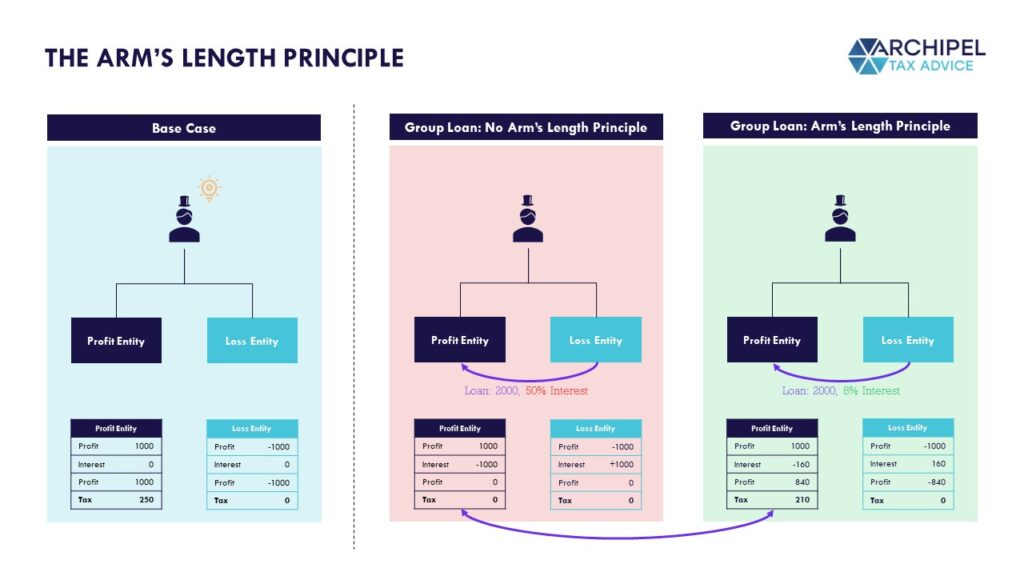

Imagine the following scenario: you are the 100% shareholder of two entities. One of these entities reports a profit of € 1.000 (the profit entity), whilst the other reports a loss of € 1.000 (the loss entity). From a shareholders perspective, it is quite understandable to think that the group as a whole will not have to report any corporate income tax. The Dutch CIT act does however consider each entity to be subject to CIT on a stand-alone basis. This will result in the profit entity reporting a taxable profit of €1.000 (i.e. ~ € 250 corporate income tax), while the loss entity reports a loss, which can be offset against future profits.

Let’s take it one step further. Let’s say, the shareholder isn’t too eager to report a profit of € 1.000 in the tax return of the profit entity. So he comes up with the following scheme: the loss entity will lend the profit entity an amount of € 2.000 with an interest rate of 50%.

This would result in the following (assuming both companies have the same taxable income year-on-year):

- The interest received by the loss entity (i.e. € 1.000) will be considered taxable income. As a result, the company will no longer report a loss of € 1.000, but rather a taxable income of € 0 (interest income of €1.000 -/- operational loss € 1.000).

- The interest paid by company B will be considered an expense for tax purposes. The company will no longer report a taxable profit of € 1.000, but rather a taxable income of € 0 (Profit of € 1.000 -/- interest expenses of € 1.000).

This is where the at arm’s length principle comes into play. In the above scenario, concluding a loan with an interest rate of 50% will not be considered ‘at arm’s length’. The arm’s length principle is a fundamental concept in (international) taxation that aims to ensure that transactions between related entities or individuals are conducted as if they were unrelated parties dealing at arm’s length. In other words, it suggests that the prices or terms agreed upon in transactions between related parties should be comparable to those that would have been negotiated between independent parties under similar circumstances. So for instance, the loan in this case could have an interest of 8%, resulting in an interest of €140 for the loss entity. Below you can see this scenario visualized:

1. To start: transfer pricing in a purely Dutch situation

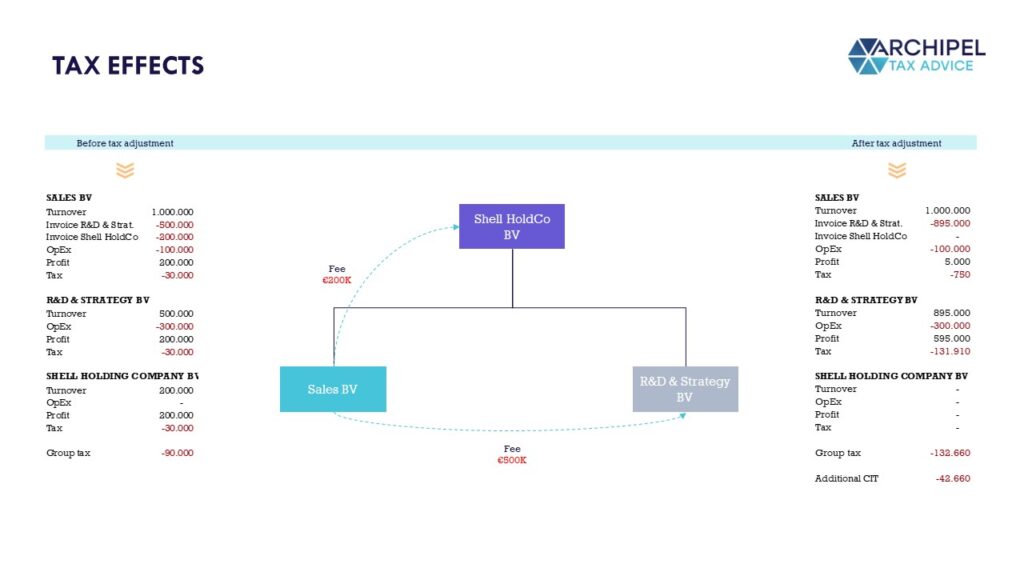

Let’s say Shell Holding Company BV owns 100% of the shares in Sales BV, the entity that invoices the customers and to whose bank account the turnover appears. The innovative product that Sales BV sells was wholly developed by R&D & Strategy BV, an entity that legally owns the intellectual property. R&D & Strategy BV is a 100% subsidiary of Shell Holding Company BV. Mainly the R&D activities and the Strategy function are responsible for the group’s turnover of €1,000,000 in total.

The group’s costs amount to €400K, of which €300K is incurred by R&D & Strategy BV, and €100K by Sales BV. The group profit therefore amounts to €600K. The group divides the income in exactly such a way that the low 15%-rate bracket (€200K profit) in the CIT is fully charged to each of the three companies, and the higher 25.8% CIT rate is levied on €0.

However, what activities does an empty (save for the shareholdings) shell company like Shell Holding Company BV perform to claim a €200K profit? Exactly, none. Would Sales BV pay such a fee to an unrelated shell company that does not contribute anything material to Sales BV’s business? No, of course it wouldn’t. Thus, this group profit allocation is not at arm’s length.

Furthermore, the R&D function and the group strategy function qualify as ‘key value drivers’, or ‘core functions’, while the sales function may rather qualifies as a routine function. The majority of the group’s turnover should therefore be allocated to R&D & Strategy BV.

In other words, R&D & Strategy BV is entitled to a higher profit than the €200K it reports, whilst Shell Holding Company BV is entitled to a lower profit than the €200K it reports.

With the chosen pricing strategy, the group thus saves €42,660 in CIT that the group would have owed with an at arm’s length pricing strategy. With regard to the tax positions of the parties involved, it is then assumed that at arm’s length transactions terms would have been agreed upon. Looking at the visual above, the financial column at the right is seen as the ‘tax truth’.

2. What happens if the Tax Authorities successfully argue that the profit allocation is not at arm’s length?

Depending on the facts in a specific case, the Dutch Tax Authorities can reclaim underpaid CIT up to 5 years back, based on article 16 of the General State Taxes Act (Algemene Wet inzake Rijksbelastingen). For the sake of simplicity, let’s say that only the year 2022 is under review. It is important to understand how tax entries work, as they affect the tax positions of all parties involved.

First of all, it is important to realize that such adjustments -in the Netherlands- cannot lead to an interference of the balance of the tax balance sheets involved. In other words, the profit item may be increased on the balance sheet, but a corresponding entry will have to be made to complete the ledger. It is called a ‘balance’ sheet after all. However, please note that the item ‘cash’ or ‘bank’ should at year-end always remain exactly where it actually was at year-end. So, how exactly does it work? In our example, there are two fees that are being adjusted (for tax purposes only!), as all three Dutch companies are being scrutinized.

