This read covers Share Valuations for Employee Incentive purposes, and what effect a later exit may have on their accuracy and ‘fixedness’. Case in point: what if a company issues shares to some Key Staff members at a certain valuation, but an exit takes place shorty after against a much higher valuation? Will the initial valuation be accepted as a given or not? And if not; will there be tax? Will there be penalties?

A rather juicy court case sheds light on some common technical talking points and the rules of engagement. This is going to be fun!

Download this article in pdf here.

The basics: Company Value is based on a reference transaction or an Arm’s Length Valuation absent one. Staff discounts on this value are taxable as Wages in Kind.

When companies issue employee shares so that selected Key Persons have a stake in company value, the company will be valued. This is to establish base-line values for the Key Persons [thus allowing for a quantification of their added value], but also for tax purposes. Reason being that if the Key Person is offered the stake in its employer at an implied or explicit discount, said discount is taxable as wage in kind. And the company has the obligation to accurately report the wage it should and will pay tax on to the Tax Authorities.

Now for Free Float stock, said valuation is rather easy. But if the company issuing the equity stake is not in free float, matters become more complex. Preferably, the value is drawn from a ‘reference transaction’ – a recent-enough third party event. For instance: if an investor bought a 10% stake for € 1.000.000 just three months earlier, chances are that the company value is still somewhere around € 1.000.000 per 10% if no major events took place in the meantime and if the 10% stake came without any special conditions. If no such [suitable] transaction can be identified, the company should be valued using a calculation method for which the Discounted Cashflow Method is the Dutch Tax Authorities’ preferred and authorized method. Our Valuations-guy Pieter van Tilburg wrote an elaborate read on this topic – find it here [in Dutch, but it works wondrously well with your browser’s translate function].

Now it is commonly accepted that company valuations are not an exact science. So what if you calculate the business’ value for a Key Staff Equity Event yourself [and report taxes on that basis], but the company value proves to be much higher in a later investment event?

A rather juicy court case sheds light on some common technical aspects and the ‘rules of engagement’. sheds light on how the Dutch judge sees some common technical elements of valuations and the related

The Case: SafetySoft’s Staff Shares and its VC Investment shortly after.

The District Court of North Holland ruled in a vast case [ECLI:NL:RBNHO:2021:11943], that gives real insight into a ‘live case’ involving a scaleup business. Now Dutch Tax Court anonymizes all its rulings. One could Sherlock what company the case actually pertains to, but since Archipel is a classy joint, we will fill in some blanks with some made up details to make this more fun.

Introducing: the company SafetySoft. A Dutch-founded software company focused on automating and bettering safety and quality procedures in the exploration business, like on offshore oil rigs.

