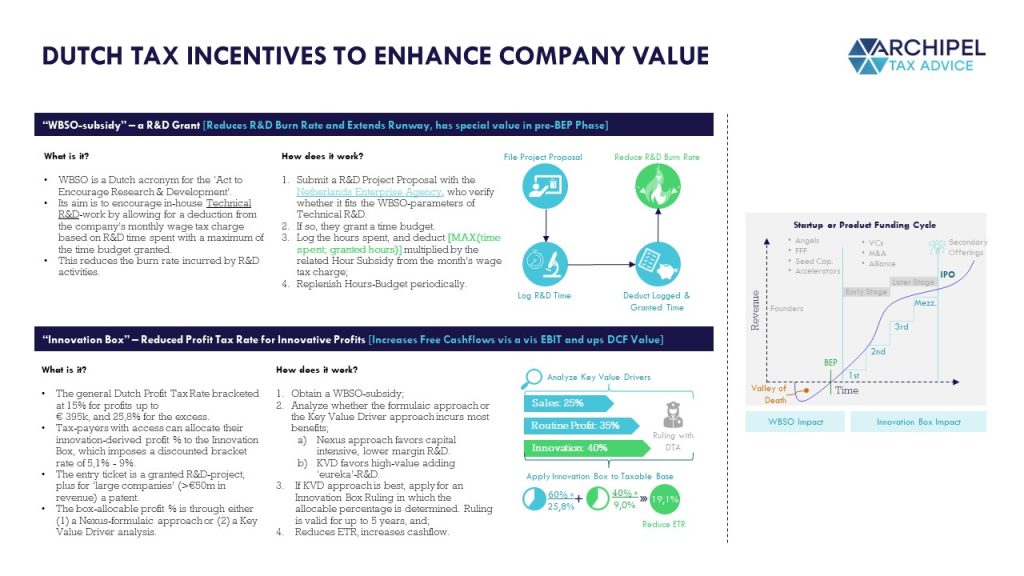

As a small country with a high-income economy, limited natural resources and little manufacturing, the Netherlands has adopted policies to facilitate the knowledge economy. The Dutch government is therefore looking for ways to highly incentivize R&D activities performed in the Netherlands by providing tax incentives to Dutch companies and individuals. This is done by 1) greatly reducing wage taxes on the R&D performed in the Netherlands (the cost-side) and 2) providing a special corporate income tax regime for any profit generated with R&D (the profit side). Both lead to a lower Effective Tax Rate, thus higher free cashflows, and as such a higher Company Value on a DCF basis (check out our explanation of the DCF method for valuating companies: NL/ENG).

In this long-read, we will provide you with the ins and outs of these Dutch tax regimes that incentivize R&D activities.

1. The cost side: the ‘WBSO’

The WBSO is an R&D remittance reduction intended to incentivize businesses to invest in research & development. This incentive greatly mitigates the cost-burden of R&D-companies by reducing the wage tax of employees conducting R&D activities. To obtain the benefits, an application needs to be filed with the Dutch Enterprise Agency (RVO) (in Dutch: Rijksdienst voor Ondernemend Nederland). The application boils down to: 1) proving that you are dealing with a project that contains a technical bottleneck, which 2) cannot be solved by any known techniques, and 3) requiring you to perform R&D work to find a solution.

1.1 The wage tax reduction

For wage tax withholding agents (i.e. employers), the WBSO entails a reduction in the wage tax to be paid for its employees conducting R&D activities. In 2022, this so-called ‘R&D remittance reduction’ is 32% of the R&D base up to € 350,000, and 16% thereafter. If you qualify as a ‘starter’ (i.e. you employ people for less than 5 years and were granted the WBSO-statement for <3 calendar years), you are eligible for an R&D remittance reduction of 40% over the first € 350,000.

| R&D Base | Regular | Starter |

| €0 till €350,00 | 32% | 40% |

| From €350.000 | 16% | 16% |

The R&D base – which functions as the basis for the wage remittance reduction – can be calculated in two ways:

Method 1: based on the number of R&D hours: this is the more straightforward regime, where the amount is calculated based on the number of hours granted, with an average hourly wage of € 29 plus an additional amount of € 10 per R&D-hour (up till 1,800 R&D hours) and € 4 for any additional hours on top of the 1,800 hours.

