The economy’s digitization has taken an exponential pace. Testament to this is that European ‘Platform Economy’ showed fivefold growth in just four years, from 2016 – 2020. These platforms facilitate a shift from ‘traditional’ employment to a gig economy. And Tax Authorities’ information processess will need to adapt in order to avoid an informalization of the economy, and to help taxpayers oversee their earnings and tax positions.

To create a *platform* for Platforms to provide such information to the Authorities, a uniform reporting requirement was developed for Platform Operators per EU Directive 2021/514, also known as ‘DAC7’ [for the 7th Revision of the Directive on Administrative Cooperation].

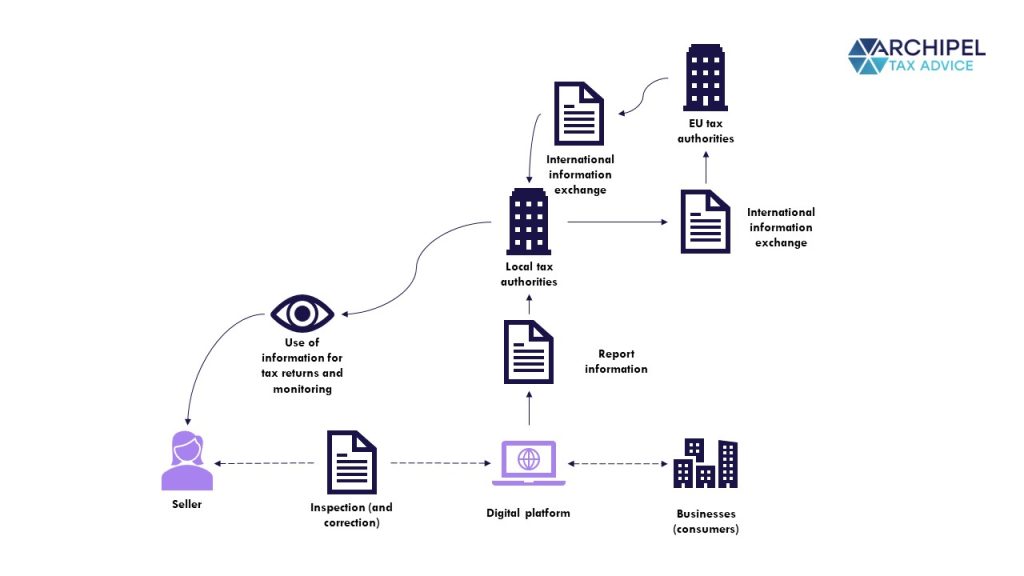

1. The DAC7 Idea: Platforms Collect Transaction Data about their Users and Report to their Tax Authorities, who Exchange the Data with their International Counterparts.

The idea of DAC7 is that ‘Platform Operators‘ collect identification and transaction data about their users and exchange it with their Tax Authorities, who in turn automatically exchange said information with their counterparts within the EU and other Participating States. This provides the Authorities insight into the sellers’ Platform revenues, and allows them to help establish, and verify, the taxes due (for instance: Income Taxes and VAT).

For Digital Platform Operators, this means a substantial increase in yearly reporting obligations. More specifically, since January 1st 2023, DAC7 requires certain online platform operators to maintain and annually report information about certain sellers on their platform to the tax authorities of an EU Member State. Subsequently, the tax authorities of that State are obligated to automatically provide that same information to the tax authorities of the EU Member State in which the seller is established (or in the case of the sellers renting out immovable property, to the tax authorities of the EU member state in which the property is located).

For completeness’ sake, we note that traditional businesses may also fall in the scope of DAC7 if they connect third party sellers and users through their website for the performance of ‘Relevant Activities’.

Online sellers are also affected by DAC7. The digital platforms on which they conduct commercial activities may ask for additional information and documentation. They must also check themselves that the data a digital platform reports about them is correct.

Digital Platform Operators that are either (1) registered or tax resident in an EU member state or (2) foreign operators that conduct commercial activities within the EU (this creates a ‘level playing field between EU and foreign operators’) need to:

- Determine whether they fall within the scope of DAC7;

- Establish which data they need to report and how they can collect this data, and;

- Set-up a process for said data-gathering.

In this article, we hand you tools to tackle each of the steps above. Naturally, Archipel Tax Advice is more than happy to assist in determining whether you fall within the scope of DAC7 and assist in setting up / streamlining your process.

