If you are reading this, chances are that you’re in an early or more advanced train of thought about Incentive Plans in the Netherlands. You may be involved on the extending or the receiving end, and either way, you would be right to consider such an intricate staff involvement scheme. Why? Extensive research shows that employee engagement and ownership schemes, in the broadest sense of the word, benefit both the company and the involved staff member. So to give you reason to continue reading, we first set forth some testimonials to Employee Incentive Plans, Employee Ownership or ‘Shared Capitalism’ Plans from the world of Science.

Download this article in pdf here.

Benefits of Employee Incentive Plans: what the Science Says.

Benefits for the Company:

The National Center for Employee Ownership maintains a great website with the best testamental papers that science has to offer. And although the Institute’s name shows its preference, the quoted independent science supports a number of encouraging observations, of which the following stand out from a company perspective:

- Companies with broad-based plans saw productivity rise 20% to 33% above comparable firms after plans were implemented, with medium-sized firms at the higher end of the scale.

[James Sesil and Maya Kroumova, “Broad-Based Stock Options Before and After the Market Meltdown,” Rutgers Working Papers, 2002.] - ESOPs led to an 8.12% increase in Tobin’s Q relative to the industry median (the ratio of the company’s stock value to its book equity value).

[“Employee Capitalism or Corporate Socialism? Broad-Based Employee Stock Ownership,” E. Han Kim of the University of Michigan and Page Ouimet of the University of North Carolina, paper for American Finance Association 2010 Annual Conference.] - Companies in three-year post-plan period compared to before and after data for comparable companies without plans [reported]: Productivity: +14.8% Return on assets: +2.5%.

[Joseph Blasi, Douglas Kruse, Maya Kroumova, and James Sesil, Broadly Granted Stock Options Improve Corporate Performance].

Another important mass-data analysis was published 2016: the Human Resource Management Journal article ‘Employee ownership and firm performance: a meta-analysis’ lead authored by Kelley School of Business professor Ernest o’Boyle noted the following:

Is employee ownership a management fad? One of the concerns voiced in recent years is management fads […]; managers could adopt employee ownership not for strategic reasons, but because of mimetic pressures and the bandwagon effect. If employee ownership practices do not aim to improve performance and are indeed fads, then effect of employee ownership on performance in empirical studies over the years should decline. However, if it is a viable management practice, then firms would learn to deploy it more efficaciously over time […] [As shown in Table 2(b), the regression coefficient for year of study […] indicates that the effect of employee ownership on performance has increased over time. It is more likely, therefore, to be an organisational practice that has led to sustained improvements in performance than a management fad.

[O’Boyle, Ernest & Patel, Pankaj & Gonzalez‐Mulé, Erik. (2016). Employee ownership and firm performance: a meta-analysis: Employee ownership: a meta-analysis. Human Resource Management Journal. 26. 10.1111/1748-8583.12115.]

Benefits for the Employee:

With evidence suggesting that employee-co-owned companies perform better, the question arises what’s in it for the employee. Although the gut feeling may be that the employee foreseeably only obtains ‘positives’, some scientific substantiation would provide comfort. In that sense, we cite a 2019 studies by the Rutgers School of Management and Labor Relations:

While the analysis of these rich data will continue, three important categories of impact are emerging from the work. First, we find personal and family impacts from ESOP resources as they create real and perceived economic stability and security. The role of ownership in asset building and work stability is the second big impact, as ownership seems to shape employees’ actions and perceptions related to participation, inclusion, value, trust, equity and fairness. Finally, the ESOP drives development of an opportunity structure built through skill, knowledge, leadership development, mentorship and advancement.

Rutgers School of Management and Labor Relations’ Institute for the Study of Employee Ownership and Profit Sharing, ‘Building the Assets of Low and Moderate Income Workers and their Families, The Role of Employee Ownership’, March 2019.

So: reasons to go for it!

Tying this together, Employee Incentive plans have the proven potential to benefit both the company and the employee. And against the backdrop of a global trend towards tight labor markets with HR-related items becoming companies’ bottlenecks for growth, an incentive plan can work to attract and retain employees and manage cashflow. For growth firms, such plans may also be a way to interest more expensive staff members in joining the company at sub-market fixed salaries, in exchange for a participation the company’s envisaged future profits.

The 5 Types of Incentive Plans

So once you’ve decided to go for Shared Capitalism, the next quest is for the most perfect plan. And the realm of possibilities is near-endless. So in this read, we set out what we consider the 5 main species of Incentive Plans and explain their workings. And as we are Dutch Tax Lawyers, that is the perspective from which we highlight their elements. Note that within these species, the details of the nuts and bolts that make up the apparatus that is the main plan are equally near-infinite. So the below is meant to help you get started on or more invested in the subject rather to pretend setting out a complete scope of considerations and options. Here goes our take.

Briefing Before we Dive In: Dutch Personal Income Tax 101

As many of the contours of an Incentive Plan can be influenced or even determined by the underlying cash parameters, one of the most predominant ones being the tax effect, we start by briefly portraying how the Dutch Personal Income Tax Code works.