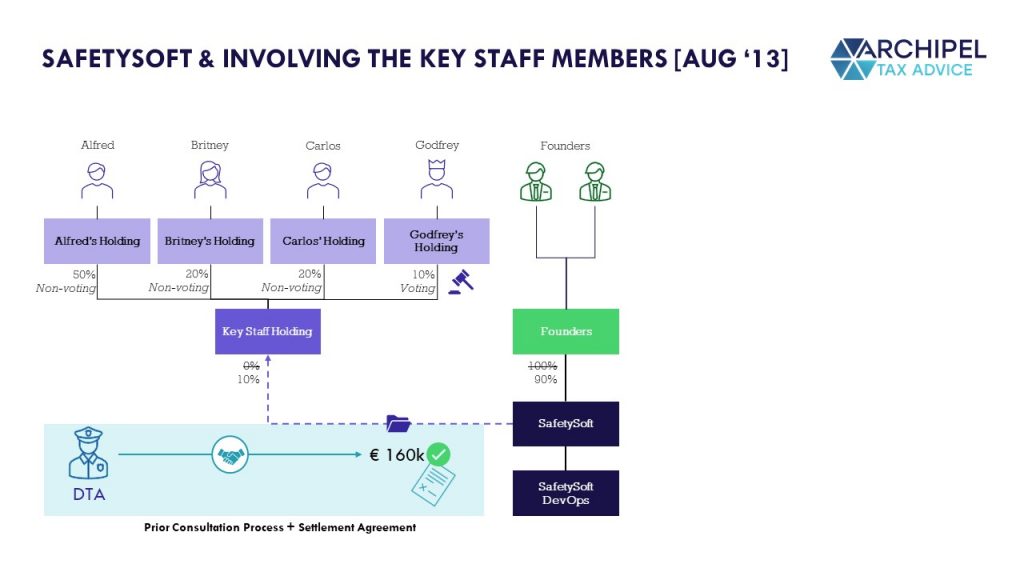

At the start of this story, SafetySoft [founded in 2008] is owned by it’s founders Jo and Ron and 45% each, with the remaining 10% being owned by its Angel-Investor-and-Non-Executive-Director Godfrey. But at some point in 2012, the board feels the time is right for an accelerated growth path. And three Key Employees are identified as important figures in making hyper growth happen. How to stimulate them? Easy. By offering them shares!

The Plan: issuing a 10% share to a freshly incorporated Key Staff Holding against a Valuation agreed on with the Tax Authorities.

The Key Staff Members were pledged these shares at the end of 2012, and so begins SafetySoft’s journey into designing a proper Ownership Plan. After some drafting, SafetySoft sets out on a reorganization in which the Key Staff Members each incorporate a personal holding entity through which to then participate in a freshly incorporated Key Staff Holding. This way, each participant could secure a direct B2B shareholder link in excess of 5% thus benefiting from the participation exemption. The Key Staff Members’ shares would be non-voting and subject to conditions such as Bad Leaver and Lock-Up clauses. Non-Executive Angel Godfrey was to exchange 1%-point of his directly owned stake for a 10% stake in said Key Staff Holding, and this 10% stake would constitute the full stake of voting stock, effectively making him the arbiter of whether or not the Key Staff Members would ultimately receive any gains.

The Key Staff Holding’s Cap Table would therefore consist of:

- Alfred [his personal holding], Director of Project & Training since December 2012, for a 50% stake [Ultimately 5%];

- Britney [her personal holding], IT Operations Director since October 2012, for a 20% stake [Ultimately 2%];

- Carlos [his personal holding], Key Account Manager since October 2009, for a 20% stake [Ultimately 2%], and;

- Godfrey [his personal holding], Non-Executive Director since April 2011, for a 10% stake [Ultimately 1%].

So: what is the Value of the 10% Stake? About € 160k, say the Tax Authorities based on the information exchanged.

As we portrayed earlier, the share structuring would hold a wage tax exposure as any discount on the share purchase would be deemed to link to the staff members in private, and to be granted to them as a result of their employment at SafetySoft. In order to mitigate such an exposure, the Staff Members were to purchase their share packages at Fair Market Value. But: there was no reference transaction to base this value on. So, it was valuation time. And as Mr. Bicycle Repairman would say: how to value this?

As this issue was material to SafetySoft, they sought out an upfront consultation with the Tax Authorities’ so as to establish their tax parameters prior to the filing event. Under such a process, the taxpayer and the Tax Authorities exchange information and arrive at a ‘Settlement Agreement’ in which such uncertain matters as the price of a non-floating share can be established. Provided the parameters of contract law are observed, such an agreement binds the Tax Authorities and therefore gives the taxpayer advance certainty. This is common practice in the Netherlands and often referred to as an Advance Tax Ruling; you can find the Dutch Tax Authorities’ site on this here.

As we now know, the DCF method is the Tax Authorities’ preferred method. But back then, and in this case, SafetySoft got in touch with the Tax Authorities and concluded that a DCF-Method would not be suitable or accurately feasible, as the business was still highly volatile. So: after exchanging certain information about the client and project pipeline and whether or not external transactions were in play, the Tax Authorities agreed to apply a certain multiplier to the average earnings over the last three years and call it clear. Safetysoft sent their proposed Settlement Agreement in June, and the Tax Authorities countersigned it after a little more back-and-forthing in Augusts of 2013. The arrived-at price: a little over € 160.000 for the 10% stake. The shares are issued, the tax filing is done.

In the meantime: Market Interest in SafetySoft picks up.

And this is where it gets juicier. Because since the Information Exchange process started as to what the value of the share package was at the moment the restructuring was proposed, market activity picked up.