2. When are ‘Platforms’ subject to DAC7?

So under DAC7, ‘Platform Operators’ based in the EU as well as foreign ones with EU operations, must report DAC7 Information about ‘Reportable sellers involved with ‘Relevant Activities’ on their platforms. And DAC7 being a legal guideline, we first zoom in on four relevant definitions:

- Who are ‘Reporting Platform Operators’?

- Who is responsible for reporting on behalf of a ‘Foreign Platform Operator’?

- Who are the ‘Reportable Sellers aka the sellers that the Platform needs to Report on?

- What are the ‘Relevant Activities’ aka the activities in scope of reporting?

2.1. Reporting Platform Operators

Reporting Platform Operators are responsible for the primary reporting obligations and must submit the first report on the year 2023 from January 1st, 2024 onwards.

The DAC7-directive defines a Platform Operator as an ‘entity that contracts with Sellers to make available all or part of a Platform to such Sellers.‘ In other words: the legal entity needs to contract with a seller and in return needs to provide them with access to the Platform.

A (Digital) Platform is any software (e.g., website or a (mobile) app), that enables sellers to be connected to users of that software. DAC7 applies to a broad range of Digital Platform operators, mainely those:

- Who operate a Digital Platform that is accessible to users and sellers for the sale of goods and certain types of services;

- Have a legal or commercial presence in EU, and;

- Whose platform is used by sellers for carrying out a ‘relevant activity’.

The Platform Operator is considered a ‘Reporting Platform Operator” in case the Platform is:

- A tax resident of an EU-member state,

- Established in the EU by way of incorporation or via a permanent establishment,

- A foreign (non-EU) platform which performs commercial activities in the EU [without any legal ot tax pressence in the EU whatsoever].

Platforms that merely process payments, list or advertise relevant activities or redirect or transfer users to another platform (such as search engines), are not considered Digital Platforms for DAC7 purposes. In other words: the platform needs to connect buyer and seller in order to qualify as a ‘Digital Platform’.

Besides Digital Platforms, businesses in traditional industries can also fall within the scope of DAC7. This is the case if they connect third party sellers and users through their website in order to perform ‘Relevant Activities’.

2.2. Excluded Platform Operators

In the Netherlands, Platform Operators that can demonstrate that no sellers are active on the Platform that they need to report on, may apply for ‘excluded platform operator’ status. The ‘Excluded Platform Operator’ status must be established by January 31st of the year following the calendar year on which they are required to report. Platform Operators may also apply for ‘Excluded Platform Operator’ status earlier so that they do not have to carry out collection and verification activities.

2.3. Foreign Platform Operators

Foreign Platforms that unfold commercial activities in the EU, are deemed ‘Qualified Non-EU Platforms’ whenever they do not have a legal or tax presence in the EU [i.e.: those with only a digital presence in the EU].

EU-Based Platforms: if the Digital Platforms are located in a non-EU jurisdiction that has adopted DAC7, and the jurisdiction is exchanging all relevant activities with all relevant EU Member States, the Platform needs to file a DAC7-report in the country in which they are deemed to be a tax resident.

Non EU-Based Platforms: if the jurisdiction of the Digital Platform is not exchanging all relevant activities with all relevant EU Member States, the Platform is still fully in scope of DAC7 if the Platform has an EU permanent establishment. If no permanent establishment is present, the Platform may qualify as a ‘Foreign Reporting Platform’. The latter Platforms may choose any EU Member State in which report.

2.4. Reportable Seller

A Reportable Seller on a Digital Platform is either a natural person a legal entity, who:

- Is a Resident of an EU member state and/or rents immovable property located in an EU Member State;

- Is registered on the Platform; and

- Performs a ‘relevant activity’ in return for a compensation during the reporting period.

Certain categories of sellers are excluded for DAC7-purposes:

- Governmental entities;

- Entities listed on a stock exchange and their affiliated entities (>50% interest) thereof;

- Sellers that have conducted more than 2,000 ‘relevant activities’ pertaining to the renting of a property (e.g. hotel chains); and

- Sellers who performed less than 30 ‘relevant activities’ of which the payments are less than € 2,000 combined.

2.5. Relevant Activities

The reporting obligations for Platform Operators apply in respect of Digital Platforms that allow sellers to connect with customers for a number of items:

- Personal services (e.g., time/task-based worked performed by an individual, either online or offline after having been facilitated by a Digital Platform).

- Rental of immovable properties (e.g., residential housing, commercial property, as well as any other immovable property and parking places).

