In this read, we discuss more of a meta aspect to your taxes and doing them, as we discuss Co-operative Compliance, and the Tax Control Framework as a supporting building block.

First off: What is Co-operative Compliance?

Compliance is the part of your tax process pertaining to doing your official filings with the Tax Authorities. Think monthly VAT and Wage Tax returns or annual Corporate Income Tax returns. These filings are the formal and legally mandated communications with the Tax Authorities.

Tax Reporting and Tax Controls.

The Tax Authorities generally have the ‘information disadvantage’ as they cannot access the reporting companies’ internal reporting without due legal cause. The Tax Authorities, therefore, often take a risk-based or random check-based controls approach and send information requests when they suspect something may be off. And if the information provided is incomplete or wrong, the Tax Authorities’ controls may evolve into an audit procedure with tax adjustments and sometimes fines as a result.

Of course, a set of ‘Rules of Engagement’ secures the taxpayer’s rights to fair trial, privacy and corporate secrecy, while they also aim to provide the Tax Authorities with fair but potent mechanisms to obtain the information and a reasonable [or lengthy!] timeframe in which to address filed tax reports.

Unintentionally, this can result in a trench war of sorts in which taxpayers tend to ‘Plead the Fifth’, while an increasingly frustrated Tax Authorities team gets more aggressive in the findings they report and the information they seek. This is bad for taxpayer morale, for Tax Authority resource allocation and for backlog at the Tax Courts… So: let’s take a breather and consider ‘Co-operative Compliance’.

Co-operative Compliance Prevents Trench Warfare and Facilitates Quick Certainty.

Under Co-operative Compliance, taxpayers wilfully ‘waive’ their secrecy and information advantage and enter into a relationship with the Tax Authorities that is often described as ‘more horizontal, less vertical’. In return, the Tax Authorities grant them a single point of contact [a real person!] who helps put in place a proper ‘Tax Control Framework’, offers them easy access to advance dialogue and certainty, and quicker ‘Final Assessments’ with waived re-assessment statutes as the end piece to tax certainty.

In the words of Eva Eberhartinger and Maximilian Zieser of the Vienna University of Economics and Business:

In cooperative compliance programs, firms and tax administrations agree on cooperation instead of confrontation. Firms provide full transparency and advanced tax control frameworks. Tax administrations, in turn, offer certainty as to the tax treatment of complex transactions.

E. Eberhartinger and M. Zieser, The Effects of Cooperative Compliance on Firms’ Tax Risk, Tax Risk Management and Compliance Costs (January 1, 2021). WU International Taxation Research Paper Series No. 2020-07.

It Builds on Advance Consultation to address Technical Items, and on a Tax Control Framework for Tax Data Accuracy.

And what is a Tax Control Framework? We quote the influential Organization for Economic Cooperation and Development: “A Tax Control Framework is the part of the system of internal controls that assures the completeness of the tax returns and disclosures made by an enterprise. The Tax Control Framework plays a central part in bringing rigour to the co-operative compliance concept.”

A quick primer to put that into perspective:

- A Tax Control Framework is an internal and individual working process that facilitates an accurate and compliant tax function;

- It has no ‘legal basis’ and there is no law that dictates what a Tax Control Framework must look like;

- However, a Tax Control Framework is a prerequisite for ‘co-operative compliance’, a working method that has been developed into ‘horizontal oversight’ in The Netherlands;

- In order to gain access to said cooperation rather than audit-based relationship with the Tax Authorities, the implemented Tax Control Framework must meet certain minimum standards;

- These standards have been documented in Guidance and Policy documents issued by the Dutch Tax Authorities, in which the Dutch specifics of the OECD’s Guiding Principles are laid out;

- It is these specified practices that we walk through in this read.

So to recap: Co-operative Compliance is a working method under which the information exchange procedure is wilfully transparent, the accuracy of Tax Data is supported and any Tax Technical discussion is frontloaded. As Co-operative Compliance relies mainly on a wilfully transparent and ‘soft’ approach between the Taxpayer as the reporting party and Tax Authorities as the controlling party, the rules can be formalized in an agreement [‘Convenant’] under which the Tax Authorities commit to expedited clearance and an individualized oversight plan with an appointed and approachable team, whilst the company commits to transparency standards and reporting quality standards:

What does Co-operative Compliance look like in the Netherlands? The ‘Horizontal Oversight’ Regime.

