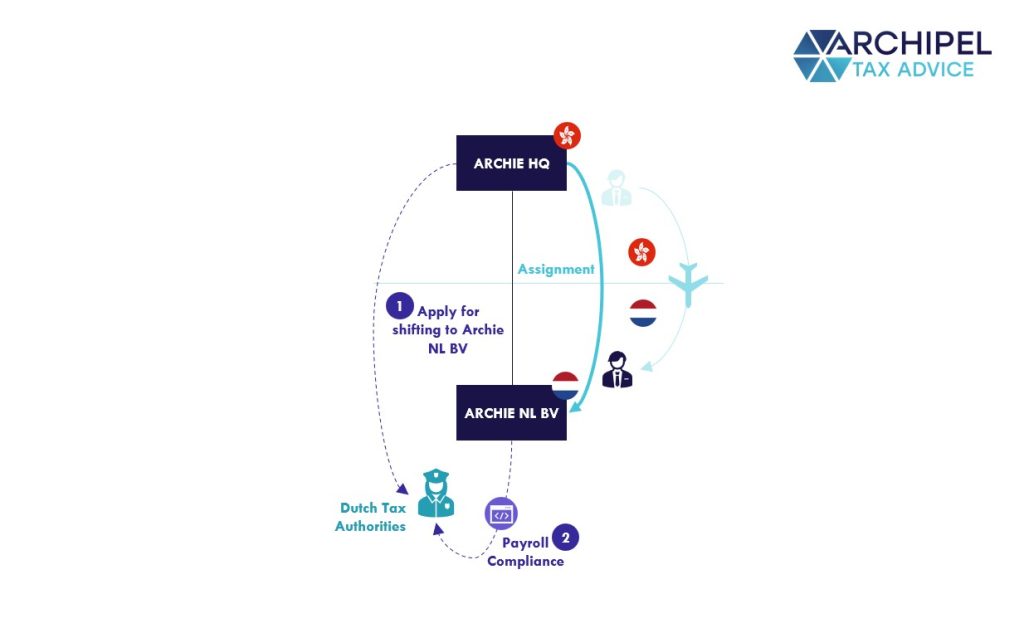

Can you shift the withholding obligation in the Netherlands?