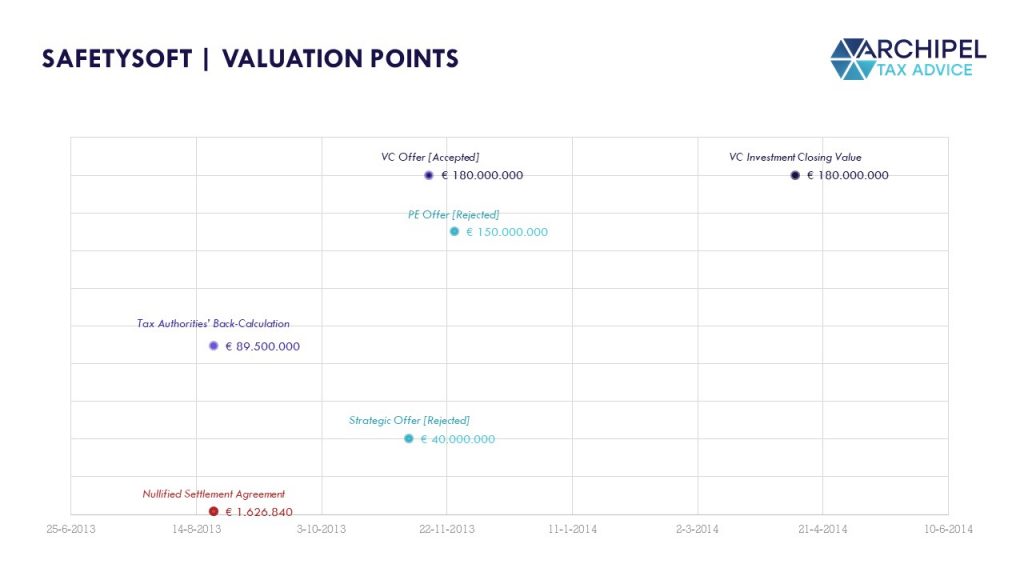

Bid 1: $ 150m Valuation in November 2013 | London PE Bidder | Started May ’13

A Private Equity Bidder from London approached SafetySoft’s Founders, as a colleague there had a bit of history with the company. The Founders initially weren’t very interested in a PE-investor despite this specific investor’s track record in technology acceleration, because they believe that PE-investment would come with significant constraints and close-watching-shareholders. They decided to entertain the chats, and these appeared to go better than anticipated. After a lower-and-rejected initial offering, a recalibration of the acquisition strategy to one aimed at ‘getting ready for hypergrowth’ led to an offer of $ 50m for 33,33% newly issued ‘Series A Convertible Preferred Shares.

Thus: the was valued at [arguably and at max] € 150m. The Founders rejected the bid as it pertained to an exit strategy and they found this a sub-optimal approach in this early phase.

Bid 2: $ 40m Valuation in November 2013 | Full Strategic Acquirer | Started June ’13

In apparent parallel to the abovementioned process, a strategic acquirer was interest in purchasing the complete company, cash, off the shareholders. This seemed promising as the Discovery involved even got resulted in a project name internally. Although the offer was enticing due to its 100% cash-element, the Founders ultimate rejected this offer too, as they deemed it too earlier a stage to exit.