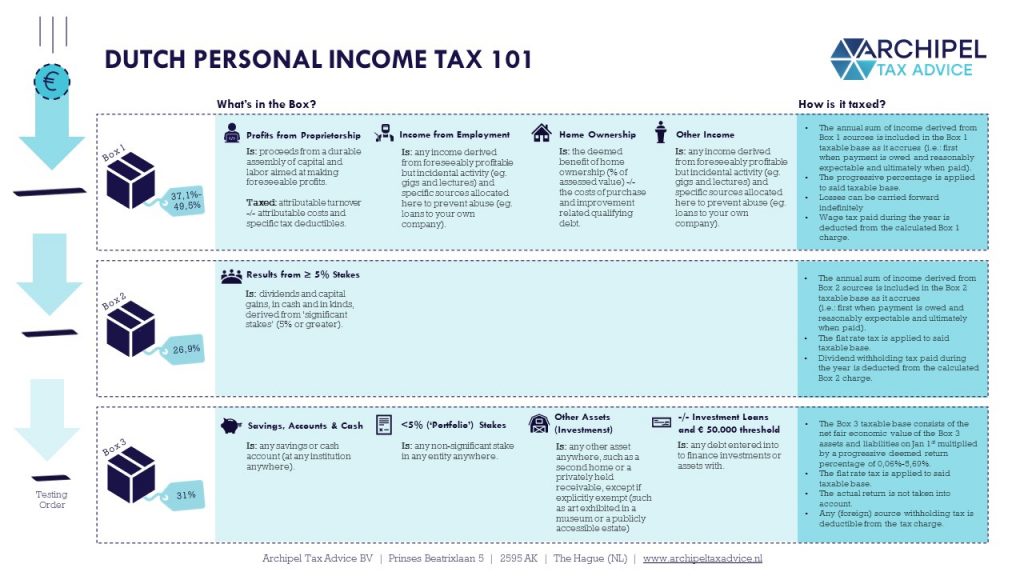

For starters, the Code is formed around the basic principle that Income Tax should cover income derived from any pre-defined ‘Source’ of income. These Sources are placed under one of three regimes that are known as the ‘Boxes’.

Box 1 taxes, at 37,1% [up to € 69.399] or 49,5% [the excess], the year’s combined income derived from the following Sources:

- Employment;

- Proprietorship;

- Home Ownership, and;

- Other Income [gigs, profitable non-business and/or specific anti-abuse descriptions].

Box 2 taxes, at 26,9%, the income derived from the Source ‘Significant Stakes’, meaning remunerated income from ≥5% stakes. Note that this covers direct stakes, so if a person owns 100% of the shares in a Personal Holding [PH] entity and said PH entity receives a dividend or capital gain but does not remunerate it to the shareholder, there is no taxable Box 2 income. If the PH’s stake in the entity from which the income is derived qualifies for the Participation Exemption [generally a direct ≥5% stake in an active and realistically taxed [≥10% CIT] entity], the PH itself does not have to pay Corporate Income Tax on said dividends.

Box 3 taxes, at 31%, a deemed income derived from the Source ‘Savings and Investments’. This encompasses income derived from any capital assets that have not been captured earlier, such as Portfolio Stakes (<5%), savings accounts and investments such as rented out houses.

The deemed income is calculated as follows: [(asset value -/- value of corresponding debts]) -/- tax free threshold of € 50.650 per person] * Deemed Income Brackets. These brackets, in short, are:

- € 0 – € 50.650: 1.82%

- € 50.651 – € 962.350: 4.37%, and;

- The Excess: 5.53%.

Guide to the 5 Incentive Types.

Type 1: The KPI Bonus. Entry Level and Highly Targeted.

The most common Incentive Plan involves a so-called ‘Key Performance Indicator Bonus’ which may be taylor-fit to nudge specific staff members towards specific targets. Put briefly, the incentive is that the employee is rewarded with an additional cash payment if and/or to the extent said specific goals or milestones are met or exceeded.

Common examples are Sales Staff who may receive an X% kickback on any closed account, or a gradually increasing cash bonus as specific annual sales targets are achieved. Or research staff who are offered a lump-sum bonus if a certain patent is granted, or HR staff being rewarded per highly sought senior hire.

How does it work from a legal perspective?

The KPI Bonus is implemented through a separate clause in the Employment Contract, or through a separate arrangement or side letter. As it constitutes an additional payment of wages, it is inextricably linked to company involvement (although some contract wording may lead to bonus severance payments upon termination or to after-payments after termination).

The KPI Bonus, therefore, is not an equity instrument and can be linked easily to employment at the company. So: if the employee leaves or is terminated, any financial rewards linked to the company’s development or targets down the road are naturally ended.

And from a tax perspective?

For the employee: The bonus payment is taxable as regular wage under the Box 1 regime. This means it is added to the year’s total wage, and taxed accordingly. This means that the bonus is a ‘top up’ of the year’s earnings, meaning it taxed in full against the marginal rate rather than against the average rate, taking into account the brackets. It is for this reason that many Dutchmen commonly misconceive that bonusses are subject to a higher rate than regular wage, but this is untrue.

