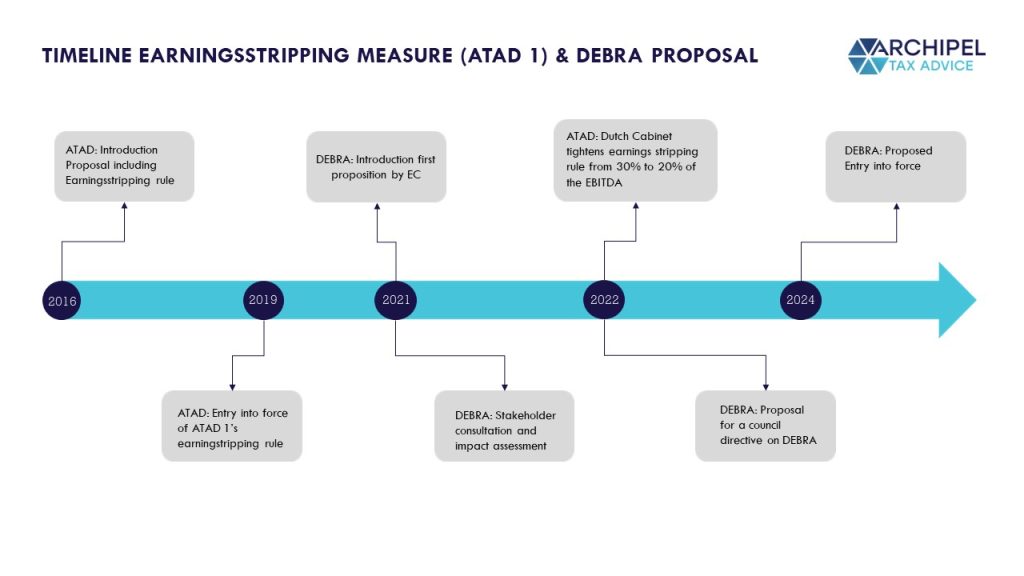

The standard rule in the world of taxation prescribes in general that interest on debt financing is deductible from a company’s taxable profit. As a rule of thumb, more interest costs result in less taxation. For years, the EC has found this limitless interest deductibility in the corporate income tax undesirable. In May 2022, the European Commission (‘EC’) published a Proposal for a Council Directive on laying down rules on a debt-equity bias reduction allowance and on limiting the deductibility of interest for corporate income tax purposes (‘DEBRA Proposal’ or ‘the Proposal’). The Proposal can be seen in light of the earlier implemented and currently effective earnings stripping rule or Interest Limitation Rule in the EU Anti-Tax Avoidance Directive (‘ATAD’) 1. The aim of the earnings stripping rule is to discourage ‘exceeding borrowing costs’ of companies. Whereas this earnings stripping rule relates to interest deduction only, the DEBRA Proposal introduces an equity allowance deduction in combination with an extra interest deduction limitation. The DEBRA Directive is expected to come into force as of January 1, 2024. We’ll explain the why, what, how and when of the DEBRA Proposal below.

What is the rationale for the Proposal?

In principle, companies are free to choose how they finance themselves – either with debt, equity, or a combination (for instance financing with SAFEs). Because only the costs related to debt financing are deductible, the EC explains that companies are incentivized to choose debt financing over equity financing. It is the EC’s belief that the deductibility of costs for debt financing is therefore undesirable; it makes companies vulnerable to unforeseen changes in the business environment. Recently, the EU countries have implemented the ATAD Interest Limitation Rule or earnings stripping rule which limits the deductibility of (net) interest based on a company’s Earnings Before Interest, Taxes, Depreciation, and Amortization (‘EBITDA’). In the Netherlands, this limitation on the deduction of interest is implemented in article 15b of the Dutch Corporate Income Tax Code (‘CIT’) and came into force on January 1, 2019. In light of the measures stipulated in ATAD and the EU’s aim to ensure a fair and efficient tax system across the EU, the EC would like to make it more attractive for companies to finance themselves with equity. On top of ATAD’s limitation on the deduction of (net) interest, the DEBRA Proposal will also make debt financing less favorable by introducing an extra interest deduction limitation rule. So, a two-way approach to reduce the debt/equity bias.

How does DEBRA work?

As said, the DEBRA Proposal consists of two parts: an equity allowance deduction and an extra interest deduction limitation. We will discuss both schemes including associated anti-abuse measures and pass-through facilities.