2.1. Tax adjustment no. 1: The payment by Sales BV to R&D & Strategy BV

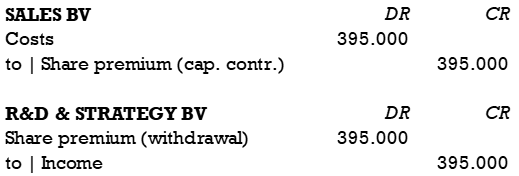

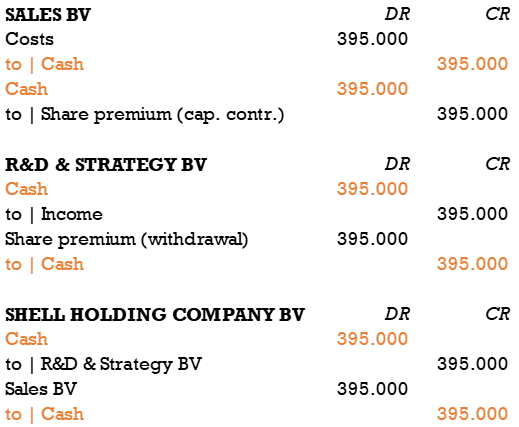

The Tax Authorities look at the relationship between Sales BV and R&D & Strategy BV, and conclude that the fee (€500K was paid) is too low. Therefore, the adjustment they make at the level of Sales BV is to increase the €500K fee to €895K by feigning a ‘secondary transaction’ of an additional 395K fee, resulting in a lower profit for Sales BV and a higher profit for R&D & Strategy BV. The tax journal entries are as follows:

Please note that not only the fiscal P&L is affected by the tax adjustment, but also Sales BV’s equity position. This is called a ‘constructive equity contribution’, which is meant to maintain the balance of the tax balance sheet.

Seeing as all three entities are Netherlands-based and the corrections have effect on the equity positions (but not on the cash positions), also Shell Holding Company BV -being the parent company of both- is affected. The tax journal entries are as follows:

The withdrawal and contribution are not taxed, so Shell Holding Company BV’s CIT burden is unaffected by this.

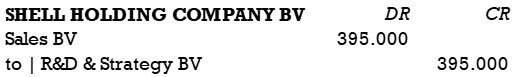

2.2. Tax adjustment no. 2: The payment by Sales BV to Shell Holding Company BV

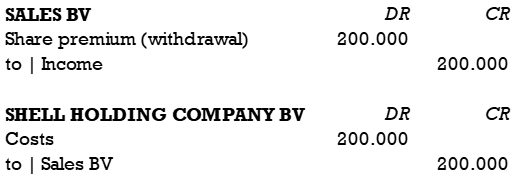

The Tax Authorities rightfully think that this fee of €200K is too high. In fact, it should be nil. This means that a secondary transaction is feigned, in which Shell Holding Company BV is deemed to owe €200K to Sales BV for the overpayment. The tax journal entries are as follows:

In short, it boils down that for tax purposes, this fee converts from a taxed fee into an untaxed dividend distribution: it is transferred from the profit atmosphere to the capital atmosphere.

2.3. The adjustments explained through cash account entries

If you have difficulty understanding the abovementioned journal entries, try to mentally add cash account entries to them. For example, regarding the tax adjustment no. 1:

This is what the journal entries would have looked like if the TP corrections’ secondary transactions had been accompanied by cash wires. However, in reality the TP corrections were not followed up by cash account entries. And because the cash position on the balance sheet is coldly ‘real’, it does not reflect any changes due to tax adjustments. It is therefore only helpful in a ‘shadow’ journal to clarify the other entries.

For the correct journal entries, simply eliminate the cash account entries from the tax journal entries above.

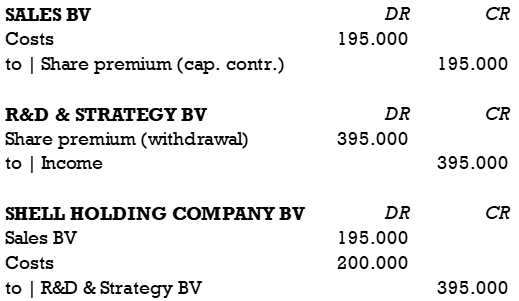

2.4. Combining the adjustments

Both tax adjustments together (without cash account entries!) look like this:

It is also worth noting that Dutch tax law does not require that these tax journal entries are written up and/or recorded somewhere. However, it is the ‘old way’, and it can prove really helpful when you’re figuring out what the transfer pricing corrections’ consequences are in the tax books of all parties involved.