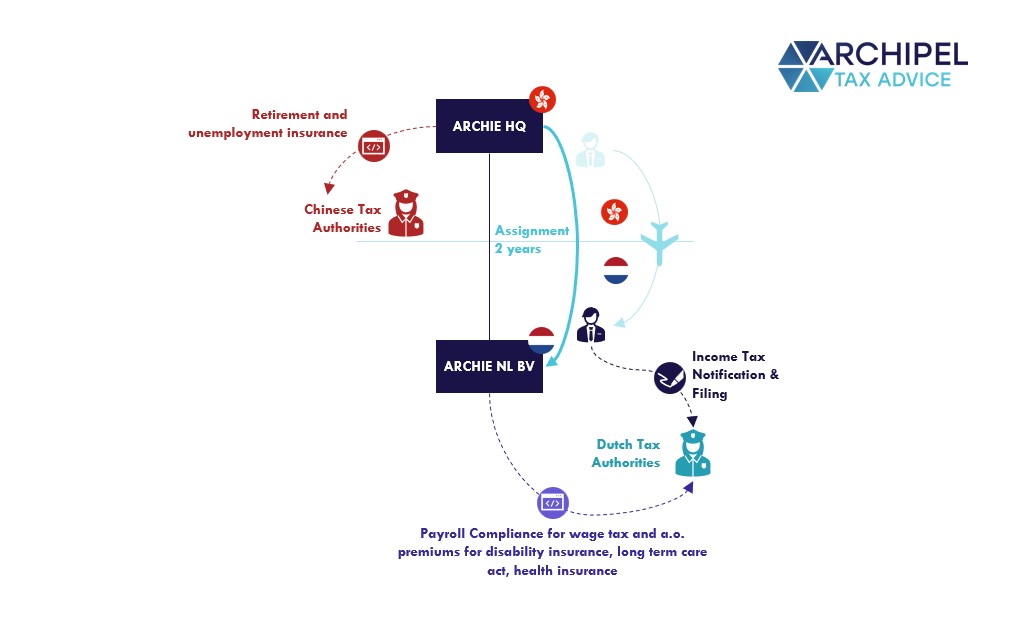

So let’s assume that Archie HQ, as a foreign employer becomes liable to withhold wage taxes in the Netherlands because they have assigned an individual to their Dutch subsidiary; Archie NL BV. Archie HQ now has two options, either register with the Dutch authorities and conduct the payroll themselves, or apply for a shift in withholding tax obligation to the Dutch subsidiary with the Dutch tax authorities. Once this permission is granted, the Dutch subsidiary can take care of the payroll compliance of Archie HQ through its already existing payroll. The shift in withholding obligation also applies to the social security withholding obligation.

Pillar 2: Social security obligations in the Netherlands

Besides the obligation to pay wage- or income tax in the Netherlands, the other major contribution is made through the social security premiums payable. These premiums pay for the various social security coverages in the Netherlands such as disability insurance or state pension. Social security premiums in the Netherlands can be divided into two categories:

- National insurances – costs payable by the employee (through withholding in the payroll or payable via the Dutch income tax return);

- Employee insurances – costs payable by employers with employees who are covered by the Dutch social security system (payable through the Dutch payroll).

If an employee is assigned to the Netherlands, they might become covered by the Dutch social security scheme. This can have consequences for you as an employer but also for your employees as they can become entitled to social security benefits in the Netherlands.

Social security withholding agent in the Netherlands – national legislation

As a foreign employer, you have to know what your obligations are in the Netherlands. In essence, it is very simple: if your employee is mandatory covered by the Dutch social security scheme, you are obligated to process a social security payroll in the Netherlands.

So the obvious question rises; when is an employee obligatorily covered by the Dutch social security scheme?

Firstly it is important to note that you only have to contribute social security premiums on income earned. Meaning that you do not have to pay premiums if you are not generating income.

Provided that an individual employee receives income from employment, the defining two criteria for obligatory coverage under the Dutch social security scheme are: 1. residency and 2. Employment activities in the Netherlands.

Dutch residency

When an individual is a resident of the Netherlands, they become obligatorily covered by the Dutch social security system. In essence, an individual is regarded as a Dutch resident when they have a personal bond of durable nature with the Netherlands. This can either be through family, employment, owning a residence or any other personal ties to the Netherlands. Residency in terms of social security purposes and tax purposes are determined the same way in the Netherlands. Therefore if an employee becomes a Dutch resident for tax purposes, this will also be the same for social security purposes.

Dutch employment activities

Besides Dutch residents, employees who work in the Netherlands under an employment contract are covered by the Dutch social security scheme. A specific exemption to this rule exists when an employee who lives outside of the Netherlands comes to work in the Netherlands and the activities are not assumed to last longer than six months at the start of the activities.