How does DEBRA’s equity allowance deduction work?

The allowance on equity under article 4 of the Proposal is computed by multiplying the allowance base with the relevant notional interest rate (‘NIR’):

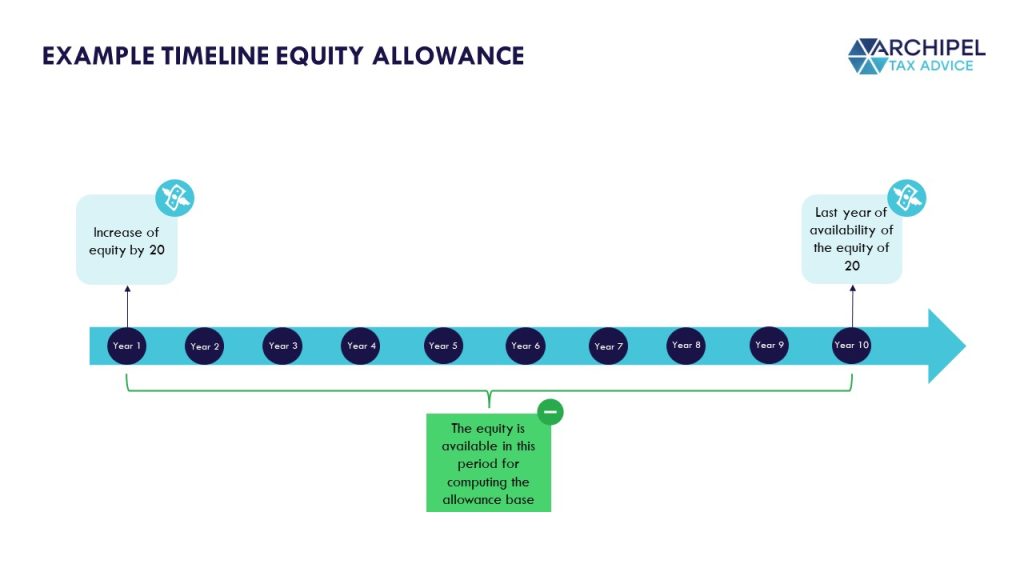

The allowance base equals the difference between the net equity at the end of the tax year and the net equity at the end of the previous tax year. In other words: a company’s year-on-year increase in equity. The Proposal defines equity as the sum of paid-up capital, share premium account, revaluation reserve, and reserves and profits or losses carried forward. The net equity is the equity without participations in the capital of associated enterprises and of its own shares. The rationale for the latter is to avoid companies cascading their participations to increase their equity positions. The allowance on equity is available for a period of 10 years; the EC found this period suitable as it mirrors the average maturity of a loan. This means that an increase in equity under this Proposal shall be deductible in the year in which it was incurred (‘year 1’) and can be ‘used’ in the following nine years (‘years 2-10’).

The NIR comprises the 10-year risk-free interest rate for the relevant currency (i.e. 0.9% in the Netherlands in 2021) and on top of that a risk premium of 1 percent. For small and medium size (‘SME’) companies, a risk premium of 1.5 percent will be granted.

The applicability of the equity allowance mirrors the earnings striping rule in ATAD, because the deductibility of the allowance is limited to a maximum of 30% of the taxpayer’s EBITDA for each tax year. This condition is meant to prevent tax abuse. As a concession, the EC introduced two facilities to carry forward unused equity allowance or taxable profit. The first facility has a time limitation of five years and the second facility is without a time limitation. Under the first facility, a taxpayer will be able to carry forward unused allowance capacity for a period of five years when the allowance on equity does not reach the aforementioned maximum amount of 30% of the EBITDA. Whereas under the second facility, a taxpayer will be able to carry forward -without time limitation- the part of the allowance on equity that would not be deducted in a tax year due to insufficient taxable profit.

Which other anti-abuse measures are there for the equity allowance deduction?

Apart from the aforementioned general limitation of 30% of a taxpayer’s EBITDA, the EC proposes ‘robust’ anti-abuse measures in article 5 of the Proposal to ensure that the DEBRA-rules are not abused. The anti-abuse measures specifically target arrangements put in place to artificially benefit from the allowance on equity in intra-group situations. So, the main function of these measures is narrowing the scope of the Directive by excluding certain transactions.

