The Dutch Cabinet confirmed its commitment this week to structurally increase the Budget for the Energy Investment Allowance (EIA) and Environmental Investment Deduction (in Dutch: MIA). This means that more Dutch based companies can save extra tax and cash in their investing phase by using the MIA and EIA. These tax schemes make the Netherlands an even more attractive country for green technology-driven companies. Please read further to learn how the EIA and MIA work and the beneficial scheme: the Random Deductions for Environmental Investments (in Dutch: VAMIL).

What are the Cabinet’s plan for green investments?

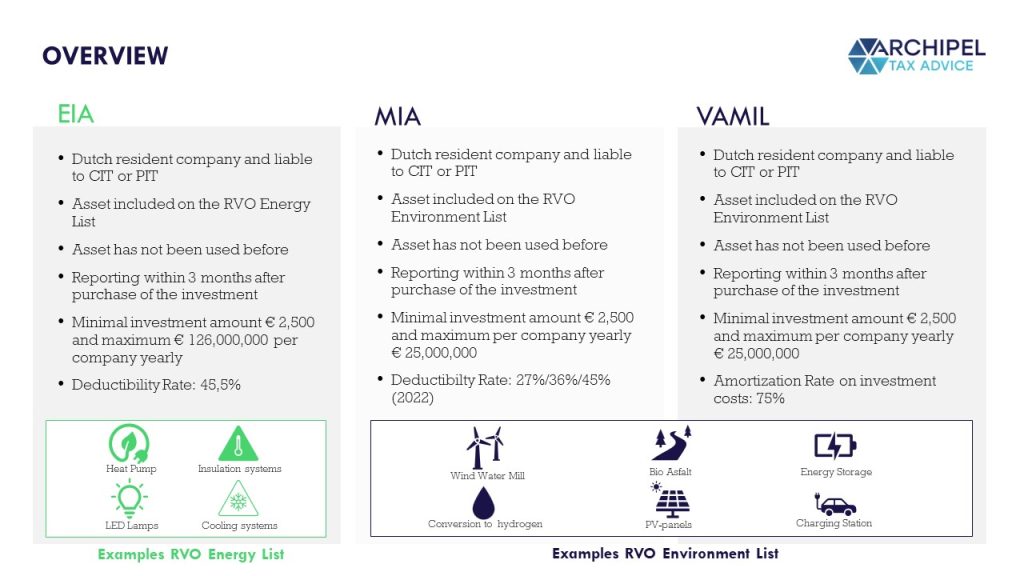

In recent years, the Dutch Cabinet has labelled climate change as a ‘hot topic.’ At the start of this Cabinet, the Cabinet parties promised in December 2021 to invest an extra € 35 billion (10% of the yearly Netherlands Budget) for the coming ten years in sustainability plans. The increase of the budget for company tax incentives will take place in the coming years. These environmental tax incentives for companies include VAMIL, MIA, and EIA. The goal of these -already existing- tax schemes is to incentivize environmentally friendly and energy saving investments, by lowering their taxable amount, resulting in a lower corporate income tax (‘CIT’) liability or personal income tax (‘PIT’) liability in the year of investment. The tax schemes are accessible to a wide range of companies and sectors. Both old and young companies can request participation in the tax schemes at the Netherlands Enterprise Agency (in Dutch: RVO). Under these schemes, businesses have the possibility to deduct or depreciate a higher percentage of the purchase amount of the investment in the applicable year. As a result, the tax burden can be lowered in the year of investment, and will result in an improved liquidity position in the year of investment.

How does the MIA works?