Horizontal Oversight is the name for the Dutch Co-operative Compliance regime. It was initially designed for the ‘Top 100’ largest taxpayers, so as to streamline procedures in order to facilitate better taxpayer compliance while using fewer Tax Authority resources. Following positive experiences and a higher degree of compliance, it is no longer a voluntary regime for this ‘Top 100’. The full-blown version they are subjected to involves, amongst other things, an individual Convenant to formalize the agreement and its rights and obligations, and requires the implementation of a jointly verified Tax Control Framework covering in-house tax departments and global finance functions.

Naturally speaking, such a setup is neither feasible nor necessary for SmallCap to MidCap businesses, whilst they may equally seek and benefit from Co-operative Compliance. That’s why following positive experiences and an increased degree of compliance under the ‘Big Regime’, the Tax Authorities developed lighter varieties that MidCap and SmallCap businesses can opt-in on. As such businesses generally have nor need an in-house tax department, it involves external Tax Counsel as a pivotal point to fulfil that role. We translate the Tax Authorities’ description of said practices:

Horizontal Oversight, what is it?

This explainer pertains specifically to Horizontal Oversight through the Tax Advisor. That is a cooperation between yourself, your tax advisor and the Tax Authorities. […] The Tax Authorities have made an agreement with participating Tax Advisors about the quality of the involved tax returns. The Tax Advisor discusses any potential bottlenecks in the returns with the Tax Authorities before filing. This allows the Tax Authorities to process and approve your returns more quickly, and generally allows queries and audits to be avoided. You will obtain certainty about your tax positions more quickly. Small and Mid-Cap businesses can participate in this form of Horizontal Oversight.How does this method make quicker certainty possible?

Dutch Tax Authorities’ Flyer on the Horizontal Oversight Program for Small to Mid-Cap Taxpayers.

Under Horizontal Oversight, your Tax Advisor agrees on terms with the Tax Authorities. These terms are laid out in a charter. […] The terms pertain, for instance, to the way the Tax Authorities and the Tax Advisor interact with one another, the quality of the tax returns, and how quickly returns will be dealt with. Also, your Tax Advisor will be appointed a fixed contact person at within the Tax Authorities, who can respond to questions quickly. But perhaps most important is that due to the better information position that the Tax Authorities have under Horizontal Oversights, said contact person can respond quickly to any matters that your Tax Advisor may want to discuss before doing the filing. This way, we reduce the chance of mistakes and later adjustments as much as possible. And that means you have certainty more quickly. Every year, your Tax Advisor and the Tax Authorities will discuss how the cooperation can be improved.

What are the Legal Coordinates of an opt-in to Horizontal Oversight?

The rights and obligations that Taxpayers and Tax Authorities have towards one another, are governed by what we call the Formal Tax Laws. These give the legal basis for Tax Authorities to ask for information, tell Taxpayers what they are and aren’t held to disclose, who’s got the burden of proof, how correspondence is supposed to take place, what response times are and many other such things.

Within this framework, the Tax Authorities – as the more powerful party – are bound to the so-called ‘Principles of Sound Administration’. This is soft law that dictates how Authorities are to treat Citizens in good faith, and includes principles such as Fair Play and Due Preparation in how decisions are made, Legal Certainty and Proper Motivation in how they are made known, and Predictability, Equality and Equitability in their contents. On the other end, the Taxpayer is subjected to escalation measures such as Reversal of the Burden of Proof and Penalties in case of bad or non-compliance, with even the potential for things to escalate to Criminal Persecution in case of persistence.

Under Co-operative Compliance, both parties willingly leave the far-end of the spectrum and vacate their rights to a certain degree in order to move closer together. The framework to that end is not specified in a specific law [although the publications by the Tax Authorities do give some legal bearing under the Principles of Sound Administration as to how things should work], so both parties can formalize their agreements, rights and obligations in a (semi-)private contract. In the context of Co-operative Compliance and Horizontal oversight, this contract is often referred to as ‘the Convenant’. It is is enforceable for both parties through Civil Law routes, just like any other private contract.

“The agreements laid out in a Convenant are atuned to one another and in my opinion, they have a reciprocal character: ‘If i am to have my internal and tax controls in check, you are to adapt your surveillance procedures to that principle. If I file my Tax return quickly, you are to answer with a Definitive Assessment quickly.’ In my view, this form a (perfectly) reciprocal private agreement in the sense of article 6:261 of the Civil Code.”

M. Huiskers-Stoop, PhD Thesis ‘The efficiency of horizontal oversight’, Erasmus University of Rotterdam, 2015.

How do I enter into a Horizontal Oversight Reationship for Co-Operative Compliance?