3. Defining the transfer price

But how do the Tax Authorities know that the arm’s length fee paid by Sales BV to R&D & Strategy BV should have been €895K instead of €500K? And what about the not-at-arm’s-length character of the €200K fee paid by Sales BV to Shell Holding Company BV?

First of all: transfer pricing is not an exact science. It is a matter of substantiation and the division of the burden of proof. This generally means that, in a discussion with the Tax Authorities, the stance that is supported by the best arguments is the ‘correct’ stance. This stance approximates what the parties involved would have agreed upon, had they been independent, non-affiliated companies.

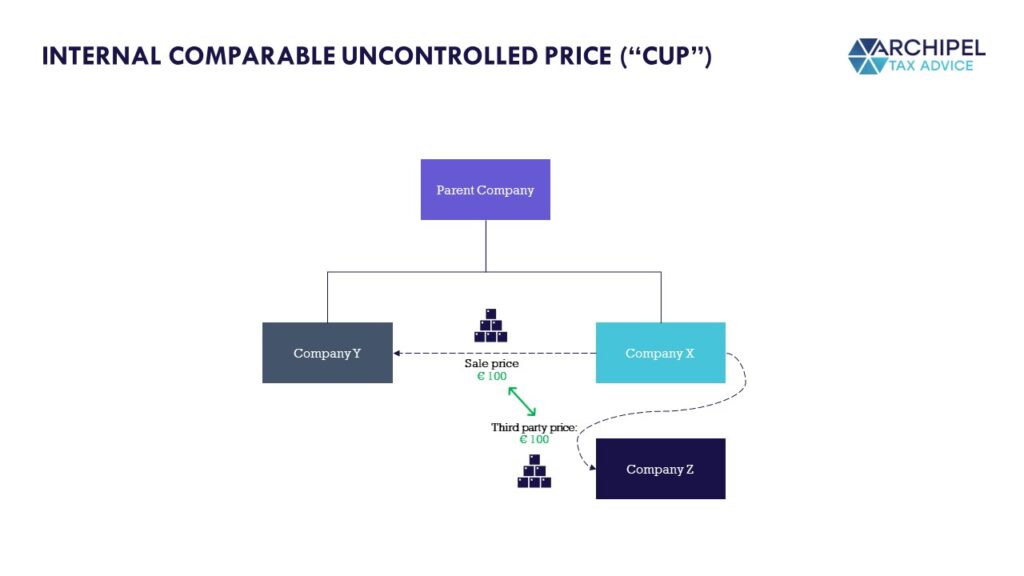

3.1. Comparable Uncontrolled Price (“CUP”)

Sometimes, this can be very straightforward. For example, in case of an internal comparable. Let’s say that company X sells fungible products to its sister company Y, but also to third party Z, located in the same region as Y. Apart from the sale of products, X and Y have no dealings with one another. In this case, the arm’s length price per product is easily determinable by looking at the price that X charges to Z. The price that X charges Y should simply be equal. This determination method is called the CUP: comparable uncontrolled price, which is one of the Traditional Transaction Methods. This method can be applied as the comparability of the transactions is very high, due to the fungible nature of the products and the same geographical location of Y and Z.

But in practice the situation often is not as clear-cut as that. If X sells services instead of products, the comparability is generally more difficult to establish. In practice, a very large majority of transfer prices is therefore determined by using the Transactional Net Margin Method (TNMM) on cost-basis.