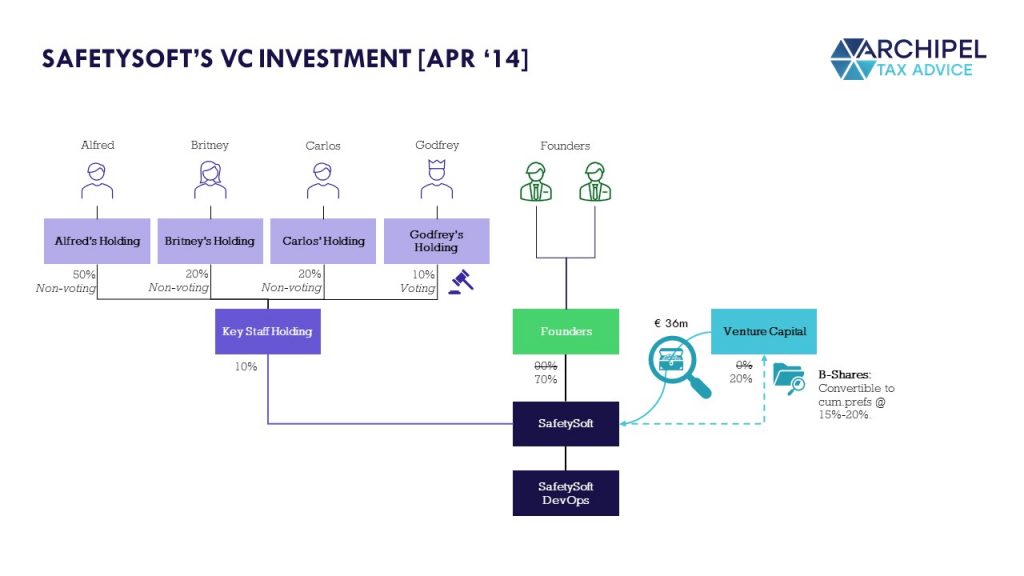

Bid 3: $ 180m Valuation in November 2013 | Venture Capital | Started November ’13, closed April ’14.

A third potential investor entered the stage in november of 2013. They offered a strategic alliance with their group of companies against a valuation of $ 180m. The conditions: a board seat, and a $ 36m cash injection in exchange for a 20% stake, to be issued as new B-Class Shares, convertible into Preference Shares with a 15% – 20% preferred dividend per annum. And so it was; after the due financial, legal and strategic diligence, the deal closed in April 2014.

Over the course of the Board Seat implementation, a new CEO got to purchase regular shares at a company valuation of $ 10m at the end of 2014.

Later Event: Ultimate Exit at $ 130m in 2018.

At the end of 2018, the company was exited against a value of $ 123.846.442. A very respectable company growth for a decade of hard work. But the question is: can we just ‘step past’ the settled valuation of € 1.6m in the summer of 2013. Because long story short:

The value signed-off on as per August ’13 was € 1.6m and the apparent Closing Value as per April ’14 was € 180.0m…

And needless to say, the Tax were not very happy about this. From a budget perspective, this is understandable, as any of the value increase that should be allocated to the time period prior to the Key Staff Conversion would be taxable with 49,5% income tax, whereas any subsequent value increase in their hands would be shareholder proceeds – initially exempt at the Holding Level and taxed afterwards at 26,9% if and to the extent that any proceeds were actually wired out of the corporate structure and to Alfred, Britney, Carlos and Godfrey.

But in this case, it appears that the Tax Authorities were not too pleased on an ‘interpersonal’ level either. They considered the concerted mix of contracts and messages in bad faith and borderline fraudulent and hit SafetySoft with a Wage Tax reassessment of € 13.312.387 [consisting of (the $ 180m valuation converted to euro’s * -/- the calculated valuation of € 1.626.840) * 10%] plus a 100% penalty for filing in bad faith with wrongfully unpaid taxes as a result. Needless to say, SafetySoft made their appeals which the Tax Authorities rejected, and the case ends up in court.

The Court Case: was the primary valuation ‘fixed’ at € 160k as per the Tax Ruling and if not, what was the primary valuation instead?

Put briefly, these developments result in three items that the judge should rule upon:

- Is the Settlement Agreement Binding? SafetySoft takes the position that the Settlement Agreement covering the share valuation for tax purposes is legally binding for the parties involved, and that SafetySoft could therefore rely on the Agreement

- The Tax Authorities take the position that significant background information was withheld during the Settlement process and that the agreement is based on an incomplete representation of facts, and is therefore not legally binding as one of the signing parties was misled.

- If not; does that make the taxes filed on that basis ‘penalizably incorrect’? SafetySoft takes the position that even if [1] the Settlement Agreement were not to be ruled legally binding and [2] the related Valuation were to be ruled incorrect, it should not be fined for wrongful filing with tax savings as a result as SafetySoft could based their filing on said Settlement Agreement which SafetySoft could, at the time, reasonably rely on as being legally binding and correctly established.

- The Tax Authorities take the position that SafetySoft would have known that the Agreement was not legally binding as they knowingly withheld important information and did so with illicit tax savings as an objective.