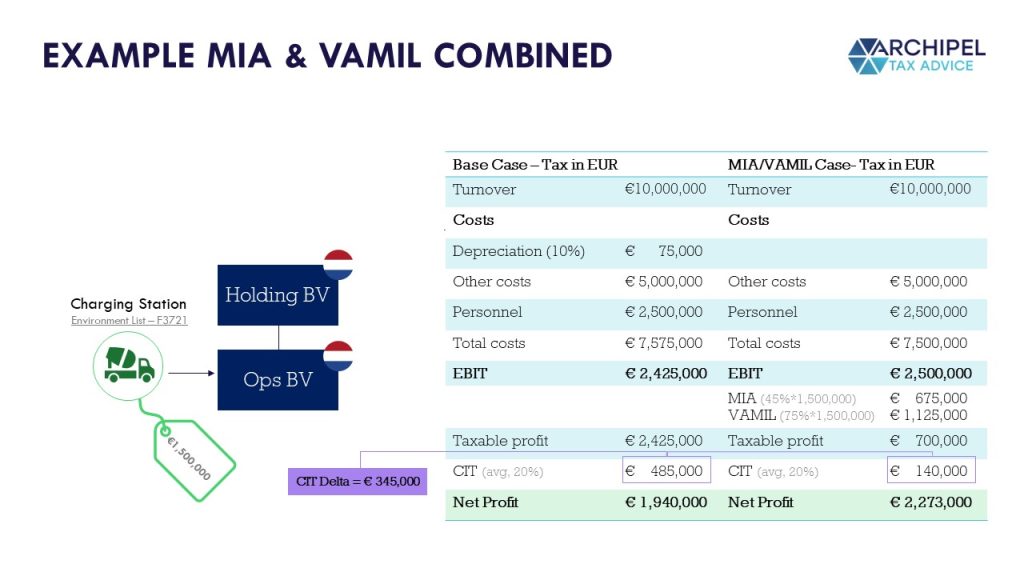

Eligible investments for the MIA must be listed on the RVO Environment list (in Dutch: Milieulijst). This list consists of asset investments generally aimed at less pollution, efficient material use, and better biodiversity. For example: resource-friendly production facilities, 3D-printers for sustainable production, and rainwater installations. The RVO also allows companies to submit newly developed assets to be included on the Environment List. The MIA consists of three categories each having a different deduction rate (in 2022: 45% for category I, 36% for category II, and 27% for category III). The category of investment as indicated on the Environment List determines how much a company can deduct from their taxable profit in one year. After approval by the RVO, the MIA can be administered on the CIT or PIT filing return. Please note that the EIA and MIA cannot be combined. If an investment would qualify for both the EIA and MIA, the former would in most cases prevail because the EIA works with a higher rate, and therefore a higher deduction ability.

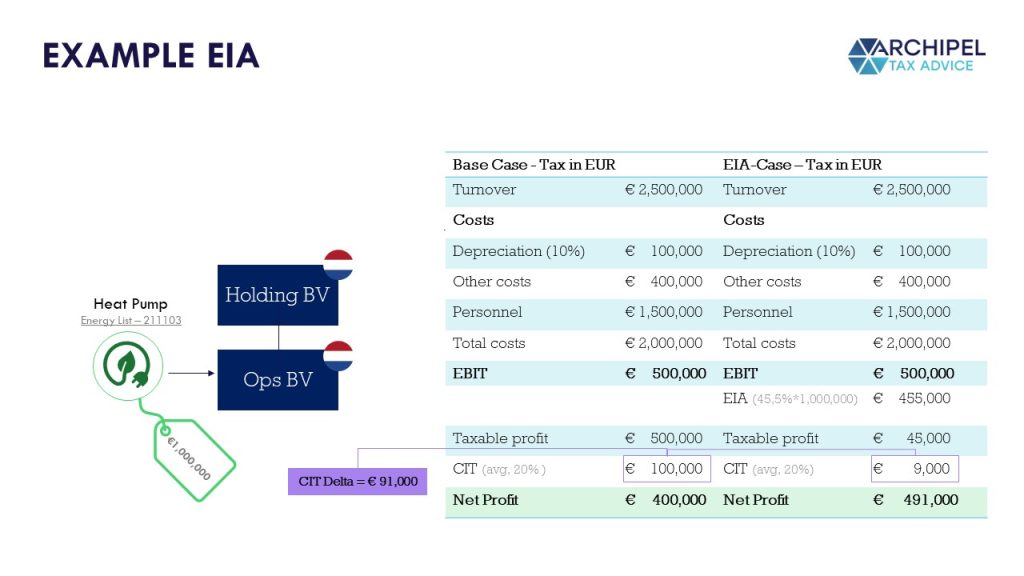

How does the EIA work?

The EIA favors companies by allowing them to deduct 45.5% of the purchase amount of the energy-saving investment from their taxable base. It results in a lower ETR in the year of investment. The asset must not be used before and must be listed on the RVO Energy List (in Dutch: Energielijst), which include assets such as heat pumps, solar panels, and other types of renewable energy technology. In addition, an investment must be a minimum of € 2,500 and a yearly a maximum of € 126,000,000. Within three months after the investment, the investment must be reported at the RVO. After approval, the higher deduction can be administered in the CIT or PIT filing return of the applicable tax year.

How does the VAMIL work?

Whereas investment in a general machine results roughly in a yearly depreciation of the total investment price divided by the lifetime of the machine, the VAMIL enables companies to make an incidental upfront depreciation and result in a lower taxable profit. Eligible investments -listed on the RVO Environment List– for the VAMIL can be depreciated 75% of the total investment amount of an asset in one fiscal year. The VAMIL can be combined with the MIA for certain assets. For the VAMIL, the investment amount must yearly be between € 2,500 and € 25,000.000 per qualifying asset. It depends on the type of asset (please see the RVO Environment List) whether both the VAMIL or the MIA are applicable. In the CIT or PIT filing return the depreciation can be administered.

The Dutch Cabinet is eager to address the challenges of climate change by making it attractive for companies to invest in environment friendly assets. Combined with the more general tax incentives of the WBSO and the Innovation box, the Netherlands will serve green, technology-driven companies well, and enable them to grow more in their investment phase. Please feel free to contact us about these tax schemes or other tax-related questions. We’d be happy to go green with you!