EU situations

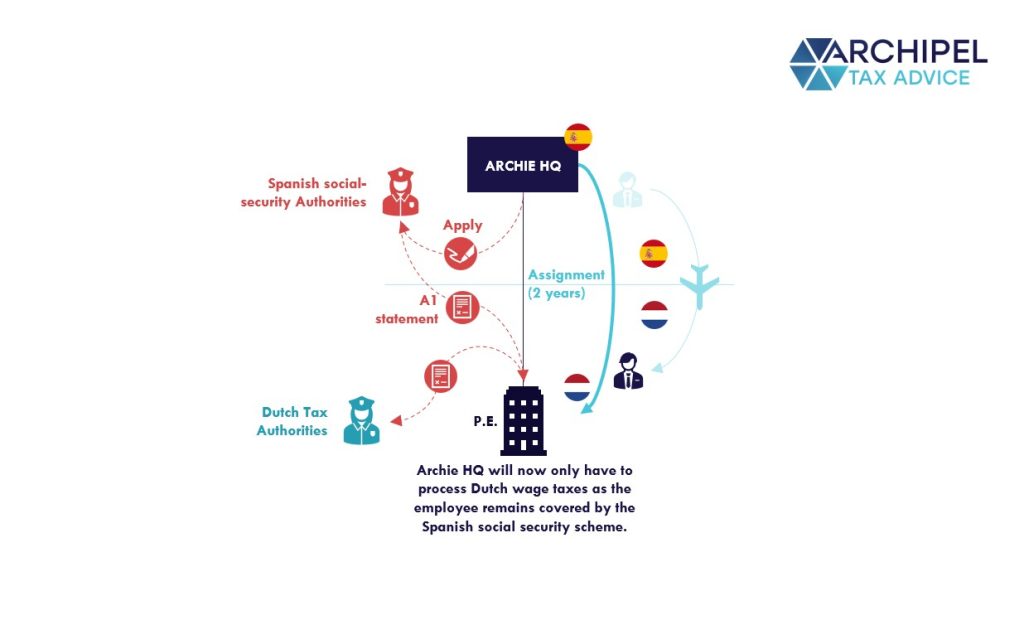

Within the European Union (EU), the coordination of applicable social security schemes in cross-border situations it governed by a specific directive: (EC) Nr. 883/2004. This directive dictates that in cross border situations, employees are covered by the social security system of the country where they exercise their employment. So in principle, as soon as an employee is assigned to the Netherlands from another EU country, that employee becomes covered by the Dutch social security scheme.

One major exception is applicable for assigned employees however. If an employee is assigned to another EU country but the assignment period is at most 24 months, that employee can remain covered under the home-country social security system.[1] It is important to have this confirmed by requesting a A1-statement from the home-country authorities, confirming the coverage of the assigned employee.

An example:

Posted worker notifications (only for intra-EU)

EU nationals have the freedom of travel within the EU, without requesting a resident or work permit. However, as of 30 July 2020 it is obliged to notify “posting of workers” at the Dutch social security authorities. Please note that all the European countries do have this obligation, but the rules per country and the penalties per country can be different. The reason behind the notification is to make sure that foreign employees receive equal salary compared to locally hired employees and to register employees coming into the country.

Treaty countries

The Netherlands has social security treaties with comparable assignment exceptions with the a number of countries.[2] These individual treaties differ in maximum duration of the assignment and the scope of the social security treaty. For example, the social security treaty with China only applies to state pension and unemployment insurance.

If an employee is assigned from China to the Netherlands and as such is covered by the treaty (thus remaining covered by the Chinese state pension and unemployment insurance during the assignment), the following social security premiums can still be due to be paid through the Dutch payroll:

- Disability insurance: Premiums for the coverage of disability after illness of employees (‘WIA’ in Dutch)

- Health insurance premiums: Dutch employers are required to contribute to the cost of their employees’ health insurance coverage (‘ZVW’ in Dutch).

- Disability insurance premiums: Employers are required to pay premiums to the Dutch Disability Insurance Act, which provides income support to workers who become disabled and are unable to work (‘WAO’ in Dutch)

- Long term care Act: Premiums for the coverage of the costs for healthcare in case employees get struck chronic illness (‘WLZ’ in Dutch).

- Premiums for Childcare allowance: The Dutch ‘kinderbijslag’ is used to cover an additional allowance for parents of young children.

Pillar 3: Income tax liability and obligations for employees in the Netherlands

We have discussed the employer’s obligations for an employee that is on assignment. However, the employee has a personal income tax obligation as well. The wage tax payable by the employer is after all, a preliminary levy of income tax (except for the employee insurances part of the social security contributions).

Employees will have to file an income tax return in the Netherlands before 1 May of the subsequent year. The tax year is equal to the calendar year in the Netherlands.

Three main types of income tax returns can be identified in the Netherlands:

- M-form tax return: This is the migration return. This only needs to be filed in the year of arrival or departure when an individual either starts or seizes to qualify as a Dutch tax resident.

- P-form tax return: This is the income tax return that is filed by Dutch tax residents (except the year of arrival or departure).

- C-form tax return: This is the tax return a non-Dutch tax resident files to declare Dutch taxable income.

In summary, an assignment from China to the Netherlands illustrated

Questions or wanting to discuss? Schedule a time below – it’s on us.

[1] Article 12 of the EU Directive 883/2004