The Convenant as the Legal Basis for Co-operative Compliance and the ‘Three Cilinders’ of Tax Quality as an Entry Ticket.

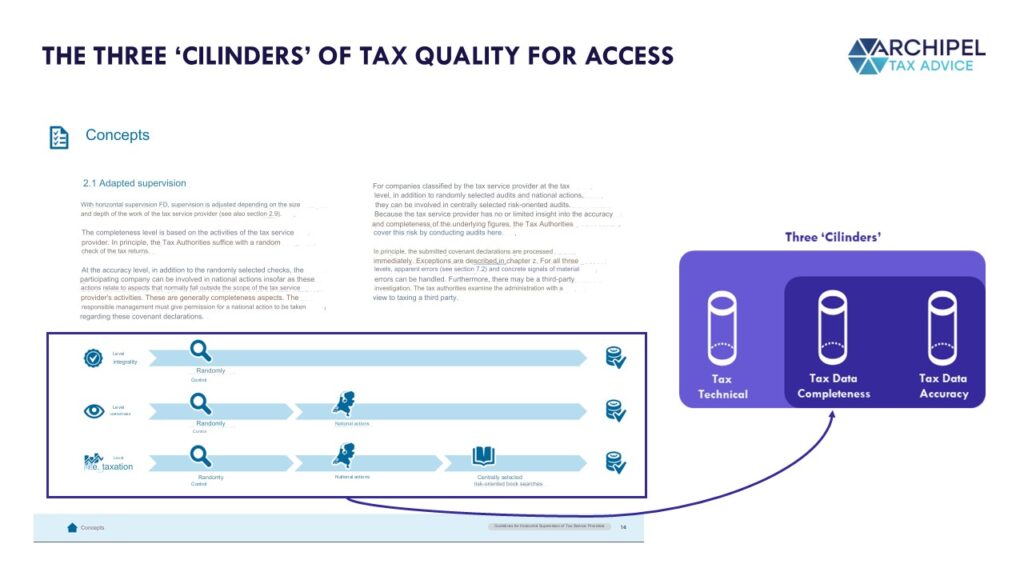

The Horizontal Oversight Relationship as the Dutch design of Co-operative Compliance is legally entered into by signing a Convenant to that end with the Tax Authorities. And to have access to such a convenant, the Tax Authorities require that you meet certain prerequisites pertaining to [1] Tax Technical Quality, [2] Tax Data Completeness and [3] Tax Data Accuracy.

For LargeCap businesses with an in-house Tax Department, the ‘Tax Quality’-cilinder is filled through a quality ‘audit’ and agreement with said department. For smaller businesses, the co-signing Tax Advisor ‘fills the cilinder’. The other two ‘cilinders’ which pertain to acuteness and completeness of data and compliance, hinge mainly on the internal responsibility for and flow of information, which is often laid-out in a Tax Control Framework.

These requirements are visualized as the three ‘cilinders’ of tax quality that you need to fill to gain access to the Horizontal Oversight regime. As derived from the Tax Authorities’ Horizontal Oversight Guide:

In other words: the Tax Authorities demand certain mutual principles to be agreed upon, and certain minimum standards to be implemented. The quality, transparency and ‘return favor’ framework is laid out in a charter. For the ‘Top 100’ and strategic Large Enterprises, these charters are always individual charters between the company itself and the Tax Authorities. For Small to Midcap Enterprises, an umbrella method was introduced which involves a Bar-member Tax Advisor as a third party and as a steward of minimum standards in tax function and reporting quality. We explain:

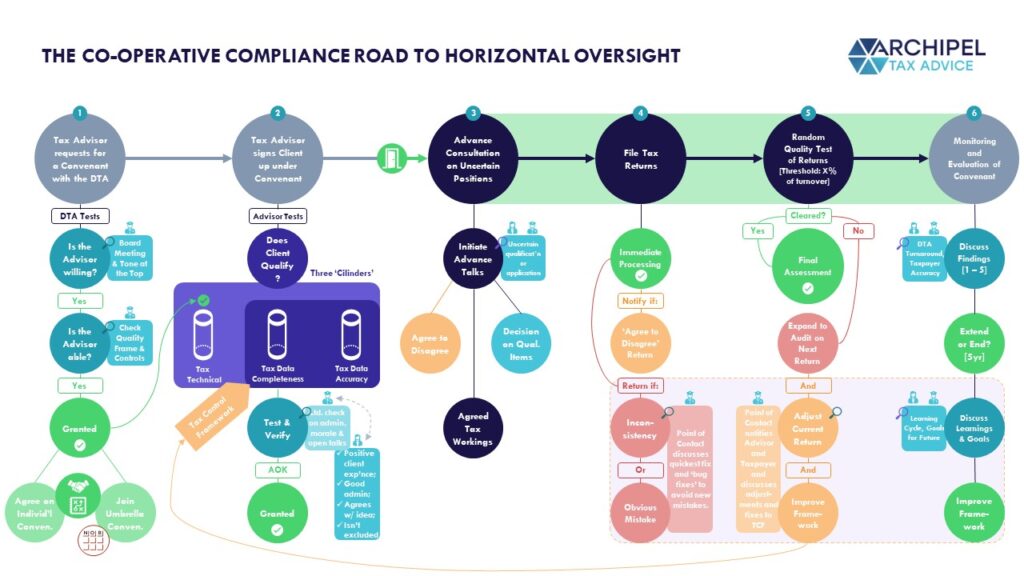

Put visually, the Tax Authorities designed the process for sub-LargeCap to work as follows:

A brief walk-thru:

- Tax Advisor Approval & Onboarding: as the Tax Authorities lean on the accuracy and quality of the involved Tax Advisor for pre-‘designated-tax-department’ businesses, the Tax Advisor needs to be weighted and committed as a prerequisite to accessing the Co-operative Compliance regime. When approved, they can sign a Convenant which formalizes the Co-operative Compliance / Horizontal Oversight agreement and allows the Advisor to onboard clients under this umbrella.

- Taxpayer Registration & Onboarding: subsequently, the participating client’s internal controls and administrative mechanisms as well as their ‘compliance attitude’ need to be on par. Part of the test is that the taxpayer can ‘fill three cilinders’:

- Tax Technique: this check is provided by the involved & onboarded Tax Advisor [acting as the outsourced tax technical department to an extent];

- Tax Data Completeness; and

- Tax Data Accuracy: the two latter checks rely mainly on the taxpayer’s internal controls and reporting process, which is often streamlined in a Tax Control Framework, which is a proved method to warrantying the required flow and timing of information.

- Advance Consultation on Relevant Items: once the taxpayer has been onboarded, they are expected to initiate talks about any relevant tax uncertainties [qualification of facts and/or application of tax laws] with the Tax Authorities prior to filing. This frontloads tax discussions and supports the ‘quality'[=undisputedness] of the return and allows the Tax Authorities to issue a final assessment straight away. The ‘right to quickness’, of course, is void for non-disclosed or non-agreed upon items, and the involved parties may still choose to ‘agree to disagree’ on advance consultation items, with the regular avenue of objections and appeals still open.

- Filing of the Tax Returns: the tax returns are compiled as per the designed framework and filed in line with any advance consultation. The returns are processed straight away.

- Random Test of the Filed Returns: the Tax Authorities turn the returns around into final assessments asap, and periodically ‘random test’ them using the ‘CAB’-method. In case of any findings, improvements to the framework are discussed and a full audit is performed on the next return to verify the process.

- Monitoring and Evaluation of the process: the parties monitor the process and evaluate – are expectations being met on both ends, what can we do better, will we continue the Convenant?

Horizontal Oversight under the Umbrella Convenant of the Dutch Bar Association for Tax Advisors

In order to contextualize what Horizontal Oversight can look like under the ‘three party’ variety for non-mastodontic taxpayers in which an external advisor fulfils the Tax Department role, we highlight the Umbrella Charter that the Dutch Bar Association of Tax Advisors has drafted with the Tax Authorities. Adjoined Tax Advisors can sign up for the ‘seal of approval’ it contains for the ‘Tax Quality Cilinder’ provided they pass the individual test as mentioned in the flow chart above, and sign up the opting-in clients for swifter and easier procedures..

First of all: what is this Bar Association?

The broader function of a ‘Tax Advisor’ is not state-regulated or state-protected profession in the Netherlands, unlike, for instance, Medical Doctors or Barristers almost anywhere, the Netherlands included, or the Steuerberater as a Tax Advisor in Germany. So put simply: anyone may advise you on your taxes, after which it is up to your own judgment whether you take their advice or not [and many times – you best shouldn’t :)].

In order to warranty a trustworthy seal of quality, the Dutch Bar Association for Tax Advisors was formed by multiple tax firms and departments consisting of academically formed Advisors [LL.Ms and M.Sc.’s]. The Bar Association [Nederlandse Orde van Belastingadviseurs, ‘NOB’ in acronym] provides quality frameworks, training, and centralized oversight, complaints procedures as well as expert input on legislative procedures. Tax Advisory firms meeting specific quality, integrity, training and permanent education conditions can elect its oversight, provided of course that they continue to meet the quality and integrity frameworks.

