In this post, we discuss the Amsterdam Flip; the restructuring of a corporate group by topping it up with an Dutch Limited Liability Holding Company to act as a Netherlands-based Group HQ of Corporate Holding vessel. Such a Dutch-topped structure has proven a recipe for success for companies looking to attract new Capital and Consumer Markets. The Netherlands’ legal & finance industry is very mature and developed and has a demonstrated history of legal certainty, institutional oversight and tax efficiency while offering access to the vast EU consumer market – which investors appreciate. Allow us to walk you through the considerations behind and pathways to The Amsterdam Flip!

Introducing: The Amsterdam Flip

Access to Capital Markets and Investors is a key component to corporate financial wellbeing in any maturity phase. Therefore, white glove service for investors is key, and operating the pivotal Holding Company in a trustworthy and efficient jurisdiction is an essential ingredient to that service. The Netherlands is widely regarded as such a jurisdiction, and therefore, many companies make the so-called Amsterdam Flip. From scaling companies, to listed mastodonts. How does it work?

The Amsterdam Flip Defined

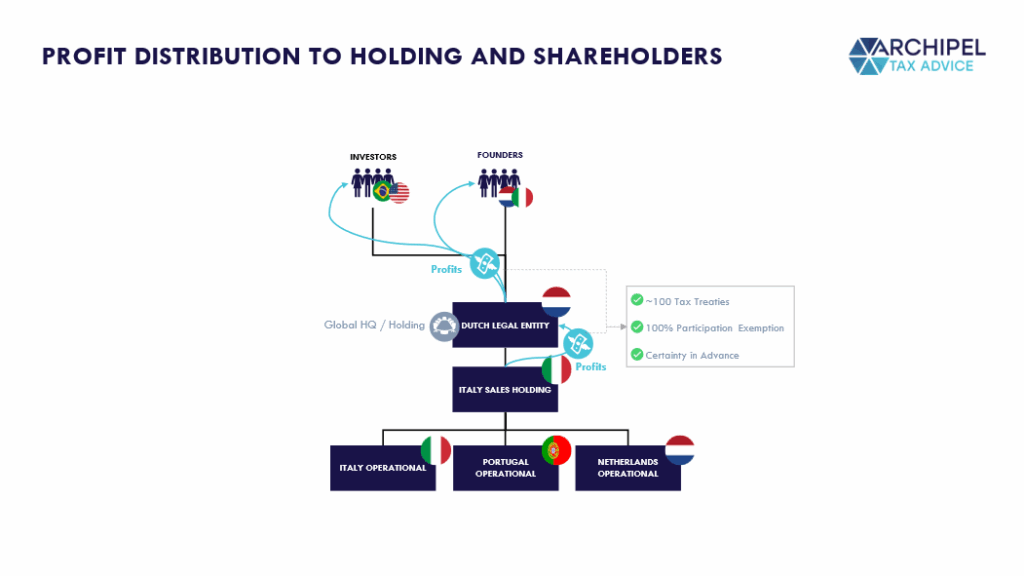

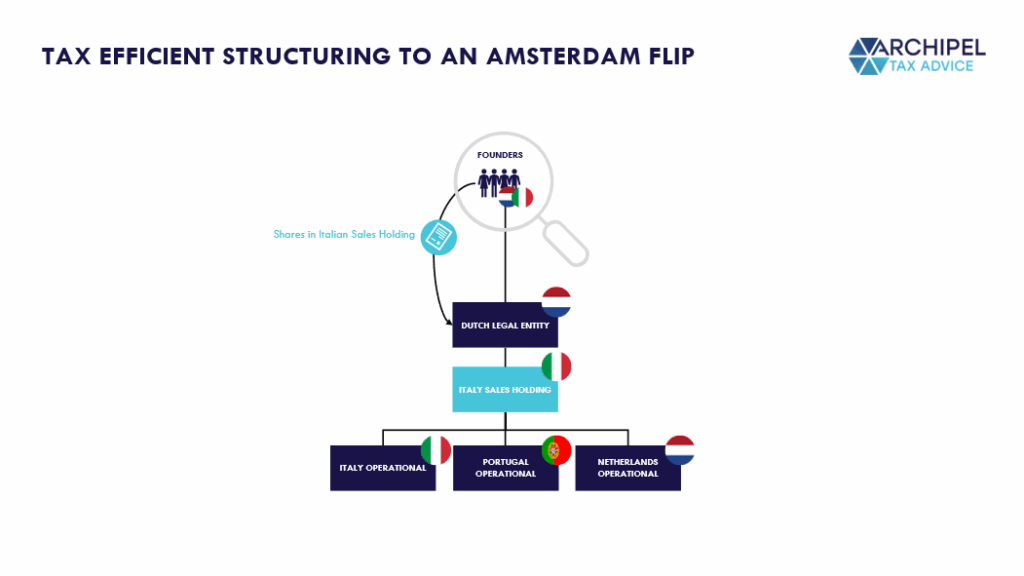

In short, the “Amsterdam Flip” is a restructuring move in which a Dutch Legal Entity is interjected between the feeders/investors and the operations of an existing, generally foreign-headed corporate structure. The new Dutch ‘Top Entity’ generally takes on the role of the Top Holding Co, either consolidating HQ operations or Group Holding functions. This ‘Flip’ into a Dutch-headed structure is a move to take advantage of legal, operational, and tax frameworks. Different stakeholders of the companies can benefit from these on the long-term. Most often, attracting investments as a main reason to ‘flip’.

We illustrate the workings with a randomized example that involves an initially Italian-based holding structure. Note, however, that any origin state can apply. After the Amsterdam Flip, the ownership chain is reorganized such that the foreign investors or founders hold shares in a newly interposed Dutch holding company, which in turn owns the pre-existing operating subsidiaries (OpCo’s). Payments, such as dividends, are now routed through the Netherlands to the ultimate shareholders.