Method 2: based on the actual costs and expenses that relate to the R&D activities.

In case you would like to calculate the potential WBSO-benefit yourself, feel free to use our open-source Excel-file. You can download the Excel file here:

1.2 The number of R&D hours: choose a reasonable number!

A WBSO-statement always applies to any future R&D work performed by the company. As a result, you will need to make a forecast of the number of R&D hours you are planning on spending (method 1).

Make sure to apply for a reasonable number of R&D hours. The reason is that the RVO 1) checks whether the number of R&D hours requested isproportionate to the project and the amount of FTE involved, and 2) the RVO regularly audits companies on their number of R&D hours spent. In case the number of R&D hours for which you applied cannot be justified, you risk a correction and a fine.

1.3 ‘But…our R&D project is not that innovative.’

While analyzing the R&D activities of a potential WBSO-applicant, we sometimes notice that the company itself does not consider the project to be ‘innovative’. In most cases this is caused by 1) R&D employees perceiving the R&D work as ‘simple’ due to them being experts in their respective field, or 2) comparing the R&D activities/ the unfinished product to the (finalized) product of a competitor. Though we understand that this might seem problematic when filing a WBSO-application, we would like to stress that both these factors are completely irrelevant for WBSO-purposes. The only relevant factor when determining if a project qualifies for WBSO-purposes is whether you aim to solve a technical bottleneck that cannot be solved by any known methods. It is therefore irrelevant if this work is perceived as simple by the R&D employees or whether a competitor has already solved this bottleneck. For instance: the RVO will not reject a WBSO-application in case you are planning on solving a technical bottleneck for a new ‘Google-like’ search engine, just because Google itself might have a way of solving the technical bottleneck. What isn’t considered R&D work – and will not qualify for WBSO-purposes – is using existing technologies to solve technical bottlenecks. For example: creating a machine learning model by utilizing certain libraries (such as Tensorflow) will not qualify as R&D work, but developing a machine learning model from scratch (and solving a technical bottleneck in the process) will.

2. The profit side: the innovation box

The Dutch innovation box is a special corporate income tax regime for companies who generate profit via a self-developed intangible asset. Any profits that fall under the scope of the innovation box are effectively taxed at a corporate income tax rate of ~9% instead of the statutory rates of up to 25.8%.

2.1 The requirements: the WBSO and a patent/plant breeders’ right (in Dutch: Kwekersrecht).

The Dutch corporate income tax act differentiates between so-called small-sized companies and larger-sized companies. The requirements a company needs to meet in order to apply for the Dutch innovation box vary depending on its size. For the small-sized companies, the application can be filed as soon as a WBSO-statement is issued by the Dutch Enterprise Agency. Larger-sized-companies require a patent or a so-called plant breeders’ right (in Dutch: Kwekersrecht).

A company qualifies as a ‘small-sized company’ if:

- The total gross margin of the company that relates to the intangible asset is ≤ € 37.5 million in the last 5 years (i.e. the sum of the last 5 years).

- The total turnover of the company is ≤ € 250 million in the last 5 years (i.e. the sum of the last 5 years).

2.2 Four methods to determine the profit subject to the innovation box

The innovation box benefit can be calculated via four methods:

- The peel-off method (‘afpelmethode’).

- The cost-plus method.

- The single- intangible asset method (‘per activum’).

- The flat rate method.