More information: https://www.nob.net/home/about-the-nob/

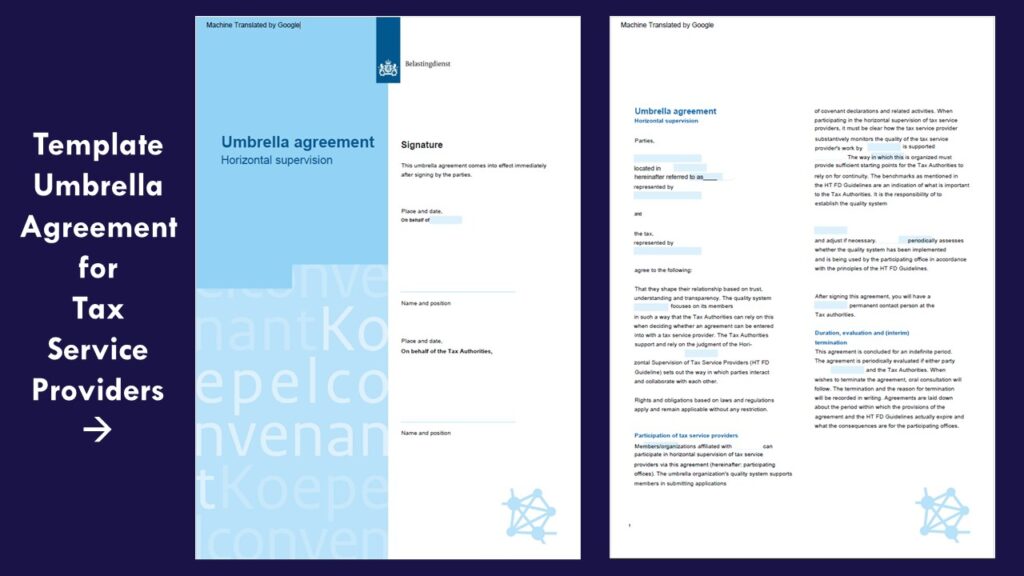

The Umbrella Convenant: a Formalization of the NOB’s ‘vouch’-after-audit for its interested Members’ Tax Quality Systems, filling the Quality Cilinder

The NOB is a publicly visible institution that has entered into an umbrella Convenant with the Dutch Tax Authorities as a Quality Supervisor for its Members, making it possible for clients of its Member Firms to quickly access the Horizontal Oversight regime. This especially makes election easier for Small to Midcap businesses, as they no longer need to go through the lengthy procedure of entering into an individual Convenant and therefore, do not need to ‘reinvent the wheel’. Also, the Tax Advisors don’t need to be repeat-audited per individual clients that wants in.

The idea behind this, is that the ‘NOB’-aligned Tax Advisor is already subject to a strict framework of quality and integrity controls, which are already built and monitored under continuous contact with the Dutch Tax Authorities and other Government Institutions as the NOB fulfills its public role. Therefore, the Tax Authorities should be able to work comfortably off the premise that said NOB-Member Tax Advisors [whose membership is revoked is they ‘fall through’] are capable of filling the Tax Technical cilinder, and helping the underlying client put in place the proper Tax Control Framework to fill the other two cilinders of Data Completeness and Data Accuracy. As per the NOB Press Release:

“The premise underneath participating in Tax Service Provider-based Horizontal Oversight is that the Tax Service Provider [TSP] has an adequate quality system in place. Under TSP Horizontal Oversight, the Tax Authorities enter into Convenants with Umbrella Organizations that [1] have a demonstrated history of contributing to their members’ quality systems, [2] set quality requirements and standards for their members and [3] monitor whether their member continuously meet the set quality standards.

The NOB has entered into an Umbrella Convenant with the Tax Authorities. Horizontal Oversight is built on three quality levels: Tax Technical Quality, Tax Data Completeness and Tax Data Accuracy. Through the NOB Umbrella Convenant, the Tax Technical Quality level can be completed for access.

Member-TSPs who want to participate in Horizontal Oversight through the NOB Umbrella Convenant can notify the NOB for access. [The NOB will then perform a two-tiered entry test to verify the [1] the setup of the Quality Systems and [2] the implementation of the Quality Systems. After a positive appreciation by the external expert, the aligned TSP signs up for TSP-based Horizontal Oversight with the NOB’s vouch for quality under a tri-partite agreement between the NOB, DTA and the TSP for a period of 5 years.