The Amsterdam flip is the European equivalent of the broadly applied ‘Delaware Flip’, which is often used by non-American companies seeking to attract and secure U.S. investments. Before making the investment, the U.S. investor prescribes that the European company should have a U.S. entity as group holding, as parent company of the European and Rest of World entities. This way, the American investment is a ‘domestic affair’ following U.S. investment frameworks, whilst the operations need not necessarily be affected. As a result of European Directives, the Amsterdam Flip provides similar access to EU Investors and Markets, and is efficient for absorbing U.S. Investments as well.

Starting Consideration: the Dutch Group Holding should serve as an OpCo or Group Holding Company [not a Letterbox]

It is important to note that the Flip works only if there are valid business reasons for the Dutch holding company. Being able to tap into the legal and tax frameworks and benefits is a key consideration behind the Flip, and both for the tax and non-tax elements, such access requires material presence or ‘substance’ (i.e.: letterboxes cannot feasibly grasp tax or legal benefits). Therefore, Dutch Holding Company’s ‘Place of Effective Management’ [POEM] should be in the Netherlands, meaning it should be managed physically from the Netherlands and/or have business operations in the Netherlands.

For scaling companies who seek the NL-Stamp, we often see that this means that the Group HQ moves to the Netherlands, as the company Foundeing Team and/or other decision makers set up office here. Company Staff can often move to the Netherlands under the 30%-ruling, which can make the personal setup all the more enticing as 30% of Personal Income is exempt from tax for a period of 5 years.

Why Do People Do an Amsterdam Flip?

The primary consideration for ‘going Dutch’ would of course be business-driven. Apart from lab or workspace, workforce or regulatory considerations, rationales may include gaining access to the Netherlands’ regulatory frameworks, institutions or strategic geographies. We list some commonly stated motivations!