- And if not the Settlement Value, what value should be taken into account and on what date? Finally, SafetySoft takes the position that no tax savings should be identified because the valuation used for filing was correct, regardless of whether of not the Settlement Agreement was properly established. This takes into account also that [1] valuation date should be when the share were pledged, and [2] at said date, the value was established correctly.

- The Tax Authorities take the position that the value is far beside the truth as the external ‘reference transaction’ that takes place “shortly after” the share issuance to the involved employees should serve as the precise valuation of the company.

- The Tax Authorities take the position that the value is far beside the truth as the external ‘reference transaction’ that takes place “shortly after” the share issuance to the involved employees should serve as the precise valuation of the company.

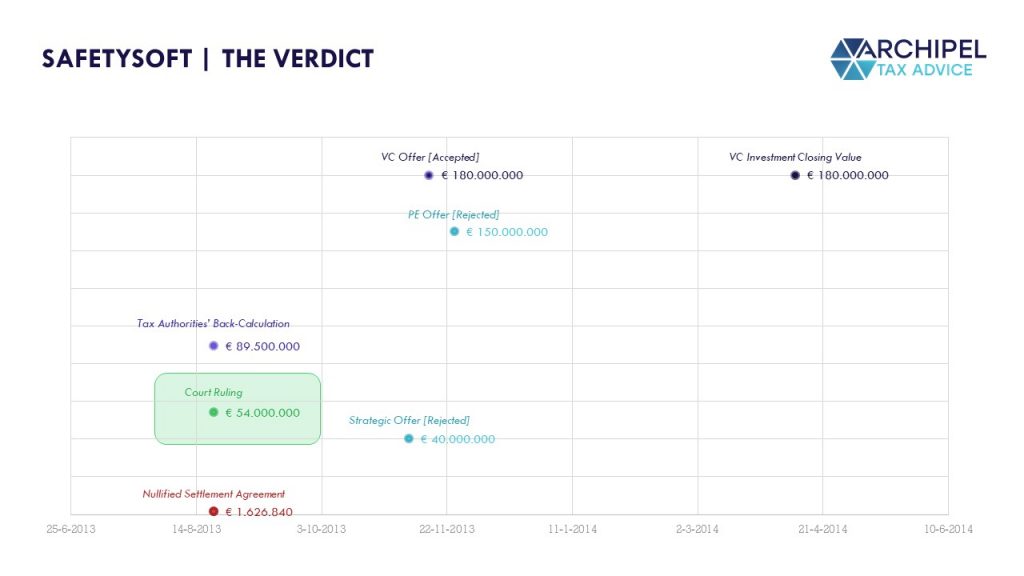

The Verdict

1. Is the Settlement Agreement legally binding? No.

A so-called Settlement Agreement can be entered into by any parties and serves to agree on ‘what shall go’ with respect to any legal uncertainty. And specifically where a private party enters into such an agreement with the Tax Authorities, it serves to provide advance clarity on any existing or future uncertainty that has an effect on a tax liability. For instance: if any discount on an employee share purchase should be considered wage in kind and as such lead to a wage tax liability, what employee purchase price would not lead to any such discount as it would reflect shares’ Fair Market Value at the time?

Such a Settlement Agreement has a long-standing history under Dutch law and finds its basis in article 7:900 of the Dutch Civil Code, which has an underlying framework. This framework dictates that if the signatory parties Agree to commit to such a position even if the later circumstances differ from what was anticipated, the Agreement is always binding. But: this rings true only if the Agreement is a result of Good Contracting, which means that the in the build-up to the agreement, the offering party must perform their informing duties in good faith and the accepting party their inquisitive duties.

As the Settlement Agreement in this case was concluded on August 5th 2013 [the signatory date of the tax Authorities, and therefore the acceptance date of SafetySoft’s offer dated July 11th as per its letterhead], this is the date up to which said framework of Good Contracting applies. So: if SafetySoft withheld any relevant information up until that date, the Tax Authorities can invoke that their acceptance of the resulting offer was misguided and that the Agreement was concluded on illicit grounds.