Which method is best suited for your business depends on your business model as well as the role R&D fulfills within your company. In practice, a functional analysis of your company will determine which method is most suited and which percentage of the profit is subject to the innovation box scheme. For completeness’ sake, we would like to note that it is a common misunderstanding that 100% of a company’s profits can attributed to the innovation box. Even the most high-tech companies in which R&D is interwoven in their entire business process cannot allocate all of their profits to the innovation box scheme. The tax authorities will – in such a case – always consider a part of the profits to be allocable to an entrepreneurship-like function within a company.

2.2.1 The peel-off method (in Dutch: ‘afpelmethode’).

In case R&D is a core activity within your company and the profits that relate to an intangible asset cannot be determined on a stand-alone basis, the peel-off method is the most suited method. The peel-off method is – in most cases – the most beneficial way of determining the innovation box profit, as the entire EBIT (‘Earnings before interest and tax’) of the company will be considered the starting point. This method works by allocating a small part of the profits to the more routine-like functions within the company. The remainder of the profits is then allocated to the core divisions/functions within the company. In a way: you are ‘peeling off’ the company’s functions layer by layer.

An example of the peel-off method allocation per core-division would be:

| Entrepreneurship | 20% |

| Sales | 10% |

| Production | 30% + |

| Total: | 60% |

| Attributable to R&D | 40% + |

| Total: | 100% |

In the above example, 40% of the company’s profits are allocable to innovation, and will therefore be taxed against an effective corporate income tax rate of ~9%.

2.2.2 When is R&D considered to be a core activity?

Well, that depends on the activities of the company. The Dutch tax authorities will take the position that the peel-off method is the most suited method if the R&D-activities are an essential part of the day-to-day operations. This is the case if R&D activities are interwoven in all of the company’s operations and the R&D function is one of the most important functions in terms of value creation for the company.

2.2.3 How do we determine the percentages attributable to each division/activity when applying the peel-off method?

When applying the peel-off method, a functional analysis determines which part of the profits is allocable to each division/function. The exact percentage per division depends on the size of the company (smaller or larger size), the industry and the function R&D fulfills within the company. Factors that may be relevant in this analysis are:

- The number of WBSO-hours.

- The intertwinement of R&D within the different business units of the company.

- The different types of products/service lines within the company.

2.2.4 The hurdle – development costs

It is important to note that the innovation box regime contains a hurdle for the development costs that relate to the development of the intangible asset. In short: the innovation box regime will only be applicable if the development costs for the intangible are compensated by the profits generated by said intangible. The goal here is to prevent a deduction of development costs against the standard corporate income tax rate of 25,8% (maximum), while the profits are taxed against an effective tax rate of ~9%.

2.3 The cost-plus method

In case innovation is not considered a core-activity within the company but rather complementary to the company’s core activity, the Dutch tax authorities may take the position that the innovation box profits should be determined on a cost-plus basis.

The cost-plus method entails adding a mark-up on all costs (direct & indirect) relating to the R&D work. This mark-up is determined by benchmarking the remuneration an independent third party would receive for these R&D activities.

Under normal circumstances, a mark-up between 8% – 15% is accepted by the Dutch tax authorities.

2.4 The single intangible asset method

The single intangible asset method is very similar to the peel-off method. When applying the single intangible asset method, the operational profit needs to be divided between routine functions and core activities/divisions of the company. The difference here is that – while the peel-off method considers the EBIT (‘earnings before interest and tax’) as the starting point – the single intangible asset method only takes the development costs and the ‘benefits’ that directly relate to the intangible asset into account. The single intangible asset method is generally used to calculate the innovation box profits in royalty structures, where there is a direct and easily identifiable revenue stream that relates to the intangible asset.

Note that – same as for the peel-off method – a hurdle based on the development costs applies.

2.5 The flat rate method

In the event that the earlier described methods are deemed to be too complex, there is always the possibility of utilizing the flat rate method. Based on this method, 25% of the profit will fall under the scope of the Dutch innovation box. The benefit is however capped to € 25,000 on a yearly basis, making this – in most cases – only a viable option for a small/ start-up company.