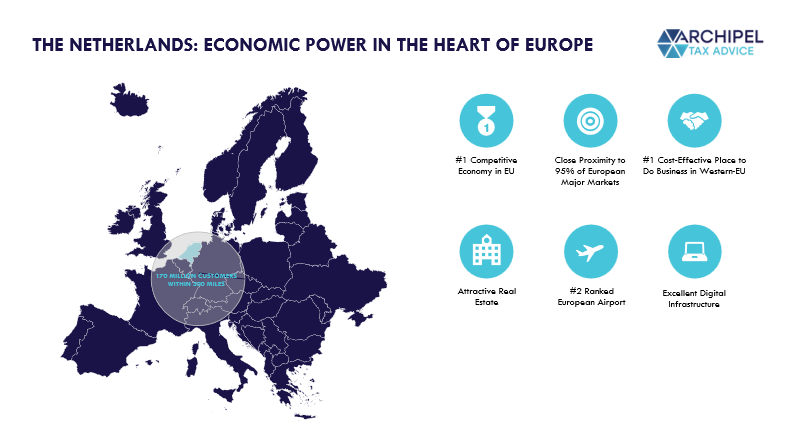

The Netherlands is an Economic Power In The Heart of Europe

Different tax and non-tax reasons exist for having a Dutch Holding Company. For starters, with its location in the heart of Europe, the Netherlands has always been attractive to international (tech) companies. This has recently been redemonstrated scaling companies like Novocycle, MotherDuck and WP SEO AI who cite Dutch talent, digital infrastructure and the overall business climate as key reasons for choosing the country as their European and operational base (https://fd.nl/tech-en-innovatie/1562357/talent-of-proeftuin-buitenlandse-techbedrijven-komen-naar-nederland).

Many companies go even further and use a Netherlands-located entity as their HQ and group holding, the Amsterdam Flip. Most often these companies already have an operational entity in the Netherlands for various reasons, such as international connectivity, a highly educated talent pool, and a strategic testing ground for innovation.

With over 170 million consumers within a 300-mile radius, world-class infrastructure including Europe’s largest port in Rotterdam and a major air cargo hub at Schiphol, and a highly skilled, English-speaking workforce, the country is a central node in global trade and logistics. It ranks among the world’s top economies, placing fifth in global competitiveness and innovation indices. By having a Netherlands holding company and local operations means that your company is located in an economically powerful country and strategically located at the crossroads of major European markets: Germany, France, and the UK.