3.2. TNMM – method

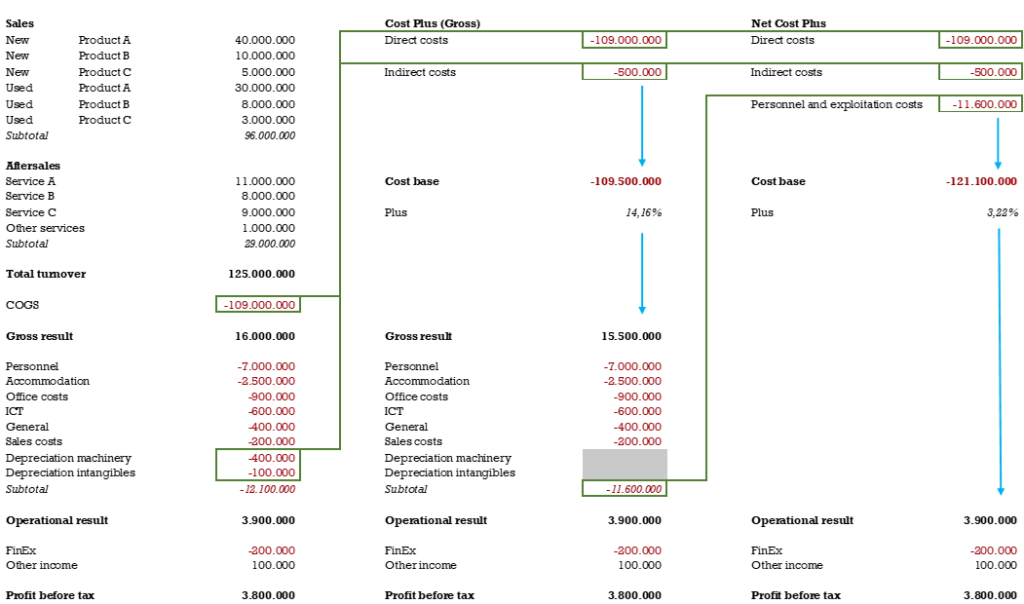

The TNMM on cost-basis is commonly referred to as the Net Cost Plus method, or simply the Cost Plus method because of its wide application. This method should not be mistaken for the ‘actual’ cost plus method, also known as the Gross Cost Plus method.

The Gross Cost Plus method looks at a comparable company’s direct costs (COGS etc.) and indirect costs (depreciation etc.) and relates it to that company’s Gross Result. That ratio leads to a quantifiable ‘plus’, and can subsequently be applied to the company that you’re determining the arm’s length profit for. Whereas the Net Cost Plus looks at a comparable company’s total operational costs, including personnel and exploitation costs, and relates it to the Net Result, from which a ‘plus’ is derived and applied to the company at hand. This is clarified by the visual below.

In essence, the visual above illustrates that for this company a gross cost+14.2% results in the same taxable profit as a net cost+3.2%.

It is important to note that the cost base is determined on the basis of financial forecasts: budgetted figures and not actuals. This means that, even when applying the TNMM on costs-basis, a 3.22% mark-up does not necessarily mean that the company at hand is always going to realize a profit. After all, there is a risk that the amount of forecast costs is exceeded by operational inefficiencies during the year, as a result of which the cost base + markup do not cover the actual costs incurred. For the Gross Cost Plus the operational inefficiency is a more profound risk, because the (forecast) exploitation expenses are not even included in the cost base.

In practice, you most likely won’t look at just one comparable company, but rather at a list of approx. 10 (no fewer than 7 and no more than 15) after elimination of non-comparable companies. This list effectively constitutes an arm’s length range within which any mark-up percentage is defensible. However, if the comparability of the listed companies is not that great, it may be more correct to limit the range to e.g. the Interquartile range (IQR) of the listed results.

4. Least complex entity

A cost-based remuneration method is usually most applicable when a group transaction involves a low-risk, routine service provider. That entity usually constitutes the least complex party to the transaction. It does not bear material risks, it does not perform significant functions and it does not own relevant assets. Low risk entails low reward, and therefore the profit margin relates to the budgeted cost base.

This is the easiest way to arrive at arm’s length pricing levels in intra-group transactions, because you can simply determine the appropriate remuneration for the least complex entity and subsequently allocate the residual profit to the other entity.

In the case-at-hand of Sales BV, we established that the sales function of the group was not that value-adding, as the product basically sells itself. Contractually Sales BV is indemnified for almost any type of risk, and it is not an asset-heavy entity. Therefore, the TNMM looks like a proper method to determine the remuneration. A benchmark analysis shows that entities comparable to Sales BV achieve approx. a 5:100 profit:costs ratio. Applying this to Sales BV, the €100K personnel costs are marked up with €5K, resulting in a €5K taxable profit. In its financial accounts, the revenue will be reported as €105K, with operational costs of €100K.

For Shell Holding Company BV, we already established that it is entitled to nothing, because it contributes nothing.

As a result, the residual profit is allocable to R&D & Strategy BV, which in this case means a tax adjustment for €395K, the additional fee that it should report as taxable income. Please note that the residual profit can vary from year to year, but Sales BV’s remuneration is based on a contractually ‘guaranteed target margin’. The existence of this guaranteed target margin in itself eliminates market risk for Sales BV, thereby justifying a cost-based TNMM even more.