For the company: The bonus payment is deductible from its CIT base.

What are the ingredients?

- A clear definition of the KPIs (sales targets, research targets, company growth targets);

- An equally clear formula or listing of the bonus payments hitting these KPIs may trigger, and;

- The payment terms for said bonus (payable at once, at year-end, or when the books are drawn up?).

The pros and cons.

A KPI Bonus can be very targeted, meaning that specific team members can be incentivized towards highly specific goals, and the incentive can be designed with near-infinite flexibility. At the same time, ‘owning’ a KPI Bonus is not a taxable event as the bonus potential is not an asset but rather a conditional right to surplus pay. That means that the staff member only pays tax when the Bonus Clause bears fruit. And as it isn’t an equity instrument, any rights derived from the clause naturally expire in case of leave or termination.

The other side of the medal here is that the incentive naturally prioritizes personal goals over team or company goals, for instance prioritizing additional last-minute work on an account that is linked to the individual employee’s bonus plan but that is less significant for the company, as opposed to last-minute work on the company’s most important client who isn’t earmarked for said employee. Company involvement as a whole can be limited, as the KPI Bonus does not result in any actual ownership. Finally, a bonus may be payable even when the company’s cash position is not strong, and the tax charge on any such bonus is on the highest end of the Incentive spectrum.

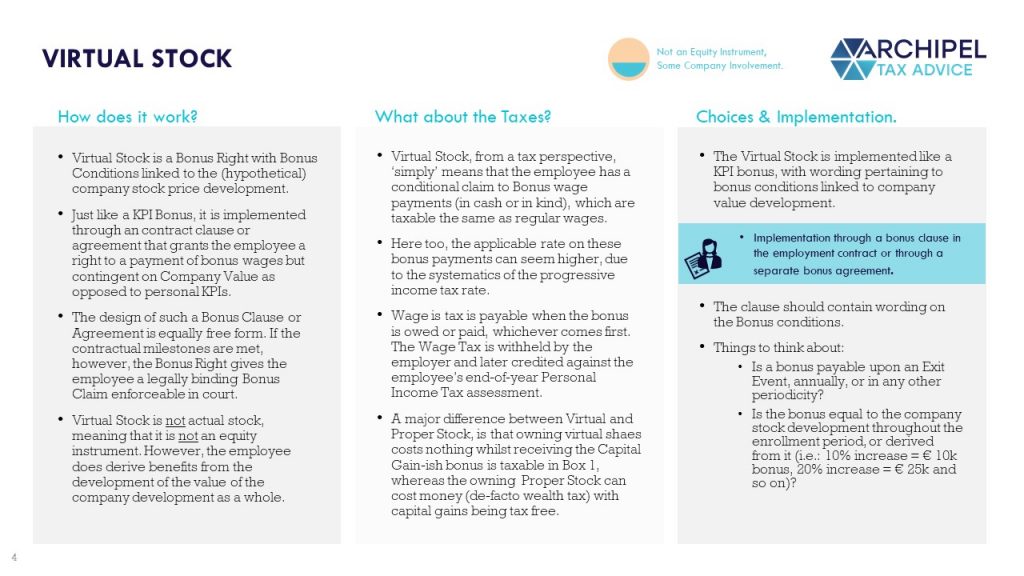

Type 2: Virtual Stock. Mimics Ownership Without the Equity.

Virtual Stock is a bit of a hybrid instrument; from a tax and legal perspective, the employee has a Bonus Clause. But from an economic or business perspective, the bonus potential is linked to the company’s real or hypothetical stock price development. This means that the involved staff member is encouraged to pursue team or company goals over individual goals, should these juxtapose.

How does it work from a legal perspective?

Much like the KPI Bonus, the Virtual Stock ownership is implemented through a clause in the employment contract or through a related side letter or separate agreement. As the name indicates, Virtual Stock is not an equity instrument but a bonus wage clause that mimics stock ownership through its link to company vale development. This means that involved is wound down naturally upon employee termination, and unlike actual stock it does not necessary require separate agreements to that end.

And from a tax perspective?

For the employee: Just like the KPI Bonus, the Virtual Stock bonus is an additional payment of regular wage, which is equally taxable under the Box 1 systematics and at the applicable marginal rate. And just like a KPI Bonus and contrary to actual stock, owning virtual stock itself incurs no taxation until an actual bonus is paid.

For the company: The Virtual Stock bonus payment is deductible from its CIT base only if the employee involved does not earn more wage than € 591.000 in that specific year. If the wage exceeds said threshold, the Virtual Stock bonus payment is not deductible.

What are the ingredients?

- A proper definition of the Virtual Stock stake [i.e.: what percentage of the company is the employee attributed and at what value], and;

- The payment terms, such as whether the company value increase bonus is payable on an annual basis or only upon an Exit Event, and when such payment then takes place.

The pros and cons.

Virtual stock encourages the employee to prioritize company value over their own position within it. Extending Virtual Stock is simple when compared to implementing an actual employee stock ownership plan and owning it incurs no tax costs until any bonuses are actually paid.

