Incentive Plans are methods of extending benefits beyond fixed wage to employees. Companies may choose to implement them in order to attract and and retain staff, to improve company performance and cohesion, and to create a more equitable and resilient workforce [check out the Harvard Business Review’s ‘Big Idea’ series on the Stakeholder Era to learn more about why!].

With the conceivable varieties of such plans being near endless, it can be a challenge to find a place to start. But: with the design and implementation of Incentive Plans making up a significant portion of the projects that we do, we like to think we’ve got some well-zipped 101s and best practices to share. Perhaps they may help.

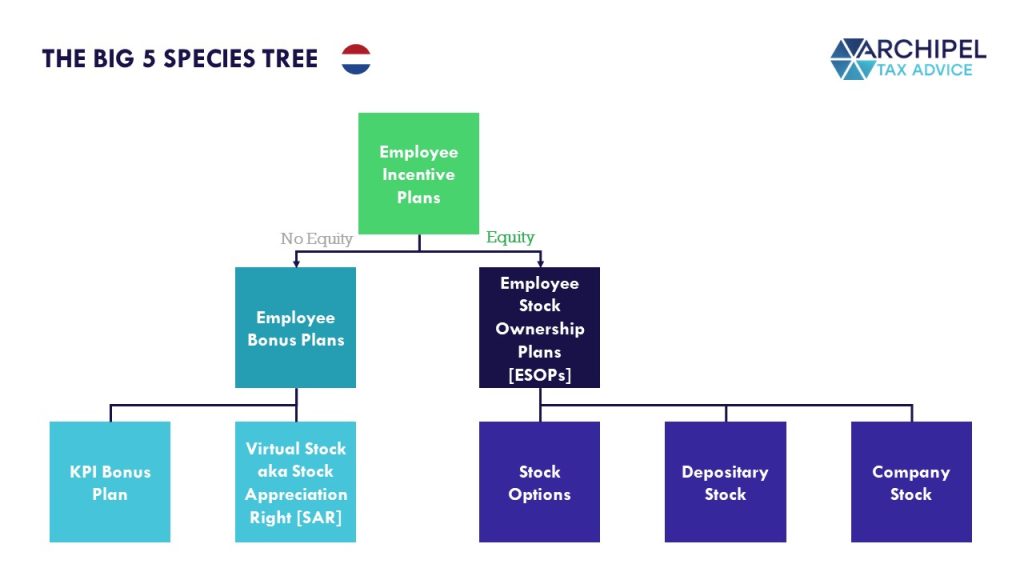

Our ‘Big 5 Species’ of Incentive Plans.

In order to mindmap the options and give the roadmap a starting point, we like to condense the endless palate of Incentive Plans into our ‘Big 5’ species tree, ranging from more airy but cash-quick Bonus Plans to the more involving and long-termed Equity Plans often referred to as ESOPs:

And of course, the real work is in the details. Playing with the nuts and bolts that make any plan yours, is where the plan becomes valuable. For a longer read on how these different Incentive Plans work and intertwine from a tax & legal & financial perspective on a broader scope, and where in the ‘Organizational Pyramid’ they’re most often and best implemented, we refer to our longread here:

Our Soapbox Webinar: a 45-minute take on these 5 types’ essence, workings and ‘things to think about’.

If you’re curious for some views on Incentive Plans, we also invite you to sit back and watch the replay of our webinar on this topic. An agenda so you know what to expect:

- Why Incentive Plans? Some hbr.org statistics on the effects for firm and folks;

- The 5 Incentive Types:

- KPI Bonus;

- Virtual Stock or Stock Appreciation Right [SAR];

- Employee Stock Option Plan;

- Depositary Stock Plan [non-voting version of ESOPs], and;

- Stock Ownership Plan [full co-ownership version of ESOPs];

- Where to start the design process;

- Things to think about [clauses and implementation], and;

- The Implementation Process.

We use Tax as a function to start the designing process from. The financial aspects behind the options are -of course- a key factor to what makes them tick, and tax influences that. But also; tax a is a natural connector between cashflow and legislation, and your projected cashflows and legal frameworks set the scope and dynamics of options.

Without further ado:

Resource List for further deep-diving.

Perhaps you’re also looking to get more concrete. We have published a number of insights that may help you do just that:

More reading about the different types of incentive plans:

This post may help you form the primary ideas of the instruments you like:

An analysis of the types’ tax deductibility for the company:

This post discusses the CIT-deductibility of incentive instruments:

A guide to tax-proof DCF [Discounted Cashflow] valuations of stock [NL]:

This post gives an overview of how non-listed stock is valued for tax purposes:

What later Exits say about self-calculated values earlier:

This post then analyzes what later events say about accuracy upfront:

Our open-source ESOP template:

And if you’re looking for a concrete template of an incentive plan to help your concretize your thoughts, check out this post:

Want to discuss? Book a slot. It’s on the house.

We try to be as sharing as possible with our Incentive Plan experiences. Making a good plan, though, is always a bespoke matter. If you’re going to expand the cap table, you had best do it right. Our added value is in filling in the details to help you do just that.

Want to ‘speak to a human’? Book a slot in my calendar. It’s on the house and I’m eager to help.