During Techleap’s 2023 State of Dutch Tech event, the Association of Dutch Universities [Universiteiten van Nederland] announced a common standard for deal-terms with academic spin offs.

In brief: academic spin-offs are startups based on solutions or -in techincal terms- Intellectual Property [IP] that was developed at a university. For instance: over the course of PhD-research, or as a result of a final assignment – perhaps in coproduction with a guiding professor. Such ‘spin-offs’ find themselves at a bit of a fork; as Dutch Universities are state funded, and the IP’s development was at least in part paid for by the taxpayer. Therefore, Universities feel a perogative to recover those costs or even co-benefit should the spin-off make it big, and there is a risk of State Aid should a privately owned company make bank based on publicly funded Intellectual Property Rights [IPRs].

Some more backrgound: the phenomenon of Spin-offs has really taken flight in the Netherlands over the last years, as the Dutch government has been on a mission to facilitate ‘valorisation’ for close to a decade now. The underpinning policy has been geared towards actively ensuring that scientific finds can be deployed with impact, and succesful commercialization is considered a key element to that [ref. for instance this Letter to Parliament from 2017].

The Issue: VC-ish Spin-off Terms make the Startup Uninvestable.

With international ecosystems evidencing the success of this model and the Dutch government pushing for better deployment of puclicly-built IP for the benefit of society, Universities opened enterprise centers that would take care of the spin-off process, making a deal with the startup-to-be about equity and IP and then releasing the caterpillar to become a butterfly. But that is where the criticism has piled up: the enterprise centers -often incorporated as separate legal entities ans sometimes staffed with formerd VC professionals- morphed into VC-like institutions that anecdotally often leaned towards deal parameters that were hardly befitting of public institutions tasked with ensuring science would be ‘deployed with impact’. On the contrary; the cut-throat University deals closed with outgunned founders-to-be often made the Spin-off ‘uninvestable startups’, and the commercialization a disaster.

So in order to prevent the deal-by-deal negotiations and overly aggressive parameters, and instead aim at mutually beneficial sweetheart deals, the Dutch Universities joined a TechLeap-facilitated platform together with entrepereneurs and investors, and so created a single and uniform set of Deal terms that should get the job done better and more predictably. Find the press release here.

By the way: SAFE as designed by YCombinator has proven the value of standardized early stage deal terms, so we have high hopes!

In this read, we walk through the standard: the Dutch Universities’ Spin-off Deal Term Principles.

The Basics of the Deal Terms

So to set the scene: we’re in a setting where in-University persons want to spend their full time on commercializing a scientific find that was made in the academic context. A University enterprise center-person is then to agree on the terms under which the envisaged startup may use and build on the IP that’s been developed by or at the University, to which it legally owns the Intellectual Property Rights.

The background as stated by the Universities:

“You want to use Intellectual Property Rights (IPR) for your spin-off. This may include patent rights, copyright on software, database rights, design rights or trade secrets that are fully or partly owned or contributed by the University. In this document you find the conditions at which access to these IPR may be granted.

As the Intellectual Property Rights that are owned by the University are (partly) funded with public money, and to comply with state-aid rules, the University has to enter into a market conform deal with the spin-off.