5. Transfer pricing in an international situation

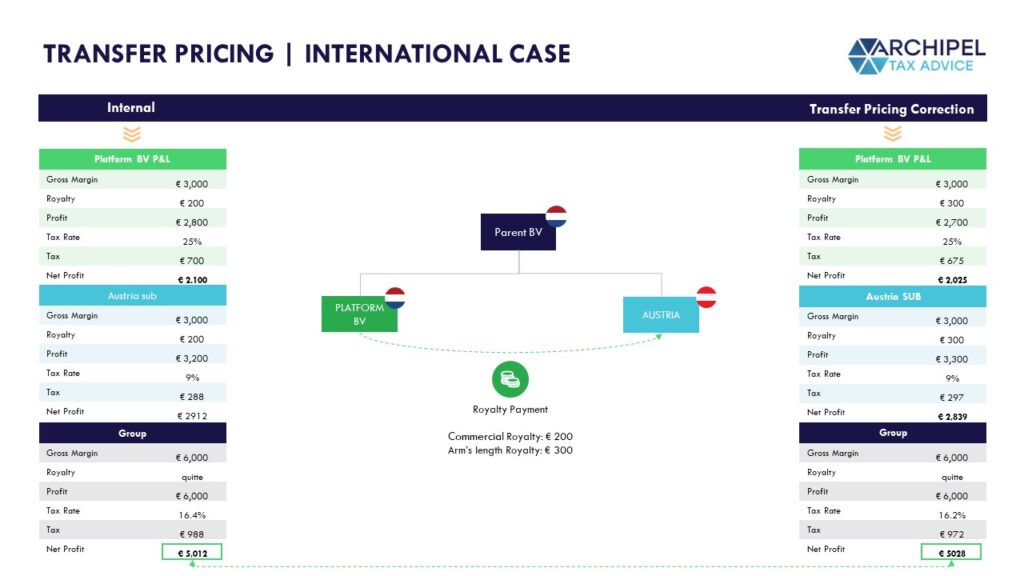

But whenever you hear the term ‘transfer pricing’, chances are that it is about a multinational enterprise, where differences in tax rates and tax bases between the jurisdictions involved provide a ‘perverse incentive’ for tax payers to shift profits to low-tax jurisdictions. However, we quite often see experience it the other way around. In most cases the transfer pricing strategy is outdated resulting in additional CIT on a group level. We visualize as follows:

In the above scenario, a slight adjustment of the TP-strategy results in a higher net profit.

