So you’re eyeballing or implementing an ESOP; an Employee Stock Option Plan. Good idea! In the colorful world of Employee Incentive Plans, ESOPs are plentiful, tested and proven. However, equally plentiful in said world are acronyms and half-defined chants, so without any intent to insult: we first portray a 101 of an ESOP. To ensure that we’re on the same page here.

What is an ESOP?

An Employee Stock Option Plan is:

- A Plan, accordording to which;

- en Employee, is granted a schedule according to which they accumulated;

- Options, or more specifically Call Options, that when exercised give allow the owners to acquire;

- Stock, in the Company at a pre-determined time or event, and against a pre-determined price: the Strike Price.

For some further background to the phenomenon that is a Call Option, we place the definition stated in the eminent Investopedia:

Call options are financial contracts that give the option buyer the right but not the obligation to buy a stock, bond, commodity, or other asset or instrument at a specified price within a specific time period. The stock, bond, or commodity is called the underlying asset. A call buyer profits when the underlying asset increases in price.

https://www.investopedia.com/terms/c/calloption.asp

So in short: under an ESOP plan, the employee earns [‘Vests’] option rights to call in for equity as they work. And with the call or ‘Strike’ price known, the employee has an incentive to advance the company, as with every increase in company value, the employees call profit increases too. Then if the earned options are indeed called, the employee becomes an equity owner and reaps dividends as the company pays out profits to its owners, and capital gains in case of a company exit. Added benefit: such shareholder proceeds are taxed at friendlier rates than bonus wages.

Why choose to implement an ESOP?

Because they’re good for business and for staff.

There is convincing research -and a convincing amount of it- that proves companies figures improve after the implementation of borad-based incentive plans. I’ve found a strong summary of why in a 1994 of the Harvard Business Review:

Every CEO says, “If only our employees would treat the company’s money as their own.” Stock options are a stroke of genius that achieve that end. Cypress Semiconductor offers stock options not only to every new employee but also to every current employee on a yearly basis. They are a powerful tool to motivate our receptionist as well as our line workers to think like owners. Of course, our shareholders are fully aware of our option programs; they always approve them by vote. They know that the option grants they approve will dilute their positions, but only if the share price goes up for the at-market option price—a win-win deal for employees and shareholders.

‘Taking Account of Stock Options’ by T.J. Rodgers, Susan P. Eichen, James F. Morgan, Robert J. Saldich,

Mary Barth, Craig McCann, and John C. Burton. January–February 1994 issue of Harvard Business Review.

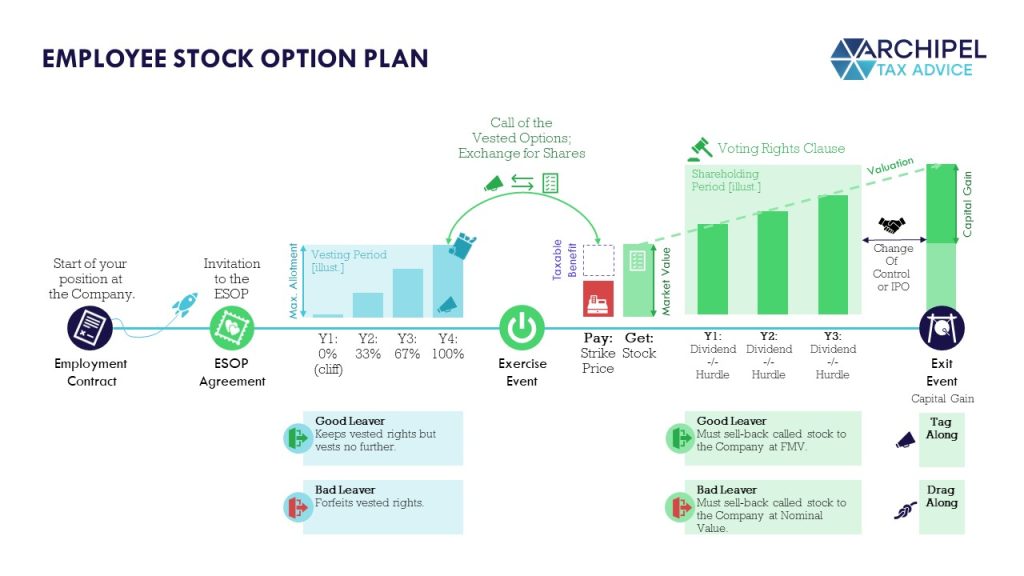

How does an ESOP work?

