Our friends at RocketX hosted us for a podcast episode -with supporting content- about our passion topic of Employee Incentive Schemes. This read expands on that talk. To hear the episode:

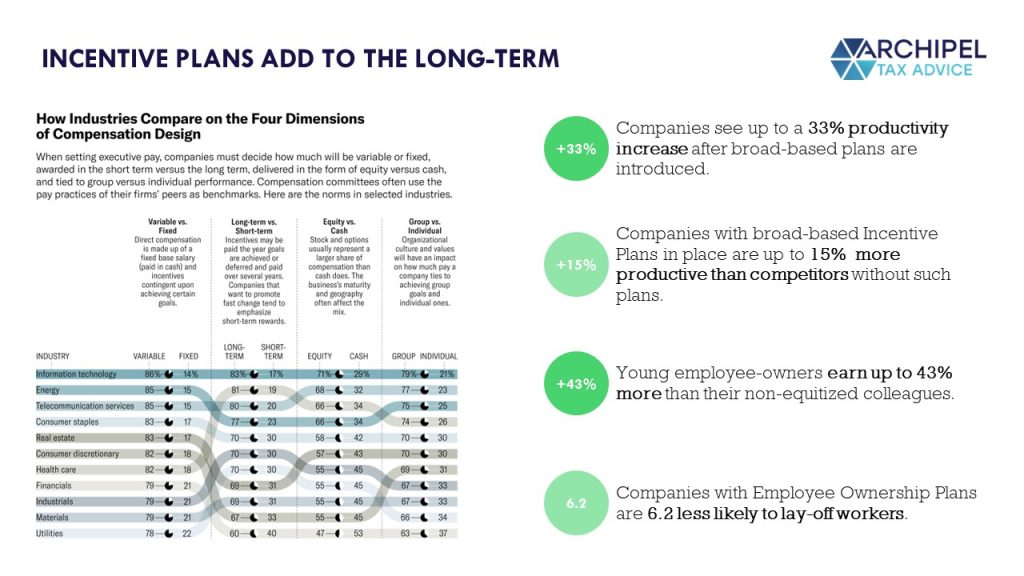

Call them Incentive Schemes, Bonus Plans or ESOPs; the Shared Capitalism space is rapidly expanding and so are the related vocabulary, methods and articles. Well implemented Incentives prove effective: the Harvard Business Review keeps a library on academic research into the topic and aggregates some impressive findings:

So: there’s plenty reasons for both the company and its people to seek out incentive schemes. And then, it is important not to let the vastness of space -the options and their legal and tax effects and the related considerations- daunt you.

To facilitate a smooth start and and a smooth ice-breaker on the subject, we therefore present this ‘demystification’ insight in cooperation with our esteemed friends at RocketX:

https://www.rocketx.group/insights/employee-incentive-schemes

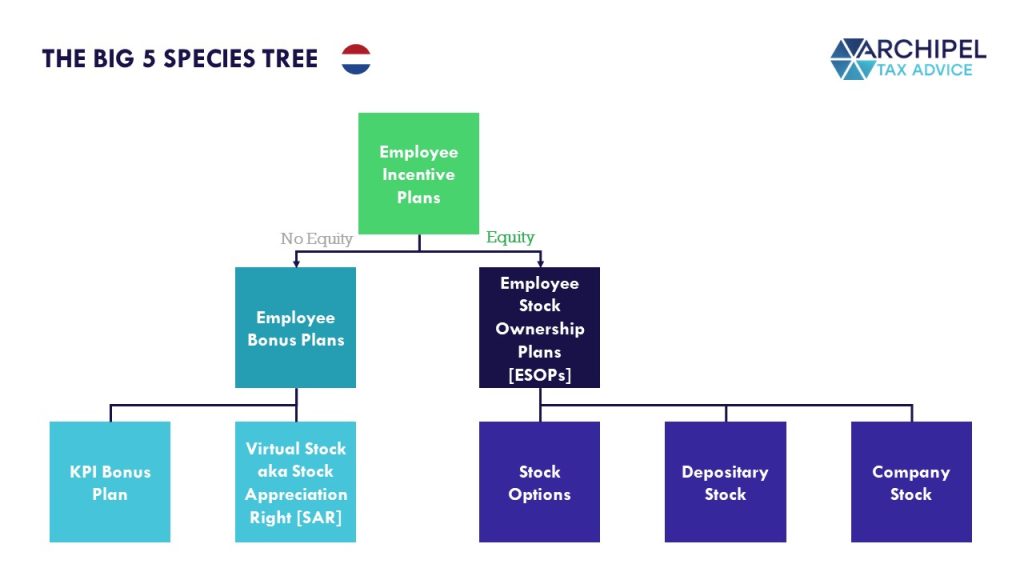

First things first: a mindmap of your options -> our ‘Big Five’.