Cons are that company performance-linked bonus potentials can leave freeloader behavior untouched, although this may be mitigated through termination and the related end of the bonus clause. Also, virtual stock that is payable annually and linked to company value increase does not take into account cash position and valuation can be difficult or a cause for debate, which can be disincentivizing. Finally, virtual stock does not lead to any actual company ownership, and when bonuses are paid, they are taxed against conditions at the unfavorable end of the spectrum.

Note: from here on out, the plans involve equity.

Employee Incentive Plans’ center of gravity can largely levitate between upfront cash and long-term ownership. And actual ownership, from a legal perspective, is implemented through some sort of equity [stock] ownership. And generally, proceeds derived from stock ownership are taxed at a friendlier Personal Income Tax rate than wage proceeds, largely because the first are not CIT-deductible and -when paid in the form of dividends- come after corporate tax, whereas bonus wages (generally) are deductible for the company. On a cumulative level, the applicable rates should add up to comparable rates. But for the employee, ownership may just ‘feel’ different. Better.

Now as company ownership follows from stock or stock derivatives ownership, implementing such a scheme contains two elements with each their distinct tax consequences: getting the equity to the employee, and the employee’s subsequent ownership of the equity. From a tax perspective, any implied or explicit discount on ‘getting the equity to the employee’ is taxable as a wage benefit in kind. And depending on how the stake is structured, the employee’s subsequent ownership is taxed either in Box 2 or 3. The friendlier regimes, that require an entry ticket that may come at a tax price. As a company’s value increases more rapidly, it becomes more rational from a tax perspective for the employee to ‘take’ that increase as a capital gain rather than as a bonus. Therefore, frontloading a shift to equity is the tax advisor’s choice, but the company’s and the employees’ cash positions need to be at a certain level to support that shift.

And as equity ownership is governed by property and company law as opposed to labor law, implementing ownership generally requires additional paperwork as the company will generally want to secure its rights in case the employee relationship turns sour. And the cap table should remain manageable if the company’s investor pitch is to remain attractive. Put briefly: some legal footwork should be done to govern what happens during a happy marriage, but also in case of an ugly divorce. So: from this equity point on out, the incentive plans become more involving, but also more delicate.

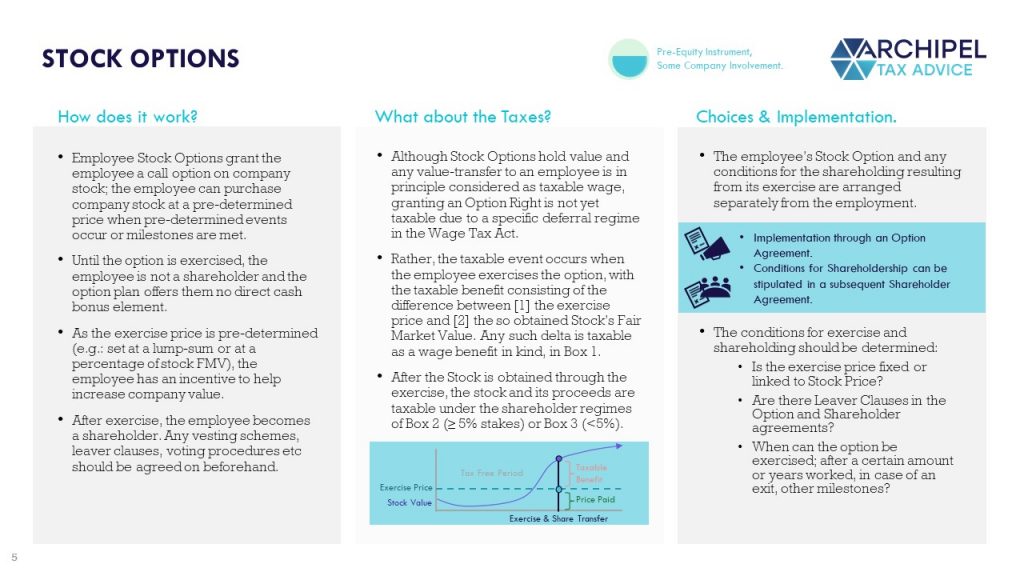

Type 3: Stock Options. Contingent Ownership.

Stock options, put briefly, are an agreement that offers the employee a call option on company stock. And this call option may be subject to conditions. When the employee ‘exercises’ the option, they obtain company stock at a pre-determined price, which may but generally doesn’t equal the stock’s Fair Market Value. The subsequent shares may be subject to drag-along clauses, meaning that the employee is to sell their stock to an investor in case of any Exit Event.

How does it work from a legal perspective?

The stock option is granted through an option clause in the employment contract or through a seperate agreement. This means that some wording is required if the intent is for the option only to be exercisable if the employee is still involved with the company. Also, if the subsequent stock ownership is to be subject to conditions (for instance pertaining to voting rights or procedures, dividend policies and hand-back clauses in case of termination so as to prevent continued benefits after ‘Bad leavership’), the stock option should be accompanied by a shareholder agreement that links to the subsequent stock and is triggered upon the option’s exercise.

And from a tax perspective?