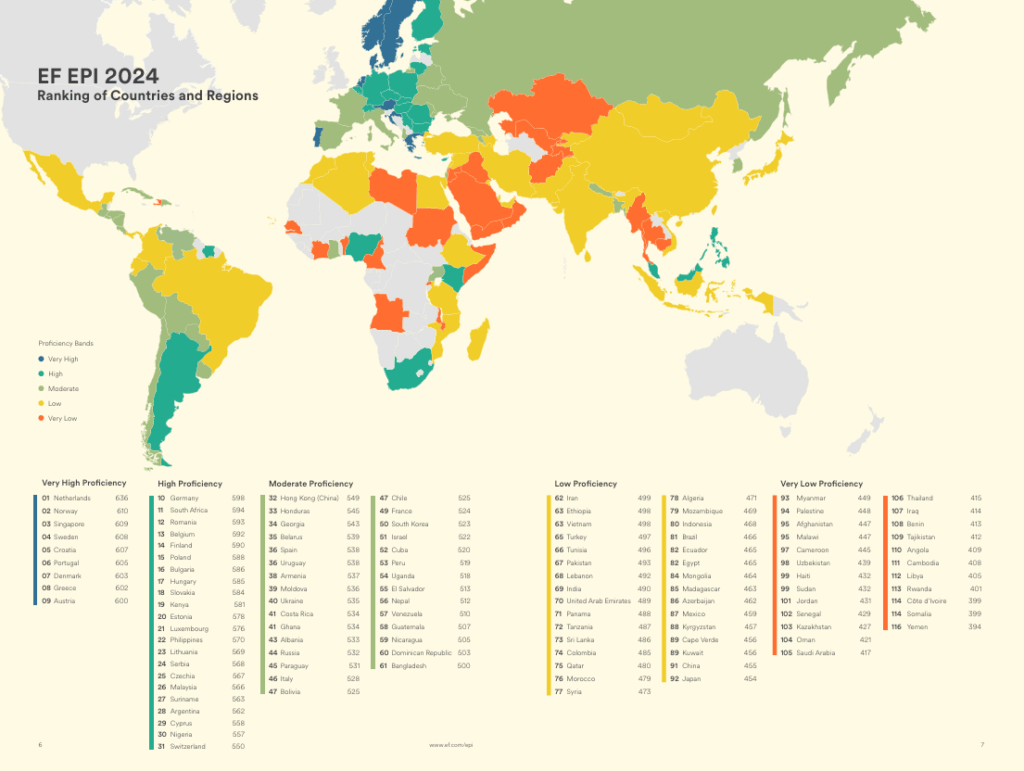

The Netherlands is Globally Connected and has a Strong Workforce

Second, the Netherlands’ infrastructure—including the Port of Rotterdam and Schiphol Airport—is among the best globally, ensuring smooth logistics and distribution. Beyond geography, the Dutch workforce is a major asset. Employees are highly educated, multilingual, and known for their open-minded, innovative approach to business. The country consistently ranks high in productivity and talent availability, making it easier for companies to recruit and retain skilled professionals.

The Netherlands is also recognized for its stable political and legal environment. Dutch corporate law is clear, predictable, and investor-friendly, offering companies a secure framework for doing business. Strong intellectual property protections further reassure businesses in innovation-driven sectors. In addition, the Netherlands is a hub for technology, sustainability, and finance. Its thriving business ecosystem fosters collaboration and innovation, supported by government initiatives and world-class research institutions.

The Netherlands is Home to Many International Organizations.

In addition, the Netherlands is the home to many International Organizations. One of them is The Netherlands Commercial Court (NCC) , which is located in Amsterdam and allows for quick resolution of corporate disputes. The NCC is a specialized chamber within the Amsterdam District Court and Court of Appeal, intended to handle complex international business disputes. The NCC is special, because the proceedings are conducted in English. This makes the NCC accessible, and attractive for international companies. Also other international organizations are located in the Netherlands:

- European Patent Organisation (EPO) – with one of its main offices in Rijswijk (near The Hague), it oversees the granting of European patents.

- International Court of Justice (ICJ) – principal judicial organ of the United Nations, based in The Hague.

- International Criminal Court (ICC) – the world’s first permanent international criminal tribunal.

- Europol (European Union Agency for Law Enforcement Cooperation) – EU’s law enforcement agency, headquartered in The Hague.

- European Medicines Agency (EMA) – relocated to Amsterdam after Brexit, responsible for scientific evaluation, supervision, and safety monitoring of medicines in the EU.

Classic ‘Netherlands Benefits’ for Americans at 10,000 ft:

Key non-tax reasons to establish a Dutch entity include:

- Strategic location within the heart of Europe;

- World-class logistics and transport infrastructure;

- Highly skilled, multilingual workforce;

- Stable political and legal environment;

- Strong protections for intellectual property and investors;

- Innovative and collaborative business ecosystem;

- Reputation as a trusted, internationally oriented jurisdiction.

According to the U.S. State Department, The Netherlands is one of the world’s most competitive and attractive destinations for foreign investment [https://www.state.gov/reports/2024-investment-climate-statements/netherlands], thanks to its stable political climate, strong financial sector, strategic location, skilled workforce, and world-class infrastructure. It ranks among the top global recipients of foreign direct investment, supported by a business-friendly tax system and extensive investment treaty network.

“The Netherlands consistently ranks among the world’s most competitive industrialized economies. It offers an attractive business and investment climate and remains a welcoming location for business investment from the United States and elsewhere.