In essence, all Incentive Schemes are additionel elements to the employment relation and the fixed pay involved with it. So Incentive Schemes can create additional earnings potential and additional ownership. That means the response should be just the opposite of quiet quitting [the result to being on an uninspiring road to nowhere], because these incentives give autonomy and impact in work, and incentivize people to do and want to do more.

But: with possibilities to incite such a drived response near endless, it is important to pick a starting point of the though process. And with that in mind, we stick to our ‘Big Five’ genome tree of incentives schemes that provides a comprehensible mind map when quarterbacking your scheme:

The Left Leg: Non-Equity Based Incentive Schemes

The first fundamental decision point is whether you want to extend equity to the selected ‘incentivizees’, or whether you want to go one step ‘simpler’ and implement a non-equity based incentive. The latter category basically consists of top-up wage schemes; staff can unlock bonus pay when certain milestones of your designing are hit, and the scheme is implemented on the axis of the employment contract.

General Pro’s:

- Implementing the scheme or ‘extending the incentive’ is not a cash or tax event and neither is ‘owning’ it;

- The natural link to the employment contract makes for and organic link to termination;

- The schemes are cash-centric and hitting the milestones therefore has immediate money effect for the involved staff members;

- The company cap table and control does not dilute, preserving manageability.

General Cons:

- Wages are generally taxed less friendly than capital returns, meaning that the top-up wage potential that the schemes give rise to, result in higher taxed ‘fruits’;

- Milestones do not link per-default to the company’s cash position while the promised top-up is legally due when the underlying milestone is hit, giving rise to cashflow exposures;

- The schemes give employees no ownership;

- In case of an exit, the plans generally ‘transport’ to the new owner, making them a purchase item.

Type 1: The KPI Bonus

Is a top-up wage potential based on specific milestones that can be highly individualized, targeted and specified. This is the traditional bonus that can, for instance, be linked to hitting certain sales, r&d or turnover thresholds and can then -for instance- give access to a lump sum, bracketed, or gradual sum.

Type 2: The Virtual Share or Stock Appreciation Right

Is a top-up wage potential based on team milestones and, more often, to the value of the company as a whole. The term ‘Virtual Share’ indicates that the economics of share-ownership are mimicked giving the employee a right to the company’s profits and capital gains as though they owned a certain percentage of its stock, and the term ‘Stock Appreciation Right’ indicates that the employee’s bonus is linked to the increase in value of the company’s stock, sometime multiplied with a certain pretend percentage.

For more details on their workings, have a look at our Free Virtual Stock Template:

Why choose one or the other? KPI Bonusses can create highly targeted incentives and encourage specific behaviors in individual staff functions, whereas Share-linked Bonusses can encourage group-thinking and help facilitate an optimale resource allocation.

The Right Leg: Equity-Based Incentive Schemes

The other starting choice is to implement an Equity-Based Incentive Scheme, which will involve the ‘incentivizees’ in the company equity in one way or another. Pro tip: if you want to know which archetype works best, ask. Talk with each other, and get some information. The space is volatile as it is hot, and you may be surprised about your options, current and future.

General Pro’s

- Equity-Based Schemes give ownership, which invites ‘thinking like owners’;

- Returns on Equity are generally taxed more favorably than wages [Returns on Work], especially when calculated on a cumulative basis rather than in-year;

- Equity Schemes create long-term and company-wide incentives and support retention;

- There is great acknowledgement and honor in ownership.

General Cons:

- Extending and Equity Instrument to staff leads to wage tax on any implied or explicit discount so offered as the discount is considered a wage benefit in kind, meaning the scheme installation can lead to a tax cash-out;

- Portfolio interests are taxed on a deemed return which means that the in-year tax can exceed the in-year proceeds during dividendless growth-phases;

- Equity plans are governed by property law, meaning that there isn’t an automatic link between the employment contract and the equity ownership, more specifically their terminations;

- Equity plans are therefore often more complex and require more extensive contracting.