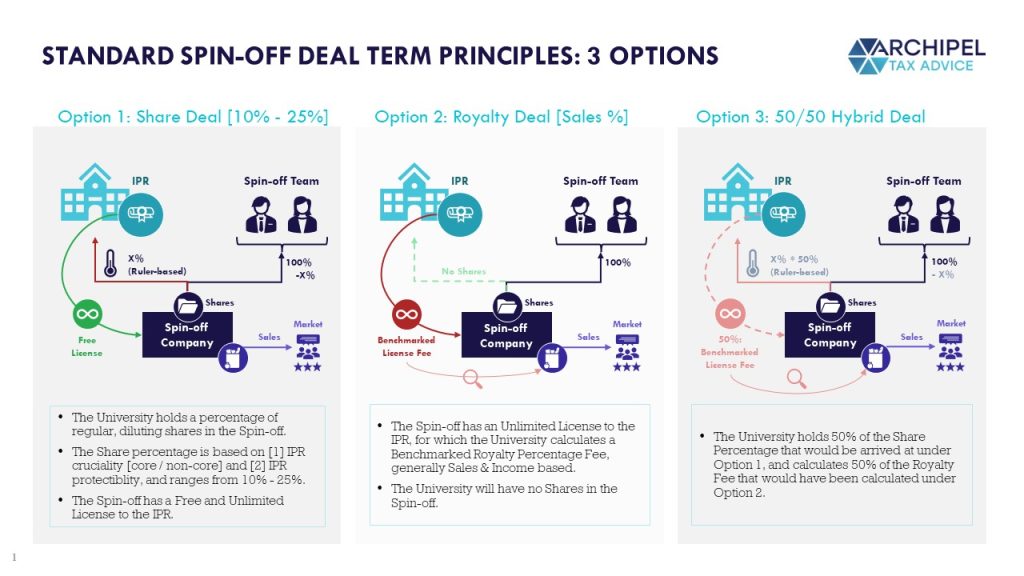

That means the University will ask for either:

- A fully dilutive equity share;

- A license deal with royalty payment;

- A hybrid equity-royalty deal in exchange for providing access to the IPR.

The University (Holding) will decide (after consultation with the spin-off) which of the deal-templates (equity, royalty, hybrid) is applicable. In this document we’ll explain what these deal-templates entail.“

The General Terms in All Cases.

In all cases, the University will work on the following principles:

- The University will continue to have free and universal access to the IPR, but exclusively for purposes of education and further research;

- The IPR is made avaiable ‘as is’ – meaning if something turns out not to work, the University isn’t going to reimburse you;

- Follow-on IPRs are not included – meaning that if the University builds on the current thing, their add-ons don’t click to your deal;

- After you’ve spun-off, you are no longer part of the University so if you need to use their resources or expertise, that is subject to separate and independent parameters, and;

- If you want or need to use University facilities and such after the spin-off, that too is subject to a separate agreement.

Option 1: a Fully Dilutive Equity Share for the University.

The first spin-off option involves shares for the University. These shares are dilutive, meaning that the University doesn’t receive additional shares when the company issues new shares, for instance in case of an equity round. The University ensure this equity is used also to reward persons who remain at the University, but who contributed to the IPR [inventors, creators and other contributors].

When can you use it?

At least one scientific founder needs to go and work full-time for the spin-off, and the IPR is at a maximum TRL of 4.

What are the conditions?

Share Percentages

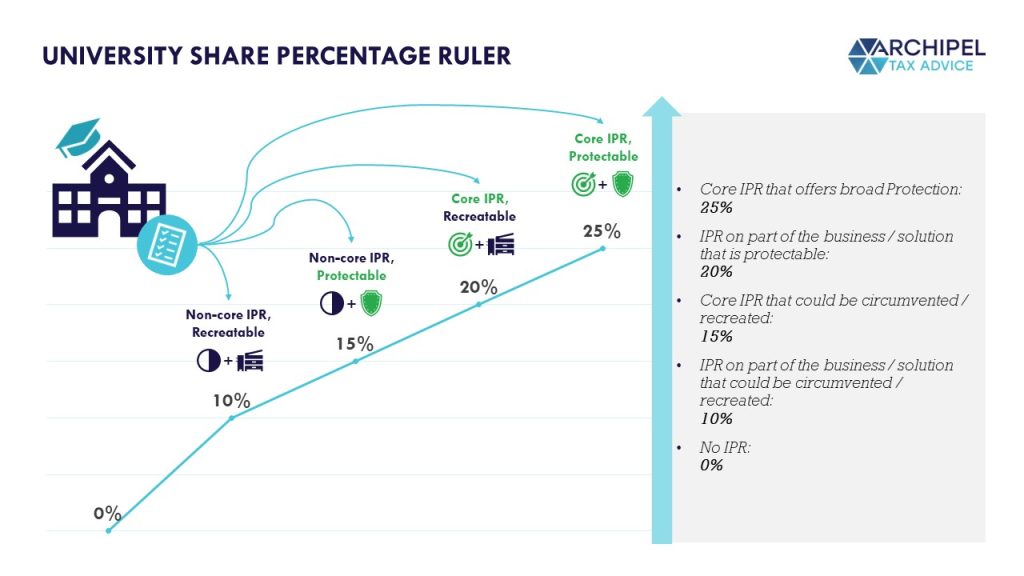

The University’s enterprise center [the “University Holding”] becomes a common shareholder in the entity for ‘X’ percent. The X depends on [1] how important the IPR is to ‘core uniqye value proposition’ of the spin-off, [2] the protectability, and [3] the potential for a lasting competitive advantage.