- Sale of goods.

- Rental of transportation modes.

In order for transactions to be in scope of DAC7, all relevant activities have to be carried out against a remuneration, in any form (net of any fees, commissions or taxes withheld or charged by reporting platform operator) that is paid or credited to a Seller.

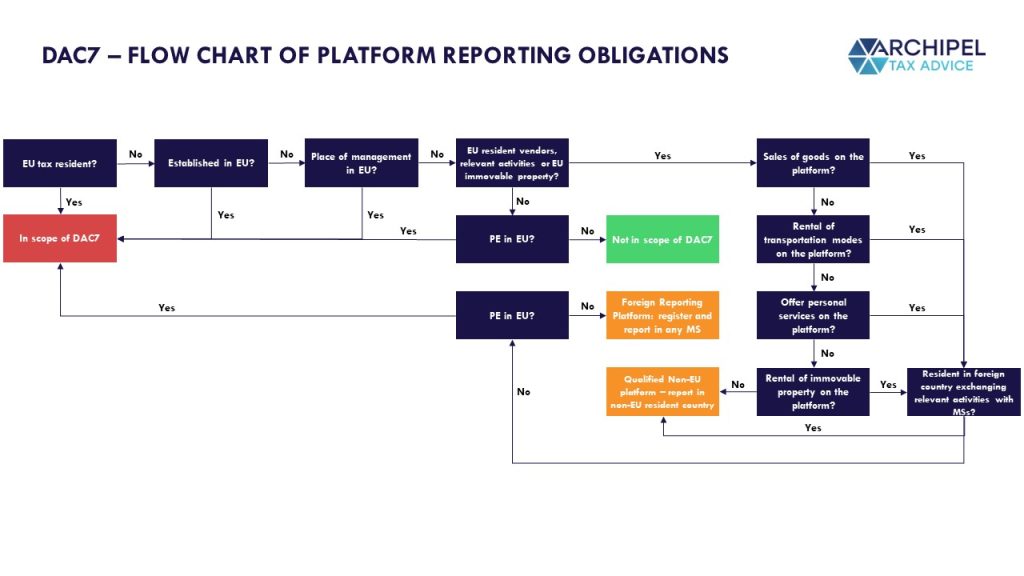

Flowchart – am I in scope of DAC7?

3. What information needs to be reported?

A Reporting Platform Operator must report both [1] information about the Platform Operator itself and [2] about the Reportable Seller.

3.1 The Reportable Information.

The platform operators’ own information includes:

- Name;

- Address;

- Tax identification number;

- Trading name(s) of the Platform; and

- Web address of the Platform;

The information that the Reporting Platform needs to submit about its Reportable Sellers depends on whether the underlying Seller is a natural person or a legal entity:

| If the Reportable Seller is a person [i.e. not an entity] | If the Reportable Seller is a legal entity |

| First and last name | Legal name |

| Main address | Main address |

| Date of birth | |

| Tax identification number (in the Netherlands: BSN) | Tax identification number (in the Netherlands: RSIN) |

| VAT identification number | |

| Financial bank account identification number | |

| Chamber of Commerce number | |

| Information regarding the presence of a permanent establishment through which relevant activities are carried out in the EU [if any]. | |

| Details of the address of the property and the land register number if a property is rented in the EU | Details of the address of the property and the land register number if a property is rented in the EU |

| The total consideration paid or credited per quarter | The total consideration paid or credited per quarter |

| The number of relevant activities paid for or credited | The number of relevant activities paid for or credited |

| Any fees, commissions or taxes withheld or levied by the Reporting Platform Operator | Any fees, commissions or taxes withheld or levied by the Reporting Platform Operator |