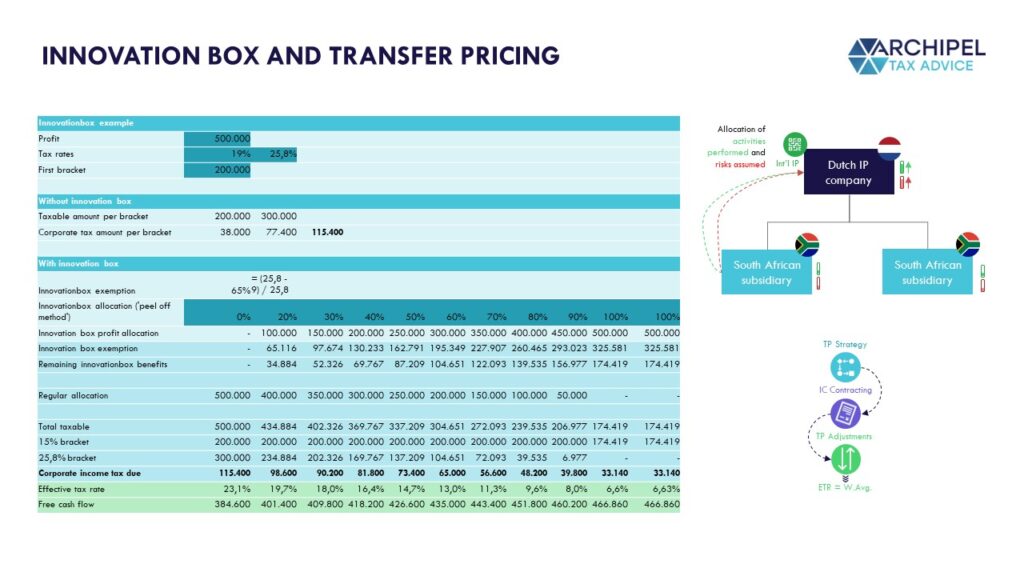

5.1. Dutch innovation schemes and a TP Strategy

The effective tax rate of the group as a whole can be lowered even further by utilizing Dutch innovation schemes, such as the Dutch innovation box. By performing qualifying R&D activities in the Netherlands, it will make sense from a TP-perspective to allocate a large chunk of the profits to this Dutch entity. The reason being that all the functions performed and risks assumed will be situated in that entity. This entity can – when meeting specific criteria – opt for a Dutch innovation box ruling, resulting in a lower effective tax rate of ~9% instead of 25,8%. By allocating a large part of the profits to the Netherlands – which is effectively taxed at ~9% instead of 25,8% – a lower group ETR can – in most cases – be achieved. The reason being that the effective tax rate in most jurisdictions will not be lower than 9%. We visualize as follows:

5.2. Transfer pricing disputes

Additional complexity can arise in case either one of the jurisdictions disagrees with the transfer pricing approach. Such a situation can arise even though the transfer pricing guidelines are internationally accepted. Such a dispute can either be prevented upfront [via an advanced pricing agreement] or solved later on via a Mutual agreement procedure.

5.3. Advanced pricing agreements [“APA”]

An Advanced Pricing Agreement (APA) is a formal agreement reached between a taxpayer and the tax authorities in one or more jurisdictions to determine the transfer pricing methodology and pricing arrangements for specific transactions between related parties over a defined period of time. The purpose of an APA is to provide certainty and minimize the risk of transfer pricing disputes and double taxation. Normally, an APA covers future transactions and applies for a predetermined period of time. An APA can also be concluded with two jurisdictions, a so-called bilateral APA or with multiple jurisdictions, a so-called Multilateral APA.

The APA covers several topics, such as:

- The functions performed and risks assumed of each of the entities.

- The chosen transfer pricing method.

- A benchmark study.

5.4. Mutual agreement procedure

In case no multilateral/bilateral APA was concluded, the tax authorities of one of the jurisdictions might dispute the transfer pricing approach taken. In such a case, the taxpayer always has the option to invoke a mutual agreement procedure, be it via the EU Arbitration convention [for disputes between EU-member states], the mutual agreement procedure in a bilateral tax treaty or via domestic legislation such as the Dutch ‘WFA’.

5.5. WFA-procedure

The WFA-based procedure provides companies with the possibility to resolve disputed between member states of the EU. For a request to be accepted, it must fulfill certain requirements. Once accepted under the WFA, the competent authorities strive to resolve the matter. The WFA includes provisions that enable the interested party to seek arbitration if the respective competent authorities fail to act within the prescribed two (or three) year period or do not reach a (potential) solution through mutual agreement. Notably, the WFA grants the interested party the ability to request arbitration independently and enforce it through legal means, providing them with assurance that any violation of the treaty regarding taxation will be rectified. Additionally, the WFA permits the submission of a case in which one of the involved states rejects access to the mutual agreement procedure by dismissing the request for arbitration, leading to a determination of whether the rejection was justified. If both states reject the request, the refusal can be challenged in a national court.

5.6. Mutual Agreement Procedure [tax treaty] or EU arbitration convention

Aside from these options, a taxpayer has the option to request for a mutual agreement procedure via a bilateral tax treaty or via the EU arbitration convention [in case of a dispute between EU member states]. In general, it should be noted that an arrangement that provides for the possibility of mandatory and binding arbitration offers the greatest legal assurance to the interested party. This applies to the WFA, as well as to tax treaties that include an arbitration provision with a mechanism for the interested party to enforce arbitration. If a tax treaty does not include an arbitration provision, the respective states are only obligated to make efforts to resolve the dispute within the framework of a mutual agreement procedure. When choosing between the WFA a tax treaty, the WFA provides the highest level of legal certainty. Similarly, when considering the choice between the WFA and the EU Arbitration Convention, the WFA also offers the greatest guarantee to the interested party that double taxation or taxation in violation of the treaty will be eliminated, as the interested party has the option to enforce arbitration through the court system.

6. Transfer pricing 101: optimizing your tax position

Due to the arm’s length principle, the price of intercompany transactions need to be substantiated in order to prevent any tax corrections. Proving the arm’s length nature of these transactions is done through preparation of TP documentation. Optimizations could be achieved if a properly designed TP strategy is set in place, which would lead to better bottom lines without necessarily impacting the material business significantly. If the compliance obligation is a given anyway, you better make the best of it. Want to know more on how to optimize your TP-strategy? Please schedule a meeting via my Calendly below.