For the employee: In principle [we know, we know], a stock option would be considered an equity instrument. This means that its transfer or extension to the employee could trigger wage and income tax on any implied or explicit discount, and the stock ownership itself would be taxable under the Box 2 or Box 3 regime depending on its structuring. However, as valuing an option can be extremely complicated and then still highly volatile, especially if the option pertains to stock in non-listed entities, a special tax rule [lex specialis] was introduced to postpone any taxation until its exercise.

Put briefly, any delta between -on the one hand- the option premium and strike price and -on the other hand- the Fair Market Value of the underlying stock obtained through said exercise [which is valued at reference transaction price or DCF-value absent one] is taxable as a wage benefit. The resulting stock ownership is then taxed still under the more favorable Box 2 or 3 regime.

For the company: The grant of option rights is not deductible from its CIT base, and neither is the subsequent exercise. This makes sense, as it is not really a business-related expense, but rather a dilution of the other shareholders’ stakes.

What are the ingredients?

- An option clause or agreement that contains wording on:

- How exercising rights vest and un-vest;

- What the Exercise Events are (when the option can be called), and;

- The exercise price (lump sum or percentage?).

- A subsequent Shareholder Agreement that sets terms and conditions for the stock obtained through exercise, such as:

- Tag- and drag along rules;

- Leaver Clauses;

- Voting Procedures, and;

- Dividend and Exit policies.

The pros and cons.

An option plan, often called an Employee Stock Option Plan or “ESOP”, is a suitable way to involve employees in the company’s future and future value developments without inducing an upfront cash-out for the company or a tax-costing asset for the employee. If the option’s Exercise Events are designed well, the equity event can be conditional on the employee’s continued involvement with the company and any cash-out can be linked to cash-in events such as certain cash positions or investments.

However, until exercise, the option bears no immediate fruits such as dividends nor does it carry meeting or voting rights. And if the company has a tough year, the option may become an inefficient incentive as it may become unattractive to exercise. Yet if the company does very well, exercise becomes more attractive as the delta between the exercise price and the stock Fair Market Value increases, giving rise to a potentially significant tax hit which may in cases not align with cash positions.

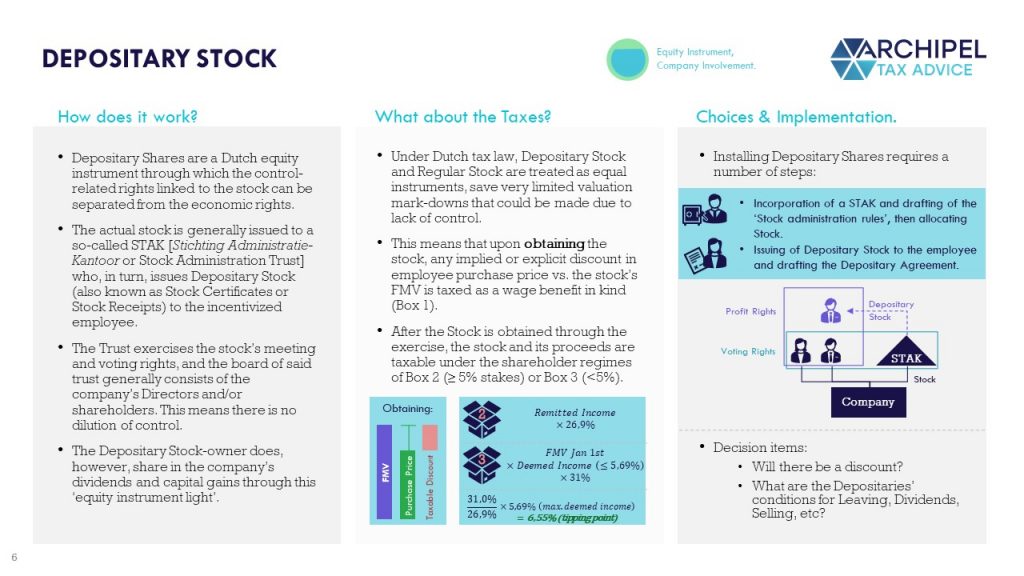

Type 4: Depositary Stock. Equity Ownership without the Say.

Company stock bears two types of rights: (1) the legal rights such as meeting and voting rights, and (2) the financial rights such as a claim to the profit reserves (dividends) and equity (capital gains / exit proceeds). Depositary Stock, also known as Share Certificates or Stock Receipts, are issued by a shareholder and grant the Depositary owner all the economic rights whilst the legal rights remain with the shareholder.

How does it work from a legal perspective?

This generally involves a Share Administration Foundation or Trust to own the shares. The company’s board generally heads said trust or foundation and exercises the legal rights, while the Depositary Shares are extended to the intended financial beneficiaries. This ‘splitting up’ of the shares results in an economic dilution of the cap table, without the decision making procedures following suit. The Depositary Stock owners have no voting or meeting rights. However, they are considered an equity instrument and are not intrinsically linked to any company employment or involvement. Therefore, any governance of such requirements should be implemented through a separate agreement, known as a Depositary Shareholders’ Agreement. The Trust Bylaws govern how the Depositary Receipts are managed.

And from a tax perspective?