Type 3: Employee Stock Option Plans / ESOPs

Give the employee a call option to acquire shares in the company against a pre-determined price [‘Strike Price’] in case specific milestones are hit [‘Trigger Event’], such as being at the company for a certain time, or the company raising external capital. If the stock is worth more than the strike price, the option is ‘in the money’. When the option is then called, the employee becomes a shareholder. The benefit derived from the exercise event [the amount for which the option is in the money] is taxed as wage, and the subsequent share ownership falls under the capital gains regime. The fixed Strike Price gives employees an interest in company valuation from the start, and the outlook on Stock gives a long-term incentive to stay.

Want a more in-depth view on the workings of an ESOP-plan? Check out our Open Source ESOP template and explainer:

Type 4: Depositary Stock

Gives the employee ‘Share Certificates’ in the company. Consider Company Shares as bearing two types of rights: [1] the control rights such as being invited to and attending the general assembly of shareholders and having a vote at it, and [2] the economic rights to dividends and capital gains. With depositary stock, these two elements are separated: the shares are placed with a Shareholding Trust [STAK or ‘Stichting Administratie Kantoor’ – often managed by the Company Management or Founders] which manages the control rights, and issues the Depositary Stock [aka ‘Share Certificates’] to the underlying incentivizee.

The depositaries are basically derivative instruments that offer them the back-to-back ownership of the shares’ economic rights. This way, the dilution on the ‘Control Table’ is less than that on the ‘Cap Table’. Any implied er explicit discount on extending the stock is taxable as wage, the subsequent ownership as equity.

Type 5: Company Stock

Is the ‘Holy Grail’ for many: full-on ownership of company Stock, including the control rights. The taxation works exactly the same as with depositary stock, but the control mechanism is different as it is also extended to the employee rather than controled by the Shareholder Trust.

For more in-depth reading on this:

How do you Implement and Incentive Scheme?

Incentive schemes are meant to incentivize, and to do so for the proper and selected actions. So the simple objective is to find what actions the company wants to encourage, what motivates the selected employees, and how these two can link. But, of course, there’s more to it:

Pre-game: Incentive Plan Anthology

Before you start ‘talking Incentive Schemes’, it’s good to scroll through a bit of a catalogue to inspire options. Perhaps you’re working on that now. And if you want a brief walk-through or some first thoughts, just schedule a time with us here – it’s on the house:

Step 1: Discuss what works; what incentivizes?

Key, of course, to any Incentive Scheme, is to make sure it incentivizes. Don’t project, don’t base your preference on hearsay, just talk! This may narrow down your list.

Step 2: Establish what the company is wiling to ‘give away’.

For any reason, some options may just not be on the table. Shareholder or investor requirements may cross some options off, and so may employee life parameters. What’s unfeasible, isn’t worth discussing.

Step 3: Forecast cashflows and see what options remain.

As you’ve read, the ‘Transfer Chapter’ of some options may cost the company or the staff member money in tax, and so may the ‘Ownership Chapter’. See what’s possible based on company and personal forecasts, and eliminate the undoable.

Step 4: Compare the remaining options and build scenarios.

The narrowed-down list can be compared, based on excel sheets and contracting option. See which options work financially and business-wise over the course of some years, and keep the numbers and ‘work feels’ in mind. Give it some time. Days. Weeks. Come up with scenarios, and think to yourself: “how will it work. and will it?”.

Step 5: Pick your Best Option, finetune and implement.

Once you’ve decided which option works best, finetune its conditions for to address the scenarios you’ve come up with and go for it. You can only implement once so be thorough, but understand that there is no ‘silver bullet’ – only a best option for you!

Step 6: Visualize, make it tangible. Dashboard it perhaps?

Once you’ve implemented your plan, make sure it pops up often. Dashboarding tools like Wevestr ensure that your incentive plan stays current, and its effect with that. These schemes don’t bear continuous fruits, so making the fruit-buildup visible is a path to supporting that it keeps motivating!

Want to dive in?

The pieces you can assemble are vast, and the nuts and bolts you can adjust are endless. That’s good news, because it means you always have the tools to make it work. Incentive plans have a proven track record of improving company performance, staff retention and employee equity. What’ss not to love. That’s why we’ve built a whole network around it. With RocketX, Wevestr, LXA Attorneys, and other friends.

So the palate is there, and so is the support. You just need to know where to start.

Think we may be a good talking partner to break the ice with or dive in further? Book a slot! We’re happy to have you.

And here’s another gentle reminder that there is, in fact, a podcast of this. Of course. We’re millennials.

Peace.