NOB Protocol for access to TSP-Based Horizontal Oversight under the NOB Umbrella Convenant.

What does such TSP Convenant of a Cillinder Filler Look Like?

The Convenant itself can be surprisingly brief, as it pretty much reference the Framework for TSP-Horizontal Oversight as laid out in the Guidance Document to that end as issued by the Tax Authorities, and formalizes the involved parties’ commitment to that. A translated version of the Tax Authorities ‘Template Umbrella Convenant‘:

And the Missing Link: How does a Tax Control Framework… Work?

A Tax Control Framework [TCF] is a freeform working method that ensures all information that is relevant for the Tax Communications gets to their proper end-stations in full and in time, with documented workflows and responsibilities. A TCF in its ‘full form’ is, strictly speaking, a ‘need to have’ only for the superlarge taxpayers who are required to participate in individual Horizontal Oversight. Nonetheless, companies may seek to install one as a tested way of ‘filling’ the TSP Horizontal Oversight ‘cilinders’ of Tax Data Accuracy and Tax Data Completeness.

Why go for a TCF in any Case?

In addition, a TCF has benefits outside of Co-operative Compliance contexts as well, and so taxpayers may elect to put one in place regardless of their chosen relationship with the Tax Authorities. As companies grow or change, it can be opaque who is responsible for which filing and when, and how they get their underlying data, from whom and when.

Especially when the company does not need a full-blown tax department, common bottlenecks can look something like this:

- The Wage Tax returns need to be filed on a monthly basis, with the proper Wage Tax withholding to be wired before the end of the next month. Who is in charge of filing the Wage Tax returns? HR or Finance? And who makes the payment? HR, of Finance? Accounts Payable? The Founder or CEO, given materiality?

- The VAT returns are to be filed on a quarterly or monthly basis and wired the month after. Who is in charge of filing? Finance? And who provides Purchasing and Sales data and when? Who wires the payment?

- What if there is unclarity about the tax treatment of certain data – who involves outisde counsel? Finance? The department confronted with the ‘grey area’?

As misfiling can lead to Reassessments, audits and/or penalties, there’s real value in money, certainty and peace of mind to be found in ‘being in control’ of tax. Designing and documenting a future-proof Tax Control Framework can help ensure that everyone is mindful of their role in the shared process to that end, facilitating quicker certainty, more accurate planning and more time for business.

How can we Visualize a Tax Control Framework

The Tax Authorities have equally published a ‘Best Practices’ and Guidance Document on Tax Control Frameworks, which differentiates between a ‘Top-100’-type business and a more mid-market type business on a scenario basis. When we compound the Best Practices for the Small to MidCap Businesses, we arrive at an overview of recommendations that would lead to a TCF using the following methods of analysis, documentation, control and improvement:

Put briefly, the steps are the following:

- Tax Strategy Note: it all starts with a vision on tax, usually drafted by the Board and any number of selected other Accountable Persons. This document would put into words what the company ‘wants with tax’ – what’s the stance on aggressive tax planning, what are the Tax KPI that Management keeps track of, what’s the view on transparency & reporting, etc. The Tax Strategy can be discussed with the Tax Authorities and gives them a ‘Client Overview’ which can serve as the basis for the individual ‘Controls Plan’.

- Tax Functions Blueprint: the next step is to gain overview in the organization’s ‘Tax Functionalitis’, which can include persons and data from many other departments than only Tax and/or Finance. The idea is to understand what the obligations are, what data is needed, who has access to it, and how you can streamline a process to ensure all data gets where it needs to be, in time, in full, and accurately. For Small to MidCap businesses, a RACI-matrix is an approved Best Practice.

- Risk Analysis: once the blueprint has been drawn out, the material risks can be established more accurately [based on experience] and hypothesized [based on logic]. On a scenarios basis, these risks can already be mitigated and addressed, and used as input for the Control Framework.

- Control Framework: is the overview of specific procedures that will be put in place to ‘reverse engineer’ working methods for complete and accurate data reporting, and fixers for any foreseen or previously experienced errors. This is the actual ‘step by step’ working instruction for all the involved persons as identified in the Blueprint and what to do to be in control of Tax.

- TCF Monitoring: is an implemented series of periodic tests that help verify whether the Control Framework works, and whether certain inevitable cracks don’t lead to any material mishaps. This monitoring can, for instance, consist of certain complete manual tests as well as periodic ‘statistical audits’ internally.