For the employee: Depositary Stock is treated equally to actual Stock. When the employee obtains the instrument, any implied or explicit discount compared to its Fair Market Value is taxable under the Box 1 systematics as wage in kind, and the subsequent shareholding is taxable under either the Box 2 or Box 3 systematics, depending on how the stake is structured.

For the company: Depositary Stock is treated equally to actual Stock, so the issuance is not deductible from its CIT base.

What are the ingredients?

- Administration Trust Bylaws that govern how and when the Stock Proceeds are paid on, as well as other possible governance wording regarding -for instance- voting (if any), and;

- Depositary Shareholders Agreement containing wording on items such as Vesting Schemes, Leaver Clauses, Drag and Tag Along arrangements and Exit Events.

The pros and cons.

Depositary Stock is a way to share the Cap Table with a broader range of beneficiaries without necessarily obfuscating the company’s decision-making process accordingly. Depositary Stock are treated equal to actual stock and are therefore taxable, once obtained, under the more favorable tax regimes of Box 2 or Box 3 depending on how the stake is structured. As it is an actual equity instrument, the participating employee is financially encouraged to pursue company goals and help increase its value and profitability.

However, due to the lack of actual Stock-related rights such as voting or meeting rights, the company involvement is often less than is the case with actual stock. And as transferring the Depositary Stock has wage tax consequences if an implied or explicit discount is applied, an accurate valuation of the stock is material in properly determining the materiality of said consequences whilst valuing non-floating stock can be highly comprehensive. As the Stock is not automatically linked to company involvement as an employee, contracting should cover Leaver events to ensure hand-backs in case of unwanted notices. Finally, if the stock is taxable under the Box 3 regime but does not perform in a cash-basis, it may become increasingly expensive and worrisome to own such shares for the incentivized employee as the tax costs may precede any actual cash returns, potentially disincentivizing the employee from pursuing company value increasing goals.

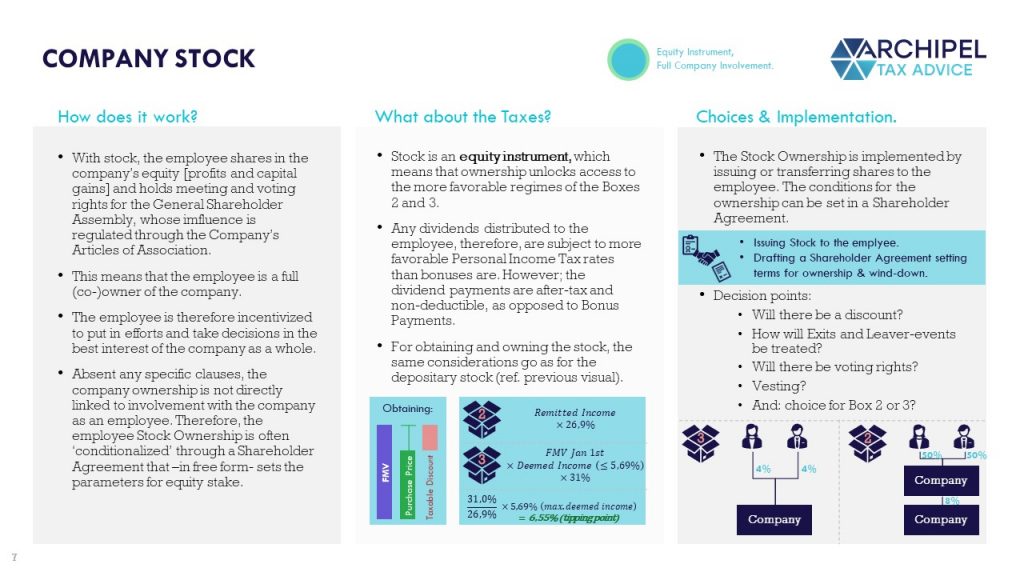

Type 5: Company Stock. The Ultimate Long Term Thing.

Company Stock means full co-ownership of the company’s equity and the right to be called up for (and usually also vote during) the company’s shareholder meetings. The Stock-owner is a company-owner and has a claim to its profits (dividends) and to the Stock’s sales proceeds (capital gains). This is the instrument to reward and secure Co-Founders and other true Key Personnel for the long term.

How does it work from a legal perspective?

Company Stock is created through a notarial deed and the owners are registered in the company’s Stock Owner Registry. These are the Persons that participate in the company’s equity and that take the company’s shareholder decisions. Stock Ownership is not governed by labor law but by company and civil law, and absent any specific clauses to that end, it is ‘absolute’ and not contingent on company involvement.

And from a tax perspective?

For the employee: As touched upon above, employee equity instruments are the entry ticket to hopping from the ‘default’ Box 1 regime on employee profit sharing to the more favorable Box 2 and Box 3 regimes. However, that entry ticket may have a price, as it would require obtaining such an equity instrument (stock) which may either cost money upfront (cash or loan) or carry a wage tax element to the extent buy-in is available under an implicit or explicit discount. The subsequent ownership is taxable in Box 2 (26.9% tax on remunerated proceeds) or Box 3 (31% on deemed proceeds).