The remaining share [100% – X%] will be issued to the founders and perhaps team members, and is intended to incentivize them in commercializing the IPR.

The Share Percentage Ruler:

The percentage that the University opts for at Spin-off depends on two sliders: [1] the importance the IPR has to the company’s commercial proposition, and [2] the extent to which the IPR is unique and can be legally protected. The ruler as per the Standard Terms:

Core IPR that offers broad prtection would, for instance, be an enforcible patent or know how that can be kept secret, pertaining to enabling technology that supports a lasting unique proposition. If such IPR creates a unique competitive advantage only in combination with other IPR or if it is product-unique but the spin-off is centered around multiple products, we slide down one step on the ruler and the IPR is no longer ‘core’. And the protection-side slides down too as the underlying model or software could be copied with some effort or altered, or if it only provides a head-start for s limited period of time as opposed to a lasting advantage. It seems obvious that this analysis will be subject of debate and negotiation.

Milestones

The University, as a shareholder, agrees on ‘Milestones’ with the Team. These are generally obective and measurable, such as: Cumulative Gross Turnover hits € XXX [OR] the spin-off reaches a valuation of € YYY in an external equity round.

The University may add a technology milestone as well, for instance one pertaining to certification.

University Dilution in favor of Team only after Milestones are hit.

Until these Milestones are hit, the University’s common stock shall not dilute in favor of additions to the spin-off’s team.

Access to the IPR

Also until these Milestones are hit, the use of the IPR will be free; the University will not charge a royalty. However, the University, as stated, always maintains access to the IPR on account of an ‘automatic, non-exclusive and royalty-free’ license. If the IPR is very broad, spin-offs license may be limited to a certain field.

Patents

If the IPR concerns a Patent Right, the Spin-off will have a say in all the patent-right-related actions like the the application, mainenance and enforcement. The University [being the registered patent holder] will bear the out of pocket costs for these patent related processes. Once the Milestones are hit, the Spin-off will reimburse the University for the costs over the last 30 months.

Hitting the Milestones within ‘X’ years means the Spin-off has proven succesful in commercialization. At that point the Spin-off will be granted the option to acquire the patent at historic costs.

Option 2: a Royalty Deal with the University

This option does not involve the University becoming a shareholder, but rather involves them receiving a royalty payment on the Spin-off’s sales or other income related to the IPR that the University makes available.

What are the conditions?

The License and Exclusivity

For a period of ‘X’ years, the Spin-off is granted an exclusive, unrestricted user license of the IPR, including the right to grant sublicenses. If the IPR is very broad, the license may be limited to a specific field of use or area. If the Spin-off meets the Milestones in ‘X’ years, the said license will be continued. If not, the University has the right to turn it into a non-exclusive license or to revoke it.

The Basis of the Royalty Payments

Consist of the following elements:

- A percentage of sales and other income related to products or services that make use of the IPR;

- A higher royalty percentage on income from sublicenses;

- Optional: a minimum annual royalty payment, of which the first one is an upfront fee upon the spin-off, and;

- Optional: a Milestone payment related to things like certifications or commercial sales.

The Amount of the Royalty Payments

The royalty percentages will be benchmarked. This mechanism ensures that the parameters are in line with commercial contracts, meaning the University does not willingly or unwillingly offer an advantage – which could constitute State Aid.

In order to arrive at a Fair Market Percentage, the percentages will be based on databases of similar but commercial license agreements between unrelated parties, and the most comparable contracts will be selected.

In order to monitor this on a continuous basis, the Spin-off must annually produce the relevant information to the University.