- Internal Reporting: is the ‘lid to the jar’ and not necessary the final step but the last procedure to design. The reporting helps prove that the TCF is actually put into practice, but also helps ‘ring the bell’ on nay new risks, inform the right person, and use the learnings to improve on the Framework so as to implement a ‘learning cycle’ for continuous improvement.

What Effect does this have on Tax Audits / Tax Authority Control Procedures?

As highlighted, a Tax Control Framework is a prerequisite for a Horizontal Oversight relationship, but it can also add value for organizations that are not interested in the less formalized manner of interacting with the Authorities. This is because apart from value found in ‘being in control’, the implementation of a Tax Control Framework can also reduce the scope of an audit, should it arise.

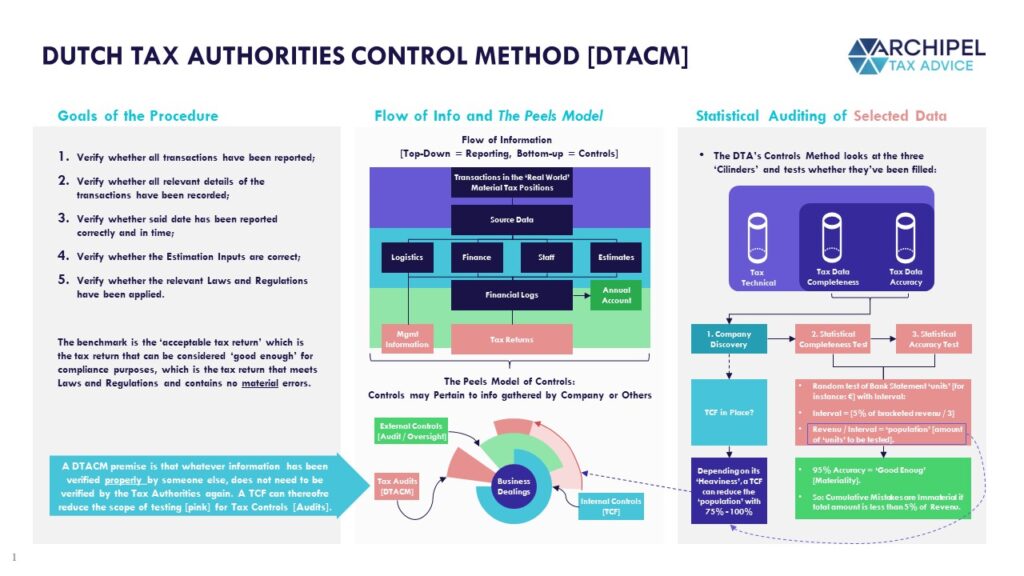

How so? The Dutch Tax Authorities have developed an Audit Method – known as the Dutch Tax Authorities Control Method – that revolves around a ‘statistical audit’. The idea is that the ‘Acceptable Tax Return’ is a return that has no ‘material’ shortcomings, which means it does not lead to a tax deficit of 5% or more. In order to test this on a random basis, the ‘materiality amount’ is compared to the organization’s revenue [or other marker, depending on the Tax involved] to create a ‘controls interval’ as follows:

Interval = [revenue or other marker amount] / [materiality amount / 3]

The Interval dictates how big the brackets in the ledger are that the Tax Inspector randomly selects a money amount from. Visualize this as the Inspector looking at the end-of-year bank cash-out statement and randomly pointing at line items to audit – what return has it been reported in and how, how are its underlying dealings recorded and reported, and does “how it’s been done” align with “how it should be”.

By dividing the revenue [or relevant marker amount] by the interval, we arrive at the ‘Sample Size’ – referred to as ‘the population’. As the Tax Control Framework has been purposefully designed to allow the Tax Authorities to ‘do more with less’ [[fewer] resources], the idea is that a well-implemented TCF justifies a reduced sample size. Depending on the [approved] TCF’s ‘heaviness’, the sample size in case of an audit can be reduced 75% – 100%, sometimes leaving only a handful of random tests to be performed. We visualize this theory:

So: does it Work, and are People Happy about the Framework?

Broader testing evidences that yes, people are generally quite positive about Co-operative Compliance. For instance: the Dutch Tax Authorities are eager to agree on Co-operative Relationships with Taxpayers, as the general policy belief is that Co-operative Compliance leads to less compliance costs for both sides of the table. A testament to their enthusiasm is a press release like this:

We have reached the milestone of 200.000 registered participants in Horizontal Oversight. The Tax Authorities are happy with this increase and sees plenty more possibilities. There are numerous tax service providers and businesses that have high quality standards and that are in control of their processes. For them, it is definitely worth considering joining in as well.

