In this shortread, we walk you through a Virtual Stock Arrangement and offer a free, open source agreement as a template for you to visualize what it means. Let’s dive in!

Employee Incentive Plans

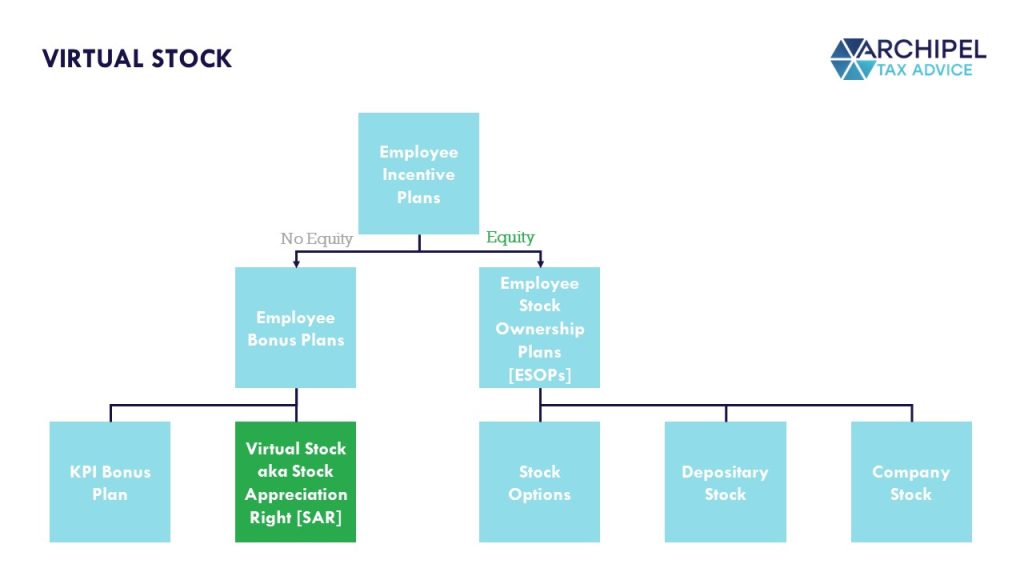

The field we are zooming in on, is that of Employee Incentive Plans. A broad term that encompasses all sorts of schemes and instruments that add-on to an employee’s fixed wage, and that help businesses reward, retain and incentivize employees. And grow while they’re at it – the numbers show that companies with broad-based incentive plans perform better.

In a bull market, the retentive element comes to the forefront. And in a bear market, it’s the incentivizing part; businesses can keep their fixed staff costs fixed, but provide an incentive linked to profits creating a joint mission to increase them.

In the species tree of Incentive Plans, we find ourselves here:

If you want to learn more about this species tree and context, check out our resources here:

Virtual Stock

There are pros and cons to equity based incentive plans: working with real shares gives real ownership and access to the share-based tax regimes, which are usually preferable over work-based tax regimes. But as equity movements are quite definitive in their base case and as any implied or explicit discount on employee buy-ins can give rise to serious tax consequences, they can be rather complicated to set up.

The Virtual Stock Arrangement creates a hybrid situation where the staff member is granted a bonus right as a top-up of fixed wage, with the bonus potential acting like stock. but: no actual stock or other equity is transfered; the plan is virtual.

This means that the employee is given a stake in the company’s distributable profits and potential exits, as they become ‘pretend shareholders’ through a stock-mimicking bonus agreement. This gives the employee an aligned incentive to increase those profits, and to increase corporate value.

How does it work?

A virtual arrangement gives two incentives:

- Virtual dividends

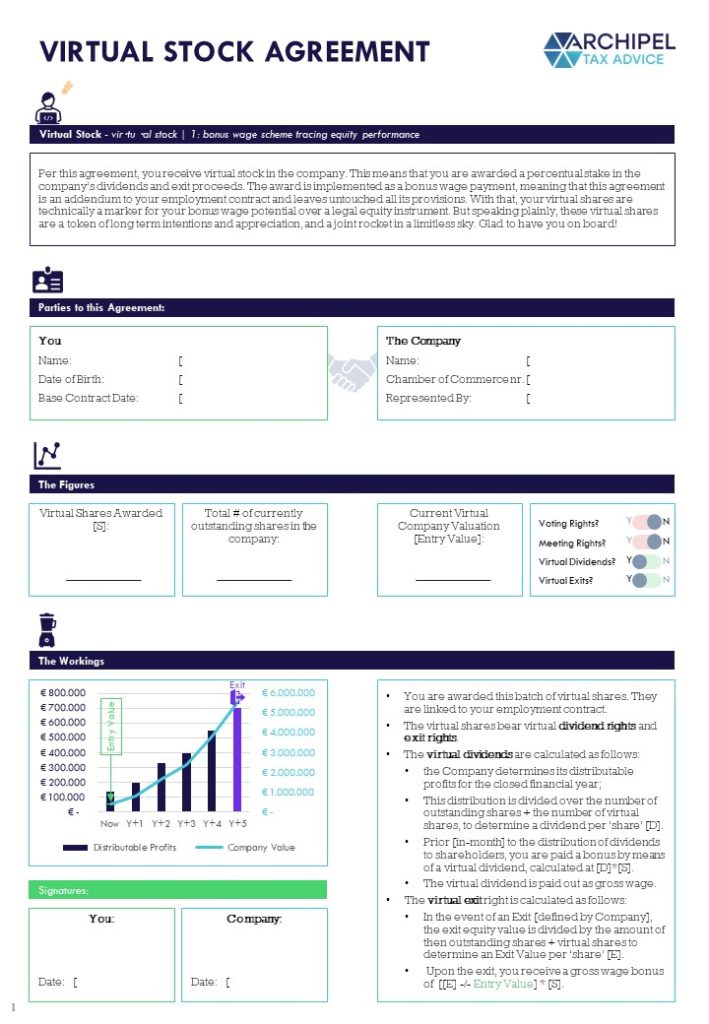

The virtual stock consists of virtual shares. At the end of any financial year [or when reporting is complete], the company will see its profit level and decide on a dividend payment [i.e.: profit position after making reservations for going costs and possible investments]. This declared dividend is divided by the amount of actual outstanding stock plus the virtual stock, to determine a dividend per share. Said sum is paid-out as a bonus wage to the virtual stock ‘owners’. - Virtual exit proceeds

The virtual stock is awarded at an entry value – the appointed price of the stock at the starting date. In case of an exit, the company’s equity value will be identified. This value is divided by the actual outstanding stock plus the virtual stock to determine an exit price per share. The exit gain on the virtual stock is the exit price per share minus the entry value per virtual stock unit. The virtual stock owner receives this exit-related sum as a bonus wage.

As the bonus arrangement is linked to the employment contract, the governing code would remain employment law rather than property law. As in fact, no actual equity was extended. This means that there is a natural link to the employment – if the employee leaves the company or gets terminated, the virtual stock vanishes.

A charming element is the natural link to the company’s cash position. Bonus plans can sometimes create the right to payments with no regard to ‘bank’, but as the virtual stock is linked to dividend procedures, the payment timing and quantity are naturally connected to the cash drawer.

How will this impact company valuation?

This element is twofold: the incentive plan should lead to better company performance, while keeping fixed costs fixed. this creates better margins and, with that, increases company valuation. But: the claim that virtual stock puts before dividends and on exits, reduces company value. In any Discounted Cashflow Valuation, the obligations incurred by the virtual stock arrangement are usually accounted for as a debt item.

Our Free Template

The best way to visualize how a Virtual Stock Plan may be implemented, and what this may look like in a contract, we have created a free template for you to look at. Naturally speaking, we don’t advise implementing something so serious without consultation and we cannot accept any liability for what you may choose to do with this piece of paper, but feel free to check it out:

You can download this template, with fillable fields, below:

Want to implement this?

Good idea! We do recommend getting some help though. Doesn’t need to be us – although we do love creating plans like this. Two items:

Employment Law

It would be best to have your employment lawyer check the clauses to ensure that all interests are protected, and that the plan fits into the HR build up.

Dashboarding

The bonus plan is in essence an artificial and virtual ‘thing’. And that can make it less efficient. Studies show that the psychological effect of a raise only last two weeks, and the same can be said for bonus plans. So: by visualizing the plan with a dashboarding partner, you can make sure the message is repeated and the effect too. Good tooling also helps manage the plan, especially as it expands.

ESOP Alliance

We have an alliance with LXA as a law firm and WeVestr as a dashboarding provider. We happily highlight and offer our streamlined package deal for this. Happily.

Want to continue the conversation or ask questions?

Then feel free to schedule a chat with me. It’s on the house!