And in this specific case, the Court rules that the Tax Authorities were indeed misguided, as SafetySoft never informed them of the concrete investment talks that already commenced prior to August 5th, whilst such talks -and any concrete offerings resulting from them even more so- are very relevant in determining the company’s Fair Market Value. For instance, no mention was made of the exploratory chats already taking place with the London PE Bidder from May 2013, or of those with the Strategic Acquirer that started from June 2013. Nor was there any mention of the presentation given to the latter party in which forecasts were used that far exceeded the numbers presented to the Tax Authorities.

The conclusion therefore: the Settlement Agreement was concluded after an invalid exchange process and is therefore not legally binding; it is the result of misguided contracting and can therefore be nullified.

2. Does that automatically make filing based on the Settlement Value a penalizable tax offense? No.

If a taxpayer files a wrongful tax return resulting in illicit tax savings, they can be issued a fine of up to 100% of the missed taxes if the wrongful filing is a result of the taxpayer’s intent or gross negligence.

The Court, however, states that the Settlement Agreement itself was not established in contempt with underlying legal provision to such an extent that the taxpayer should have known upfront that it was not be relied upon and furthermore that the agreed on value was too low. So: the mere fact that the Settlement Agreement is nullified at a later stage, does not mean that when SafetySoft did its filing, it was intentionally stating too low a value or being grossly negligent in its filing. Preventing any such wrongful filing was, after all, the whole purpose of the Settlement Agreement procedure. So: back taxes yes, penalty no.

3. What value should be attributed to the shares, and at what date?

So: leaving the formalities behind, the Court must now leave the Legal Waters and venture in the much mistier Economic Waters. Because if we must indeed re-calculate, without penalty, the tax charge so as to establish the back taxes, what was the share value upon their issuance, and what do we take as the issuance date?

The Court rules, first of all, that the critical date is not the date on which the shares were promised or pledged, but the date on which the economic ownership of the shares was actually transferred. That is because the Dutch wage tax act states the following [art. 13a]:

Wage shall be taken into account when: [a] it is paid or settled, put at the discretion of the employee or becomes interest bearing, or [2] when it is legally owed and collectible.

And as pledging / promising the shares itself does not constitute either of these facts, and no earlier such fact than the shares actually being transferred can be identified, the transfer date is the critical date.

The question, then: what was the value on August 21st, 2013? The Court has a vast number of logical data points it can use and ‘reason back from’; a number of third parties put in bids, and one was accepted.

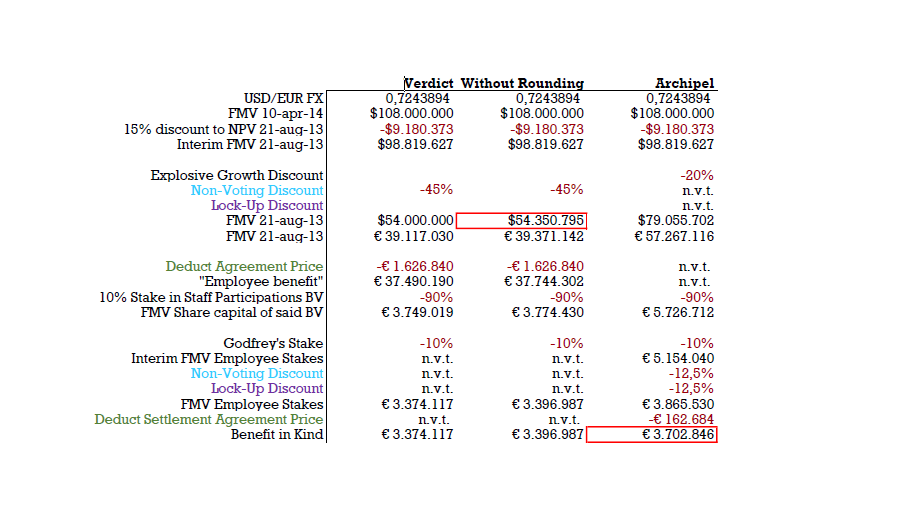

The Tax Authorities ask their in-house Valuations Desk for a report and their conclusion, put briefly, is the following:

For back-calculating the vale as per August 21st, 2013 using the proven value as per April 10th, 2014 as starting point, two aspects should be taken into account. First it the aspect of time. This can be done by taking the shareholder value of April 10th and calculating the Net Present Value on August 21st 2013 using a 15% discount rate, being the dividend percentage linked to the convertible cum.pref shares. Second is the aspect of company development – it a dynamic and not a static thing. This means that said Net Present Value can be reduced by another 25% discount. This discount percentage is difficult to substantiate and is therefore based mainly on the vast experience within our Valuations Team. The potential value-reducing effect of a lock-up period has implicitly already been factored in as the external investors too were subject to such a period. The shareholder value as per August 21st, 2013 can then be calculated at […] rounded off to € 89.500.000

Tax Authorities’ Valuation Team, memorandum of July 13th, 2018.

The Court, however, sees things differently. Look at these data points:

The Verdict: The Court establishes that the memorandum drafted by the Tax Authorities’ valuations desk already arrives at a lower [€ 89m] than the value that the Tax Authorities used for their Additional Tax Assessment and Penalty, as this was based on the full 2014 Closing Value [€ 180m]. However, this latter, lower value is also counter-argued by SafetySoft, and the Court rules as follows:

- In their valuations memorandum, the Tax Authorities do not sufficiently take into account the fact that the SafetySoft is a fast-growing business.

- Also, the Tax Authorities do not sufficiently take into account that the actual investment made by the VC investor, includes certain provisions such as their shares being convertible into cum.pref shares, making their share value not fully transposable to SafetySoft company value. I.e.: the regular shares, as granted to the employees, are substantively more restrictive, and therefore substantively less valuable than the Investor Shares.

- However, the Court does agree that the Closing of April 10th 2014 can serve as a Reference Transaction, and therefore as a starting point for a ‘back-calculation’ from that date. It bases this position on the famous and infamous ‘Chinese Vase’ case from 2013 [pertaining to the inheritance value for tax purposes of a first-deemed worthless but later expensively auctioned vase that was found on grandma’s attic] where it is stated that if neither party successfully argues an upfront value, back-calculation from a known transaction is the best remedy.

- The Court then calculates a Net Present Value on August 21st, 2013 using a 15% Discount Rate, equal to the cum.pref percentage on the investor shares and equal to the Tax Authorities’ idea.

- But: the Court rules the subsequent 25% discount on the shares ‘for the company development’ too limited, as SafetySoft should be classified as a ‘fast growing startup’ and such companies’ development is generally not so linear but more parabolic – if things go right. the Court therefore rules on a 45% discount instead.

- The Company Value so arrived at, should then be adjusted to represent Share Value. Factors here are the significant preference on the Investor Shares, which later [as per Exit 2018] turned out to ‘cannibalize’ most of the Regular Shares’ proceeds, and the substantial Lockup period on the Employee Shares [Regular Shares]. The value-reducing effect is determined at 2,5% per year, resulting in a 12,5% discount for the 5-year Lockup clause.

- As a result, the Court judges that the relevant Company Value on August 21st, 2013, is $ 54m. The Court sees support for this valuation in the fact that a $ 40m bid was rejected on November 7th, 2013.

So there we have it. Company Value: $ 54m.

The calculation the Court makes remains enigmatic, as some items do not appear to have been calculated properly. When we retrace the steps as per dictum, we arrive at the following conclusion:

So what do we learn?

Important stuff!

- A Settlement Agreement can be nullified if you do not give full disclosure of facts. So: there is value and advance certainty only if you do!

- Back-calculations are a viable means of valuation only you do not provide a viable upfront calculation. So: later success does not necessarily ‘topple’ your previous valuations.

- The Court understands that Growth Companies do not necessarily grow on a linear basis, but often shows a much more dynamic pattern. And that goes back to support point 2.

Want to discuss? Schedule a chat!

If you are working on an Employee Ownership Plan, we can help you go for upfront certainty. We will make an upfront share calculation, and together we can ‘fix’ this value for tax purposes in an Settlement Agreement with the Tax Authorities. Full disclosure. Investors lover that; no exposure after the fact!

Want to discuss? Feel free to pick a time. it’s on the house, and I love this stuff.

Download this article in pdf here.