3.2 How do i need to report the Information?

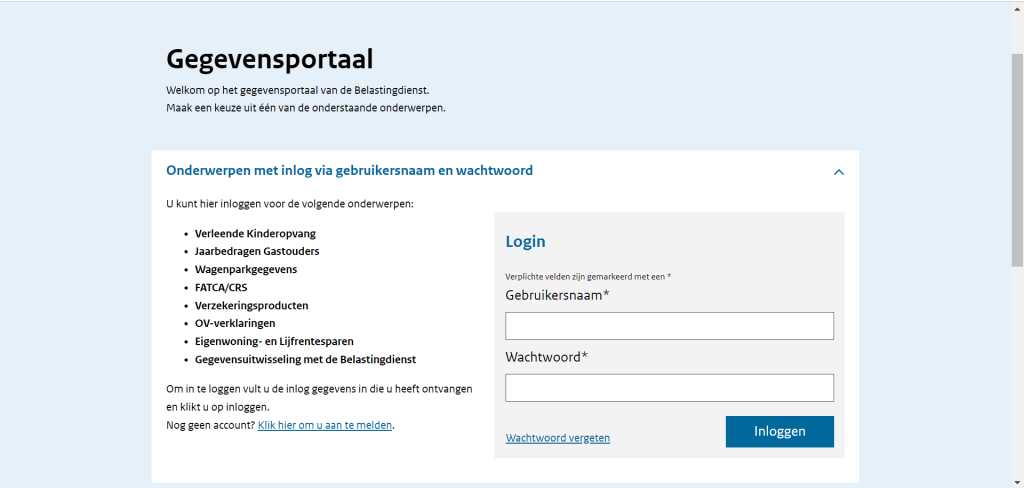

In the Netherlands, Reporting Platform Operators can submit the required information on Reportable Sellers through the data portal provided by the Dutch tax authorities. If a Platform Operator is obliged to report information to the tax authorities to multiple EU Member States, it can choose in which one of the member states they fulfil their reporting obligations. Hence, there is no need to report in multiple States. However, the Platform Operator is obliged to inform the tax authorities of each of the States regarding its choice.

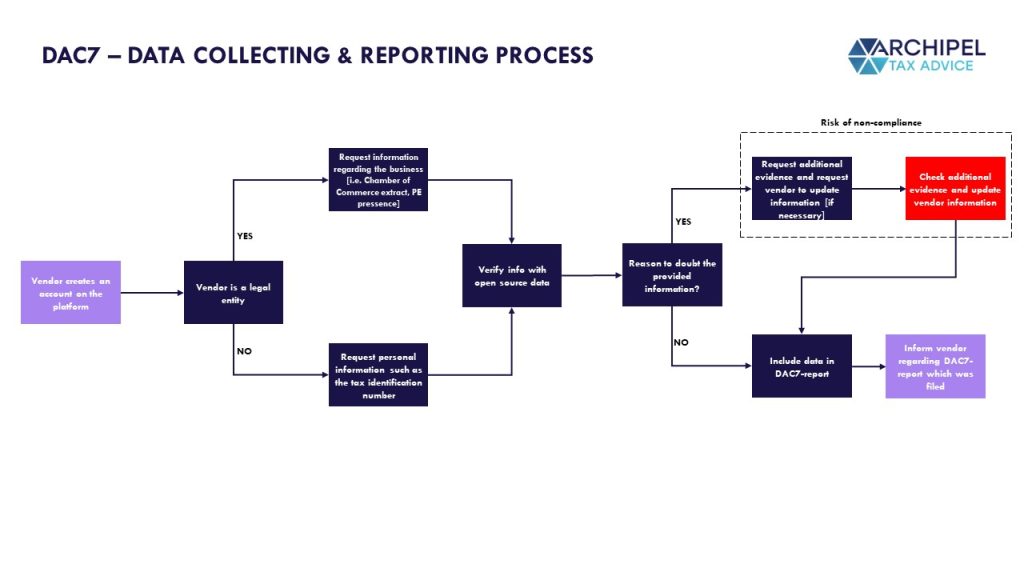

3.3 How should the Platform verify the Information?

The Platform is obligated to ‘verify’ whether the information gathered about the sellers is correct. The Platform can do so by using ‘any information and documents available’. We therefore expect a check of internal documents and publicly available information to suffice.

For the purpose of determining the validity of the seller’s tax identification number or the VAT identification number, the Reporting Platform Operator shall use an electronic interface made available free of charge by a Member State of the EU.

The Reporting Platform Operator who has reason to believe that information provided by the seller may be incomplete or inaccurate, needs to perform additional checks and request additional information/documentation of the seller. An example of these documents are:

- A valid ID issued by a government agency; or

- A certificate of residence.

- A structure chart proving EU/non-EU presence [in case of a legal entity].

3.4 Penalties for non-compliance

A breach of the obligations under DAC7 may have (international) consequences for the exchange of information regarding reportable sellers and thereby on countering tax evasion. This risk is increased by the cross-border nature of digital platforms. Moreover, compliance with these obligations is regarded as vital to preserve the level playing field between digital platforms and traditional businesses.