The first anti-abuse measure excludes equity increases that originate from (i) intra-group loans, (ii) intra-group transfers of participations or existing business activities, and (iii) cash contributions. Only if a taxpayer demonstrates valid commercial reasons for those transactions and the transactions do not lead to a double deduction, the anti-abuse measure will not be triggered. The second measure sets out specific limitations to the calculation of the base of the allowance where equity increases originate from contributions in kind or investments in assets (e.g. to prevent the overvaluation of assets). The third measure in the Proposal excludes equity increases that originate from converting old capital into new equity, which already existed in the group before a reorganization (e.g. through a liquidation or the incorporation of a new company).

How does DEBRA’s interest deduction limitation work?

As mentioned, on top of the existing generic interest limitation or earnings stripping rule introduced under ATAD, the Proposal introduces a new interest deduction limitation in Article 6. This article contains a restriction of 15% on the deductibility of debt-related interest payments, limiting the deductibility of interest to 85% of exceeding borrowing costs (interest paid minus interest received). The introduction of an interest deduction limitation in the Proposal is seen as efficient by the EC, because it ensures that the debt-equity bias is addressed simultaneously from both the equity and debt side. In addition, it ensures that EU Countries’ public earnings are not lowered drastically.

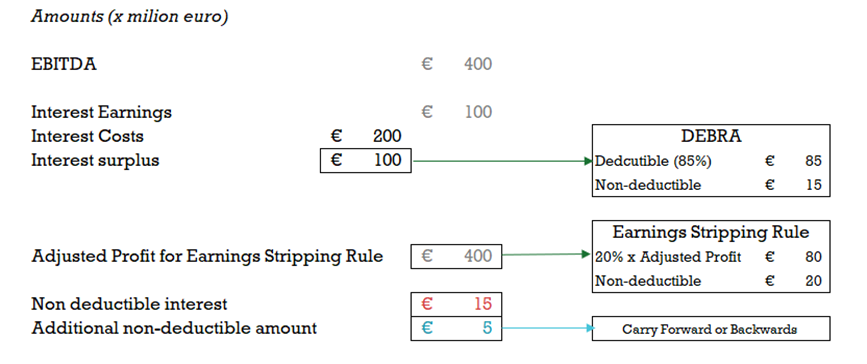

The EC sets out rules on how to apply ATAD’s earnings stripping rule in combination with the interest deduction limitation in the Proposal. First, the taxpayer would be required to calculate the deductibility of exceeding borrowing costs under DEBRA. Secondly, the taxpayer computes the amount that would be deductible under the earnings stripping rule. The difference in deductibility (i.e. the additional non-deductible amount) can be carried forward or back in accordance with the conditions of the earnings stripping rule (in the Netherlands this would be article 15b CIT). The applicability of the Dutch earnings stripping rule (in 2022: 20% of the EBITDA) in combination with DEBRA is explained in the example below. The below example is based on the example given in the Proposal:

In this example the difference in deductibility of 5 would be carried forward or back in accordance with article 15b CIT. The overall result is that the amount of 15 of interest borrowing costs is non-deductible and a further 5 of interest borrowing costs are carried forward or back.

What do we think?

The DEBRA Proposal fits in with the course that the EC has been steering in recent years. According to the EC, the partial equalization of the treatment of debt and equity capital will contribute to the creation of a ‘level playing field’. The Proposal is introduced at moment in time when the European Central Bank has announced to raise interest rates for the first time in more than 13 years. The Proposal could therefore be seen as another step towards further enhancing the liquidity position of growing companies. The Corona crisis has forced a lot of companies to use their reserves to keep their businesses afloat. Combined with the large ‘corona-debts’ companies have with the Dutch government, quite some of them are struggling with poor solvency. The DEBRA Proposal, therefore, pursues an economically desirable goal. Encouraging investments with equity capital could have a positive effect on the solvency of companies and could result in economically healthier companies. On the other side, the EC assumes blindly that attracting equity capital is accessible. In the Netherlands, it is for example expected that angel investors will put their foot on the brake and will be more hesitant to fund early-stage companies. The effectiveness of the DEBRA Proposal could therefore be limited to companies able to attract equity financing. Alongside this, the DEBRA Proposal could be seen as unjust to companies that are already financed with equity, as the DEBRA Proposal only benefits companies which make a year-on-year equity increase, but does not take into account already existing equity positions.

We advise companies to assess and consequently anticipate potential impact of the equity and interest deduction in the DEBRA Proposal.

Any questions or want to discuss?

Feel free to book a time below – it’s on the house!