2.6. The corporate income tax benefits

Although it may seem a bit nitty gritty, it is important to note that the innovation box benefit is actually a tax base exemption -rather than a tax rate reduction- calculated via the following formula: (16/25.8) x innovation box profits (2022). This exemption results in an effective tax rate of ~9% for any profits that are subject to the innovation box scheme. It also results in an additional – and in most cases unforeseen – benefit that the innovation box scheme ‘extends’ the first corporate income tax bracket.

2.6.1 Extending the first corporate income tax bracket and further reducing the effective tax rate

Besides the fact that the innovation box reduces the effective tax rate of profits that fall within its scope, the innovation box also positively influences the remainder of the profits. This is a result of the fact that the remainder of the profits (i.e. part of the profits that are not subject to the innovation box) are taxed against the regular, below-mentioned corporate income tax rates.

| Taxable profit (2022) | Tax rate |

| € 0 till € 395,000 | 15% |

| From € 395,000 | 25.8% |

Consequently, the remaining profits will first be taxed in the first bracket at a tax rate of 15% up to € 395.000, thus further reducing the effective tax rate. In case you are wondering how this would affect the effective tax rate of your organization, feel free to use our Excel-file which shows you the effective tax rate depending on the taxable profit and the innovation box percentage. Note that we based this Excel file on the peel-off method. You can download our Excel file here:

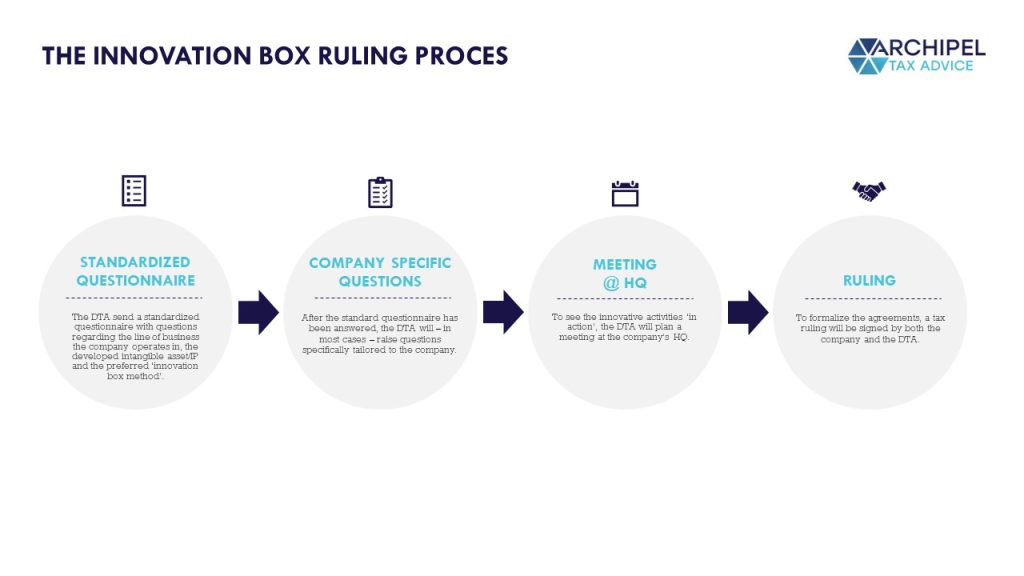

3. The ruling application process

The innovation box ruling process starts with a ruling application request. Once filed, the Dutch tax authorities will send over a standardized letter containing several questions to get to know the applicant. These questions relate to: 1) the line of business in which the company operates, 2) the intangible asset/ intellectual property developed by the company and 3) the preferred method to determine the innovation box profit. In most cases, the Dutch tax authorities will request a company specific questionnaire following the initial application. Once the Dutch tax authorities have a clear initial image of the company’s business, they will plan a meeting at the company’s HQ. This meeting is meant to help the Dutch tax authorities understand how the business operates and what role R&D fulfills within the company. After the meeting, the Dutch tax authorities and the company will conclude a tax ruling . The ruling will contain:

- a description of the company;

- a description of the R&D activities;

- the method to determine the innovation box profit.