The Tax Authorities refer to Horizontal Oversight under an individual of umbrella covenant for Tax Advisory bodies as ‘Tax Service Providers Horizontal Oversight’. A Tax Service Provider can register their clients to the regime for different taxes, such as Vat, Corporate Income Tax or Wage Tax.

Under Tax Service Provider Horizontal Oversight, the Tax Authorities lean on the work that the Tax Service Provider has already performed with and for the client – the business. And what’s already been done well, does not to be done again by the Tax Authorities. It is important that the Tax Authorities are clear upfront that the involved Tax Service Provider delivers the required quality. The supervision on their client can then be adjusted.

The assumption of the program is that the Tax Service Provider files a timely and accurate return on behalf of the taxpayer that meets the norm [the ‘acceptable return’]. The basis for this, is the disposition of the advisor and the taxpayer as well as their internal quality systems. In addition, the Tax Service provider commits to discussing any relevant tax uncertainties with the Tax Authorities before filing. This guarantees the quality of the returns, allowing the Tax Authorities to provide quick certainty on the underlying taxpayer’s tax positions.

DTA Press Release of March 23rd, 2023.

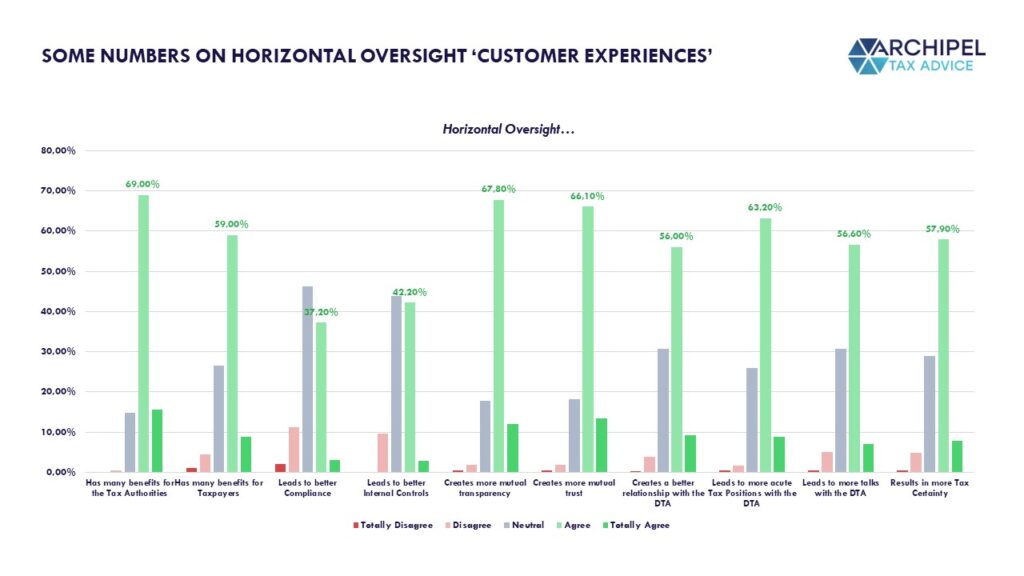

Simultaneously, participating taxpayers report a high degree of satisfaction as well. Notably, in Esther Huiskens-Stoop’s PhD Thesis on the topic of Co-operative Compliance, 74,9% of the respondents stated that they were satisfied to very satisfied with the effects of Horizontal Oversight; the name of the Co-operative Compliance framework developed by the Dutch Tax Authorities and its chain partners. Some figures:

So what do we Conclude?

Co-operative Compliance as a concept, and the Horizontal Oversight regime as the Dutch implementation of that, is a voluntary working method that asks for the implementation of certain control mechanisms and transparency promises in exchange for more and quicker certainty on taxes and easier access to advance talks on difficult positions. There’s value in ‘being in control’ and in that certainty, which is hard to quantify but easy to imagine. As per the OECD:

The value to both a taxpayer and the tax administration of a fully developed and monitored internal control system that includes a robust tax control framework is well demonstrated.

The OECD.

Implementing such frameworks isn’t super ‘taxy’ work, but it does require a conscious effort and understanding of formal and material Tax Law. The aim: better and quicker certainty and more control over taxes. If you want to know more, or if you want to discuss how this may work for you: get in touch below 🙂

Want to Discuss? Book a Time – it’s on the House!

Whatever suits your schedule.