Strengths of the Dutch economy include the Netherlands’ stable political and macroeconomic climate, a highly developed financial sector, strategic location, well-educated and productive labor force, and high-quality physical and communications infrastructure. Investors in the Netherlands take advantage of its highly competitive logistics, anchored by the largest seaport and one of the largest airports in Europe. In telecommunications, the Netherlands has one of the highest levels of internet penetration in the European Union (EU) at 93 percent and hosts one of the largest data transport hubs in the world, the Amsterdam Internet Exchange.”

U.S. Department of State, 2024 Netherlands Investment Statement.

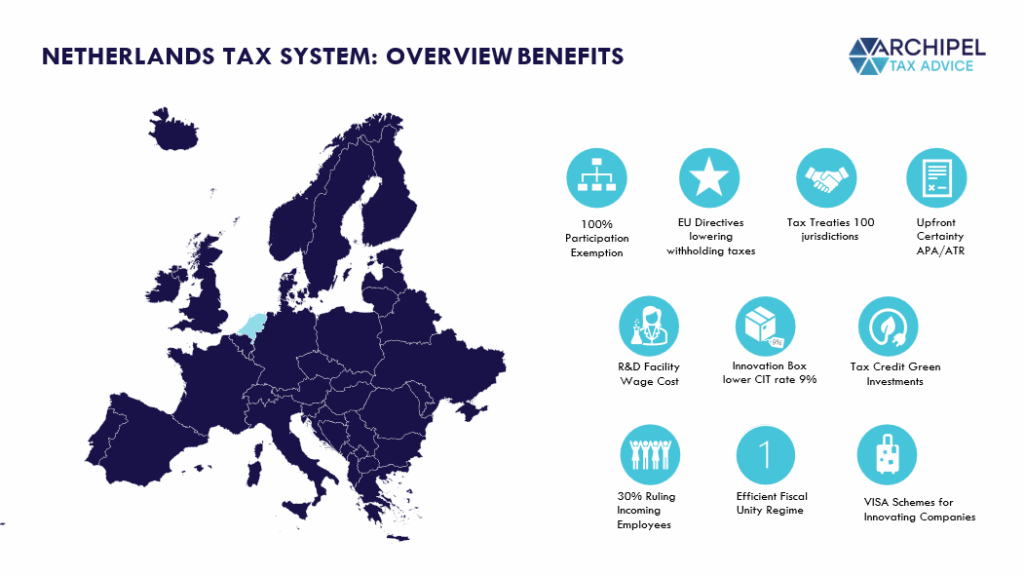

Zooming in on Tax

Past business reasons, tax considerations can cement your choice for The Netherlands as a hub in your Corporate Structure. One of such tax reasons may be that the Dutch Tax System, along with its Treaty Network, is strongly focussed on optimizing market scale meaning the Dutch system is designed to minimize capital import and export barriers. We zoom in.

Tax Efficient Distributions to and from your Dutch HQ

Having your HQ/Top Ops in the Netherlands, will enable access to the Netherlands’ extensive Tax and Bilateral Investment Treaty Network [intra-group & shareholders], stable legal system and strong reputation as a European hub. Compared to many other European jurisdictions, the Netherlands offers a relatively low corporate income tax rate, with a progressive rate structure that starts at 19 % and rises to 25.8 % for profits above €200,000. Beyond the nominal rates, the Dutch tax framework is known for its business-friendly approach, offering various incentives and reliefs that appeal to internationally active companies. We highlight the three most important features of the Dutch tax system for international companies:

- 100% Participation Exemption: Capital gains and dividends from qualifying shareholdings are fully exempt from corporate income tax at the level of the Dutch holding. A shareholding would be considered qualifying if at least 5% of the nominal paid up capital is held and the lower-tier activities are considered operational. The Dutch participation exemption does not have a holding period and a minimal investment amount.