1. The staff member is invited to the ESOP.

It all starts with determining who gets to participate. Classically, and ESOP is built to attract and retain key staff members. And the ESOP equally classically incentivizes its participants to ‘think company goals’ over personal ones. Therefore, the instrument is often designed for persons with team leading roles. But some companies go the ‘Shared Capitalism’ route and implement much more broadly.

As far as we can tell, the form of participation […] is unimportant in comparison with four factors: A significant percentage of the workforce—generally, most of the full-time people—must hold equity; employees must think the amounts they hold can significantly improve their financial prospects; managerial practices and policies must reinforce the plan; and employees must feel a true sense of company ownership. In essence, management must encourage rank-and-file workers to “own” their responsibilities once it has allowed them to own, literally and legally, their employer’s equity. The four factors add up to an ownership culture in which employees’ interests are aligned with the company’s. The result is a workforce that is loyal, cooperative, and willing to go above and beyond to help make the organization successful.

‘Every Employee an Owner. Really.’ by Corey Rosen, John Case, and Martin Staubus, Harvard Business Review June 2006 Issue.

2. The participating staff members Vests their options.

The staff members are allotted a call option on a specific number of underlying equity units. Generally, this option cannot be called in full from the start; the staff member must stick around for some time and earn their right to call the allotted options. This is called a ‘Vesting Scheme’. As certain milestones are hit, such as staying employed for an X amount of time or hitting certain R&D or revenue targets, the options become exercisable. They ‘Vest’.

3. The staff members Exercise their Vested options.

At one point, the time to call comes around. The right to do so may be linked to specific events, but may equally be a free choice. Upon the call, the staff member pays the Strike Price and obtains the equity units in return. Actually making this happen can require a certain execution procedure, which may involve a notary lawyer, etc – but this is details.

Calling in the options means that the staff member is now a company owner. And depending on whether the options pertain to Depositary Shares or actual Stock, they are now at least ‘economic owners’ of the company and may even have voting rights and decision making power now.

At this immediate point, however, the most imporant change for the staff member is generally that the equity units give rights to dividends and capital gains. A stake in the company’s profits and its value developments. And from a tax perspective, such equity returns are generally taxed favorably. In this lies a real key to an equitable society – everyone wins.

4. The ESOP and subsequent Equity Ownership is governed by your Framework.

And this framework is laid out in the ESOP Agreement. It arranges things like:

- How do the option rights vest?

- When can the vested options rights be exercised?

- What is the strike price for exercise?

- Will there be a Hurdle on the Units or a Strike Price loan if the price or value is too high?

- Will the Units carry voting or meeting rights?

- Will the Units be transferrable?

- What is the dividend policy?

- What happens if an employee leaves the company, in a good cases or in ugly cases?

- And what if an investor comes along – will the staff member be forced to sell along [drag along] or allowed to tap in to the deal [tag along]?

We would visualize this as follows:

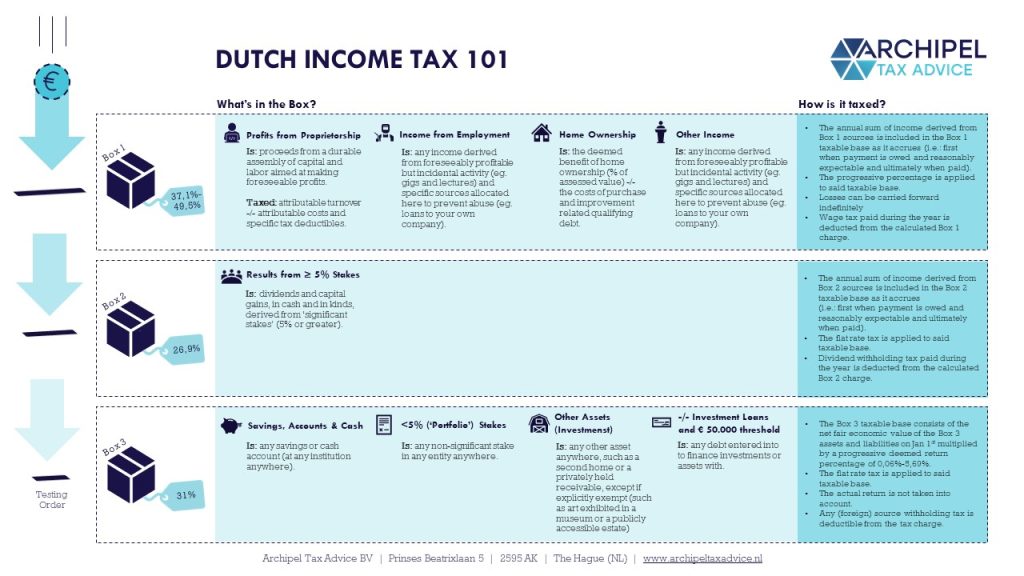

How does the tax work?