For the company: Similar to Stock Options, the issuance of Stock is not deductible from its CIT base.

What are the ingredients?

- A Stock Ownership Plan, that covers who is eligible and under what conditions and how Ownership Rights vest (etc), and;

- A Stock Owners Agreement, which governs elements of the subsequent ownership such as Vesting Schemes, Leaver Clauses, Drag and Tag Along arrangements and Exit Events.

The pros and cons.

Company Stock is the ultimate incentive for Key People that must stay and who are instrumental to the company’s functioning and development. As this instrument implements full equity ownership, the connectedness to the firm is greater than with any other incentive instrument. The proceeds derived from Equity instruments are generally subject to more favorable Personal Income Tax regimes than those derived from employment. And when such a proceed can be a significant Exit Amount, the incentive to help advance the company is tremendous.

However, the wider Stock ownership is spread, the more complicated its cap table and decision making process becomes. In some cases, this may be detrimental to investability. And: absent any specific clauses to that end, company Stock ownership has no immediate link to company employee involvement. In some cases, the Box 3 regime may be detrimental, for instance where the deemed return increasingly exceeds the actual return specifically on a cash basis, as this may result in tax cash-outs preceding any cash events.

Frequently Asked Questions

When designing an equity plan, some questions turn out to be evergreens. We walk through a few to mitigate any needless fuzziness in your process.

Why does this seem so complicated?

Because there is a near-infinite amount of decisions you can make in the design of a Participation Plan due to the Freedom of Contracting. And because the Dutch Tax Code is quite adamant about none of those choices leading to the tax free ‘Equitization’ of an employee’s labor for a valuable company.

Don’t stress – designing a great Incentive Plan is a highly rewarding and creative process and once you’ve become invested in the topic, you’ll design a plan that gets your highly valuable business partners invested in you. And: that same freedom that can seem daunting at first, soon becomes a basis for a highly tailored plan that suits your wants and needs like a glove.

I want to give my employees Stock. Since I have never made a profit yet, can I value them at zero?

Short & simple: no. Unless something really weird is going on. The theory behind the Arm’s Length valuation that is central to establishing taxes, is that related parties (such as an employer and an employee) cannot influence tax charges by basing them on pricing that an unrelated party could not opt for. Note: this doesn’t mean that the employee must be charged the external price, but it does mean that any discount is calculated using the external price as the reference point vis á vis the charged price to determine whether a taxable discount was given.

How is that external price established? If there is a recent and representative share transaction with an external party (such as an investor), the company valuation concluded in that transaction is apparently the external price and serves as the basis. If there is no reference point, the Discounted Cashflow Method is the preferred pricing method. This is because it is a dominant method in corporate finance practices where unrelated parties come up with bids, and because on a theoretic level the DCF-Method looks at future cashflows rather than past cashflows and that is precisely what an investor (who ‘purchases the company’s future promise’) would be concerned with. So: if you argue that your company value is nil, you equally argue that you will neither be growing not profitable, and you would equally sell me a share at € 0. If that is the case, give me a call!

We understand that for certain young companies a lack of a historical performance track-record makes it hard to project future cash flows. Nonetheless, the Tax Authorities may not want to deviate from the DCF-Method, so why not give it a decent try anyway? The proprietor’s business case may serve as a sound basis, with downward adjustments for cash flow projections that are intended more to attract investors/financiers than to reflect the most probable business trajectory.

How can I limit Stock value if I accept that my company itself is not worthless?

It is important to distinguish between company value and share value. I often see it this way: if you buy a bowl of 100 Red Skittles for € 10, you can realistically deduce that every Red Skittle it contains is worth € 0.10. But if you’d purchased a bowl containing 90 Red Skittles and 10 Mars Celebrations for that same € 10, that pro rata valuation no longer holds up. The same logic applies to Share Types and Share Classes.

If your company valuation is such that it appears unfeasible to extend equity to employees in any meaningful way, it may be worth considering issuing shares with certain caveats. For instance: shares with a Liquidation Dispreference up to the current company valuation and bearing Dividend Rights only to profits made from their issuance onwards. Be aware that in such a scheme, you’ll sacrifice some of the scheme’s simplicity though.

And how can I mitigate any discount if the upfront cash needed to purchase the envisaged stake isn’t available?

If the employee purchases the Stock involved in the plan, any tax on the equity transfer event is out of the question. But as company value increase (and as the incentivees are Millennials or younger), it become less and less likely that the employee has said upfront cash available.

A common method to mitigate this, is to ‘lend’ the employee the money. That means the employee forfeits on the upfront price and is offered an instalment scheme, which carries an arm’s length interest rate for tax purposes. The employee can then use any dividends or capital gains received to pay down this loan, and ultimately gets disposable income only after said loan is paid-in. This economically works as an assimilation period, as the employee pays back- dues for the company value already built up prior to their equity involvement. This leads to less ‘skin in the game’ (but an enforceable debt nonetheless) for the employee and gives rise to some anti-abuse measure risks, but may improve options for issuing meaningful stakes.

How do I choose and opt for a Box 2 or Box 3 allocation of employee equity?