- Certainty in Advance: Dutch companies with nexus in the Netherlands, can obtain advance certainty on tax matters through formal agreements with the Dutch Tax Authorities. Companies can request an Advance Pricing Agreement (APA) to confirm their transfer pricing approach, or an Advance Tax Ruling (ATR) to determine how the law applies to the taxpayer’s particular circumstances.

- Extensive Tax Treaty Network: With treaties in place with about 100 jurisdictions, Dutch companies benefit from reduced withholding taxes on cross-border dividends, interest, and royalties. Access to tax treaties also make it attractive to make tax efficient profit distributions to the ultimate shareholders.

Based on Dutch tax rules, Netherlands-based companies that are part of a multinational group must comply with OECD-based transfer pricing rules. This includes maintaining a Master File and Local File if the group’s consolidated turnover exceeds € 50 million. Groups with annual turnover exceeding € 750 million must comply with country-by-country reporting obligations. Dutch companies may also fall within the scope of the Pillar Two regime starting from the 2024 financial year, requiring them to file GloBE information returns and, in some cases, pay additional top-up tax in the Netherlands.

Tax Incentives for R&D activities in the Netherlands

Beyond holding facilities, the Dutch tax system offers several targeted incentives to stimulate innovation that make the Netherlands a solid jurisdiction for expansions into R&D-hub. One of the key instruments is the Wage Tax Credit [WBSO or ‘Wet bevordering speur- en ontwikkelingswerk’] which provides payroll tax relief for employees engaged in research and development. In 2025, companies can reduce wage tax and social security contributions by 36% on the first €380,000 of eligible R&D costs and by 16% on the remainder. Start-ups may qualify for a higher rate of 50% on the initial bracket. Applications must be submitted to the Netherlands Enterprise Agency (RVO) before the R&D work begins.

In addition, the Innovation Box regime allows profits derived from qualifying intellectual property to be taxed at a significantly reduced effective corporate tax rate of 9%, instead of the standard rate. This applies to patented inventions as well as copyrighted IP such as software developed in-house, provided the company meets certain substance and documentation requirements. This 9% regime applies to a designated ‘Box Allocation’ of total revenue rather than mere royalty income, and can be leveraged through Transfer Pricing strategies creating an attractive ETR setup for investors.

Together, the WBSO and Innovation Box make the Netherlands a highly attractive location for technology-driven and R&D-intensive businesses. To attract employees from around the world, qualified incoming employees may receive up to 30% of their gross salary tax-free for up to five years, a major benefit for attracting international talent. These employees may als have access to different type of visas.

Time to Flip? Make sure the Restructuring itself is Tax Efficient!

From a tax structuring perspective, you need to make sure that the transfer of the shares in the starting holding company, will be tax efficient for the existing shareholders. In our example: when the Italian and Dutch Founders transfer shares in the Italian holding company to a newly incorporated Dutch holding company in exchange for shares in the Dutch entity, this is generally treated as a share-for-share exchange which can be tax-facilitated within the EU and guided internationally.

When the shares are held through a personal holding company, the taxable gain on the shares will be exempt under the participation exemption, as part of the EU Parent Subsidiary Directive. If the shares would be personally held [so with not a personal holding company], such transaction can often be carried out tax-neutral if specific conditions are met, such as meeting the requirements for a legal merger or share exchange. It is recommended to analyse what the local tax implications would be of the restructuring for the existing shareholders of the company, such as the founders. And as an Alliance Firm in the CLA Global Network, we are happy to connect you with local advisors around the world.

Convinced? Let’s FLIP!

The Amsterdam Flip is more than just a smart tax planning strategy. It brings together legal certainty, attractive tax benefits, and increased confidence from investors. When it is implemented with genuine business activity, a clear commercial purpose, and strong compliance measures, it can support sustainable growth, encourage innovation, and make cross-border profit distribution more efficient. The Netherlands offers the infrastructure, skilled workforce, and stable, reliable environment needed for businesses and their shareholders to operate with confidence and to build long-term success in an increasingly competitive global market.