The Milestones

The Milestones are identical to those of the Share Deal Option; these are generally obective and measurable, such as: Cumulative Gross Turnover hits € XXX [OR] the spin-off reaches a valuation of € YYY in an external equity round.

The University may add a technology milestone as well, for instance one pertaining to certification.

Patents

Like under the Share Deal, if the IPR pertains to a patent right, the Spin-off will reimburse the University related to filing, maintaining and protecting the Patent Rights.

IPR Purchase Option in case of an Exit Event

If the Spin-off makes an Exit, meaning it is acquired externally or makes an IPO, it will be offered the option to acquire the IPR from the University, provided the IPR is not ‘broad IPR’. If the Spin-off wants to use this option, the price will be negotiated upon that Exit Event. If the Spin-off doesn’t call it, the Royalty Deal continues.

Option 3: a Hybrid Deal

This deal combines Options 1 and 2, but implements 50% of the full percentages of stock and royalties respectively.

How do you Choose what Option to go for?

Perhaps this is typical ‘legal speak’, but that depends on your specific situation; your forecasts, targets and corporate structure ambitions.

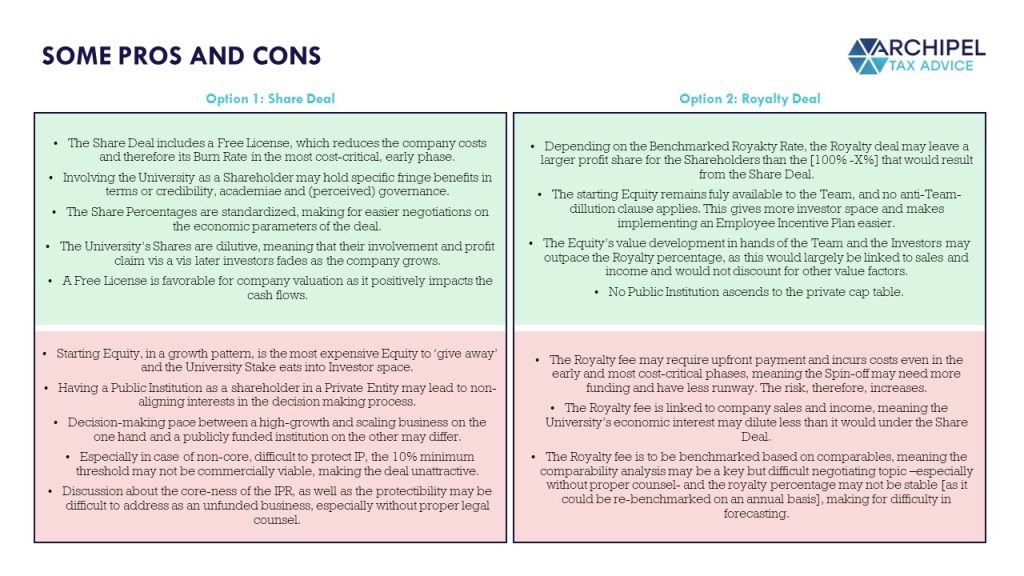

The Share Deal reduces the company’s burn rate and is cash-friendlier in the opening phases. However, a classic rule of thumb is that in case of a succesful commercialization, equity is never so ‘expensive’ for the founder [because worth-less for the investor] as it is in the early stages. And: experiences with in essence public institutions as shareholder are mixed. At the same time, University involvement -especially in specific industries- may add credibility.

The Royalty Deal, on the other hand, is more cash-expensive from the start, but leaves the Team with more equity to work with. At the same time, the Royalty Fee may grow with the company as it would be linked to sales and income, meaning the University may not dilute on an economic basis the way it would in a Share Deal. Also: the Royalty is periodically re-benchmarked, which means forecasting maybe more difficult.

So What is to you as Tax Folks?

Well, the ‘Tax Desk’ is where business economics, cap table legalities and corporate plans meet organically. We often advise companies on how to design their cap tables and cost patterns to faciliate their plan, and hepl align this tax and non-tax benefits and growth plans. This starting decision is at the core of that design!

Want to discuss? Book a Slot of your Choosing. it’s on the House!

We are happy to share our two cents’ and of course hope to piggy back on your trip to the moon as the tax guys in your corner 🙂