Box 2 is the regime for income derived from significant stakes and Box 3 the regime for income from portfolio equity stakes. A personally held equity stake crosses the bridge from ‘portfolio’ to ‘significant’ if it equals or exceeds 5% of any share ‘type’. So put briefly, if the shareholding is structured such that the employee ultimately owns 5% or more in the topmost legal entity in any chain of entities involved, the stake is allocated to Box 2. Note that any entity-to-(non-tax haven)-entity stake that equals or exceeds 5% (of the total nominal paid-up share capital), in turn, falls within the scope of the Participation Exemption for Corporate Income Tax, meaning that no tax is due on any dividends or capital gains derived from such stakes until they are paid onwards to the private individual behind the ultimate entity. This de-facto deferral mechanism can prove useful.

When choose one or the other? Box 3 takes the equity stake’s value at Jan. 1st, applies a progressive deemed return rate of 5,53% maximum [2022] to said value and taxes that return at 31%. Box 2, meanwhile, taxes any actual returns ate 26,9%. Since the Box 3 tax charge is effectively capped at 31% of 5,53% return, a quick sum shows that if the stake’s return exceeds [(31,0% / 26,9%) * 5,53%=] 6,37% on an annual basis, a structuring that facilitates a Box 3 allocation is rational from a tax perspective. However, as the tax charge is annual, it may be more enticing from a cash perspective still to opt for the potentially less favorable but more matched in timing systematic of Box 2…

I want to issue stock to a Dutch employee in the non-Dutch HQ. Would that still be taxable in the Netherlands?

Yep. The stock issuance is linked to the employment contract and if that is executed in the Netherlands, any such issuance (provided there is a discount, of course) is part of the Dutch employment wage.

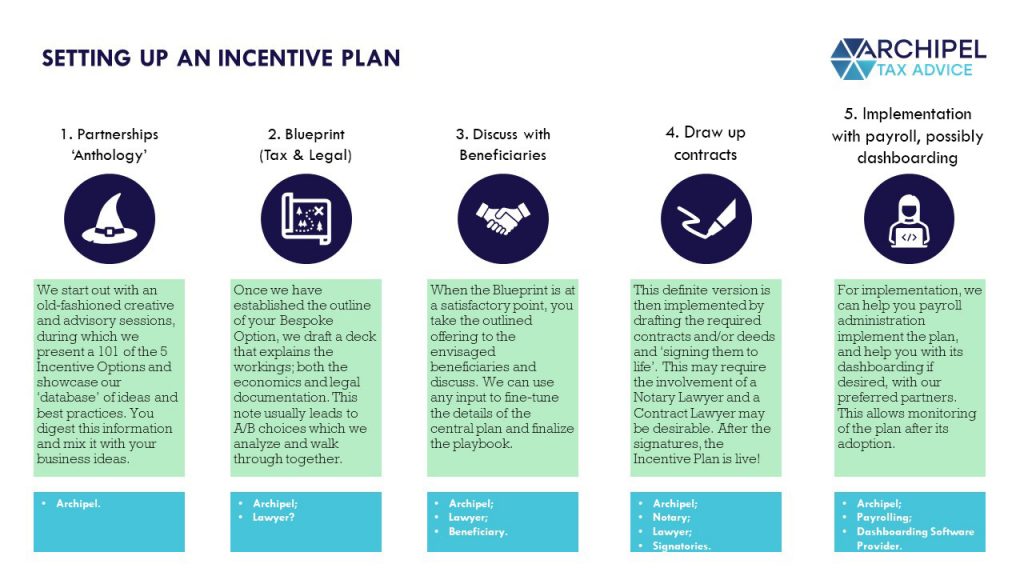

How does the Incentive Plan design process work and what can you do for me?

This read sets out an array of tax and some legal considerations. But above anything, an Incentive Plan is based on your business vision and goals. So usually, the process starts with just that. You should decide, for yourself, what your dream Incentive Plan looks like. Then, you call us.

- We start with a ‘101’ in which we explain the Tax & Legal parameters, and this may set the range of options that are feasibly available in your situation.

- Together, we then design a best plan within that range and blueprint it, then take some time to digest and ‘test’ its workings in different hypothetical scenario’s.

- Once you are satisfied with the polished Blueprint, you discuss with the beneficiaries whether they find it incentivizing, comprehensible and otherwise, well, a good plan. We can tighten the final nuts ‘n bolts, then;

- We draft the contracts and/or the deeds, potentially together with Contract Lawyers and/or Notary Laywers. Your service level is your choice; the more you want to arrange upfront the more an extra pair of eyes adds. And don;t worry; we have preferred suppliers who we will happily propose and involve in making your vision work smoothly.

- Once all the documents are signed, your plan is live. We can then help your payroll departmen implement the plan, an possibly involve our preferred dashboarding software suppliers so that the plan can be monitored on an ongoing basis, providing the beneficiaries with real-time information on the fruits of their extraordinary efforts and preventing different readings down the road.

Want to know more? Schedule a chat (link) or get in touch!

We love this neck of our professional woods and would be eager to explore your situation and considerations. Feel free to schedule a chat or get in touch, and we will walk it through together.