From our earlier article ‘The 5 Types of Employee Incentive Plans in the Netherlands’:

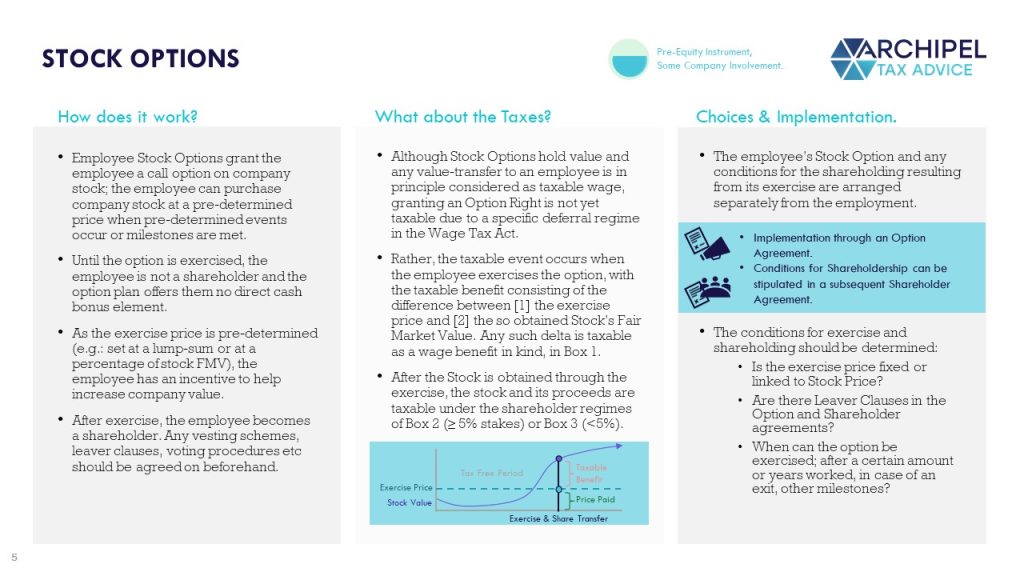

Put briefly, a designated provision in the wage tax code creates a regime under the option’s granting or vesting is not a taxable event. Instead, taxation is postponed until the option is called and the Equity is obtained. At that time, tax is levied on any ‘benefit’ that arise from the Strike Price being lower than the value of the equity obtained [which is valued at ‘reference transaction’-price, or at DCF-value absent one].

So: imagine that the employee can call the option at strike price € 50 to obtain equity worth € 100 on the open market, said € 50 is identified as ‘wage in kind’ and taxed accordingly. In case of a gross clause, the employee would pay the income tax on it [37% – 49%] wheres in case of a default net clause, the employer would gross-up the payment and pay the wage tax on it.

Note: an option to postpone this tax will be introduced as per 2023 – the taxable event [and Fair Market Value measuring point] can then be set at the moment that the underlying stock becomes transferrable / unblocked / in free float.

After said taxable exchange of options for equity, the equity ownership is taxed under the more favorable Box 2 or 3 regime [ref. above] in the hands of the staff member.

For the company: The grant of option rights is not deductible from its CIT base, and neither is the subsequent exercise. This makes sense, as it is not really a business-related expense, but rather a dilution of the other shareholders’ stakes.

How do we implement an ESOP?

This is where our template may come in handy. Before you use it, please note that there is a clear 80/20 rule in setting up Incentive Plans. The basis, say: thise template, would cover 80% of your project. But the real value comes in fine-tuning the clauses such that your company is all aligned and your staff is incentivized and building equity, while your carefully built assets and decision power are secured.

Study after study proves that broad-based ownership, when done right, leads to higher productivity, lower workforce turnover, better recruits, and bigger profits. [But] “done right” is the key.

‘Every Employee an Owner. Really.’ by Corey Rosen, John Case, and Martin Staubus. Harvard Business Review, June 2005 issue.

So necessary disclaimer: get it right. We cannot guarantee that our template is right for you. But by all means, feel free to us it for inspiration.

Our Free-to-Use Template.

And if you want to have a chat about this, feel free to pick a timeslot. It’s on the house and I love the subject. Cheers!