For the reasons above, DAC7 requires EU Member States to impose a penalty that is effective, proportionate and dissuasive. Each Member State may impose its own penalties for non-compliance under DAC7.

In the Netherlands, unintentional non-compliance is likely to be dismissed with a ‘proportionate’ administrative fine. What constitutes a proportionate fine depends on all the relevant facts and circumstances of the case at hand. These are weighed by the Dutch tax authorities and may lead to a substantial reduction in the amount of the fine. Deliberate or wholly culpable non-compliance with the obligations by Reporting Platform Operators may be punished with an administrative fine (and in extreme cases criminal prosecution).

4. Data Gathering and process validation

At this moment, the Dutch Tax Authorities’ DAC7-reporting-systems are not yet available. Therefore, it is currently a joint effort between the Authorities and the sector to understand how this European-originated compliance legislation is to be implemented in practice.

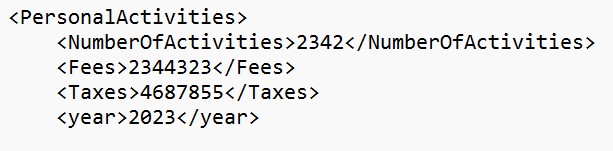

4.1 XML File, Sent in by January 31st in the New Year.

The current state of information is that the data will need to be submitted via a so-called XML-file. An XML-file is a structured data file for storage and communication of data. A benefit of the XML-file structure is that the recipient of the file is able to accurately extract the data given the right parameters.

Fortunately, the OECD published some guidelines that the XML-format must meet. This gives software developers the opportunity to create software for DAC7-reporting.

Most of the information that needs to be filed can be collected and recorded via the Digital Platform itself. We would therefore advise to have the sellers on the Platform update their account details in order to gather the relevant information. When registering an account as a seller on the Platform, the account information should at least contain this person’s or entity’s personal data. Additionally, the amounts paid to the seller should be recorded.

Challenges might arise in case the Platform does not automatically convert the relevant data to the XML-file format. Developing a data extraction and conversion tool might seem like an overkill for the smaller . However, the alternative would be to license third-party software in order to gather the necessary information and file the report. This would result in a lot of manual labor where one needs to first extract the details of the seller out of the platform and then upload the information to the Dutch tax authorities.

4.2 DAC7-in scope or not

The DAC7-process should first start by gathering the relevant data prior to filtering and reviewing the data. This can either be done by the Platform itself which most likely saves the relevant data on an SQL-server. Based on this data and the relevant company info of the Platform itself, the Platform should determine whether they are within the scope of the DAC7-regulation and whether they should file a report.

| Step 1: Determine whether the platform and transactions are in the scope of DAC7 |

| Assign a designated DAC7-specialist who will champion the DAC7-process. Does the Platform enable sellers to be connected to any users? Does the platform have a legal or commercial presence in the EU?Is the platform used by sellers for carrying out a ‘relevant activity’? |

4.3 Data gathering

If the Platform Operator concludes that a report needs to befiled, it is vital that the Platform Operator establishes which information must be collected and communicated to the tax authorities. Note that the Platform Operator is responsible for filing a correct DAC7-report.

| Step 2: Establish which information must be collected and communicated to the tax authorities |

| The Platform Operator must report the company’s information. In addition, the Platform Operator must report information about the sellers which are active on the Platform. This information needs to be verified with the seller prior to them being able to register on the Platform. In case the information of the seller does not meet the data in open-source databases, the Platform should request additional information. This can include: a structure chart of the company, copy of a person’s passport and a residency certificate of the seller |

4.4 Streamline data and communicate information with the tax authorities

Once the information is provided by the seller, the data – including the Relevant Activities – needs to be bundled. The transactions on the Platform itself need to be matched with the seller and a final check needs to be made. A huge chunk of this process can be automated given that the Platform records this data correctly. We do however advise to have the data reviewed prior to submitting the report to the tax authorities.

| Step 3: Streamline data gathering and communicate information with the tax authorities |

| Process the data and convert the data into a relevant XAML file. Either via third-party software or via self-developed software. To ensure that a 4-eye principle is met, review the DAC7-report prior to submitting the file to the tax authorities. |

4.5 Summary of the DAC7-process

Want to Talk about your DAC7 Process? Book a Timeslot – It’s on the House!

We are more than happy to help you face any DAC7-challenges that may arise. Want to know whether your platform qualifies for DAC7-purposes or whether your data gathering process is up to standards? You can find a Calendly link below.