To further specify which part of the profits will be subject to the innovation box scheme, an addendum to the ruling request will be concluded, based on the company’s commercial forecasts. The ruling will be concluded for a period of 5 years.

4. FAQ

4.1 Can I outsource some of the R&D that contributes to my intangible asset?

You are able to outsource some of the R&D work as long as the costs that relate to the R&D work (as well as any potential risks) are borne by the innovation box applicant.

4.2 Does this mean that I can outsource the R&D work to an affiliated entity?

Outsourcing to an affiliated entity is possible, but may impact the total innovation box benefit. The Dutch corporate income tax act contains a limitation on the innovation box benefits that relate to the outsourcing of R&D work to an affiliated entity. The reason is that – in most cases – affiliated entities are able to structure their R&D activities between different jurisdictions. To mitigate any unwanted tax structuring which might arise in such a case, the innovation box benefits will be limited based on the following formula:

| Qualifying innovation box benefits = | Qualifying expenses X 1,3 ________________________ Total expenses | X benefits |

In the above formula, the outsourced R&D expenses to an affiliated entity are not considered ‘qualifying expenses’. As a result, a maximum of 30% of the expenses can be outsourced to an affiliated entity without it impacting the innovation box benefits.

4.3 An Innovation box ruling is concluded for a period of 5 years, what if my corporate structure/ my business model unexpectedly changes during this time?

Every tax ruling contains a clause stating that the ruling remains valid as long as the relevant facts and circumstances do not change. In such a case, you are obligated to notify the Dutch tax authorities accordingly. This may result in the termination of the current ruling.

4.4 I filed a WBSO-request for 2.000 R&D hours. In reality, my company conducted > 2000 R&D hours. Can I file a new WBSO-application to retroactively receive a wage remittance reduction for these additional R&D hours?

Unfortunately, it is not possible to file a WBSO-application to retroactively receive a wage remittance reduction for any additional R&D hours. As a WBSO-application does need to be filed on a yearly basis however, you are therefore able to file a new request next year. For completeness’ sake, we note that you are obligated to notify the Dutch Enterprise Agency in case you spend less than the requested number of R&D hours. As a result, the wage remittance reduction will be reduced accordingly.

4.5 So, the Dutch tax authorities agree to allocate 15% of my EBIT to the Dutch innovation box. Does this mean I can allocate 15% of my EBIT right of the bat?

While concluding an innovation box ruling, the Dutch tax authorities may consider an start-up phase to be present. The duration depends on the innovation type as well as the business structure. As soon as this period ends, you are able to allocate the full amount – 15% of the EBIT – to the Dutch innovation box. For example: in case you conclude a start-up phase of 3 years and an R%D percentage 15%, you will receive an innovation box allocation of 5% in the first year of the ruling, 10% in the second year and finally 15% in the third year.

5. Combine the WBSO and innovation box for an enhanced investment case and company value

Where R&D-cycles generally see any revenues being proceeded by a cost-burning phase, a cost-side tax benefit can logically make an R&D project more feasible, as it (1) reduces the burn rate and (2) lengthens the runway. The WBSO does exactly that and therefore provides great value in the ‘pre Break Even Point’ phase.

Investors investing in ‘post-BEP phase’ companies are generally enticed into the high-risk financing of an R&D cycle by the calculation of (1) the chance of success * (2) the rate of return. As the investor rate of return is influenced heavily by profit tax functions, the innovation box can make an R&D project in the post-BEP phase more feasible as well since it increases the outlook of factor (2).

By combing both the WBSO and subsequently the innovation box, a more attractive investment case can thus be achieved.

Interested in applying the WBSO and/or innovation box to your company? Book a timeslot with us below, it’s on the house!